Disclaimer: The information presented does not constitute financial, investment, trading or other advice and is solely the opinion of the author.

The past seven days have seen some major developments amid the ongoing bull run.

Asset management giant Blackrock will take the spot on November 15 Ethereum [ETH] officially submit an exchange-traded fund (ETF) application has found its way to the department of the US Securities and Exchange Commission (SEC).

On the same day, the SEC notified that it had delayed its decision to approve the rule change requested by Grayscale Investments to convert its Ethereum fund into Futures Ether ETF. The SEC now has until January 1, 2024 to make a decision. It was in September that the asset manager had submitted for a change.

The anticipation surrounding ETFs has certainly led to a wild price rally on the charts. However, it has led many to wonder to what extent such developments could negatively impact the decentralized model of the crypto market’s underlying blockchain technology. This is why AMBCrypto also took a look at what’s next for Ethereum.

How it started and then split

A child of Vitalik Buterin, the Ethereum blockchain network was first explored in a white paper in 2014. His colleagues on the project included Gavin Wood, Charles Hoskinson, Anthony Di Iorio and Joseph Lubin.

The team then established a Swiss non-profit foundation, the Ethereum Foundation (Foundation Ethereum). The project started in 2015.

Ethereum was created with the aim of being scalable, programmable, secure and decentralized. It natively supports smart contracts, an important part of decentralized apps. Smart contracts, in combination with blockchain technology, enable a wide range of decentralized finance (DeFi) applications.

Users can also generate and exchange non-fungible tokens (NFTs). These are tokens that can be linked to specific digital assets such as photos. Additionally, several other cryptocurrencies use the ERC-20 token standard on top of the Ethereum blockchain and have used it for initial coin offerings.

Just a year after its launch, the project split into Ethereum and Ethereum classic [ETC].

What happened was that in 2016, a group of network participants gained majority control of the Ethereum blockchain to steal over $50 million worth of ether raised for a project. Most of the Ethereum community has chosen to reverse the theft by invalidating the existing Ethereum blockchain and adopting a blockchain with a revised history: Ethereum.

However, a faction of the community chose to keep the original version of the Ethereum blockchain. The unmodified version of the blockchain has been permanently forked and has become Ethereum Classic.

The event became known as the Hard fork.

The merger and the Shapella

Ethereum initially used the proof-of-work (PoW) consensus mechanism. It required energy-intensive computing, known as mining, to validate blocks.

Due to criticism of the mechanism’s impact on the environment, the project transitioned to a proof-of-stake (PoS) consensus mechanism in September 2022. The event became known as the To combine.

It is critical at this point that we understand what both of these mechanisms are and how they differ.

A consensus mechanism consists of the rules and protocols that govern how a blockchain network agrees on its state. The two most popular mechanisms are PoW and PoS.

PoW requires the use of computing power by miners to solve challenging mathematical riddles and validate transactions. The first miner to solve the challenge will receive new coins and transaction fees. While it would be more secure and decentralized, it also uses a significant amount of energy and resources.

Instead of requiring miners to fix problems, PoS requires validators to pledge some of their coins as collateral. The network then randomly chooses a validator to construct a new block depending on the stake size and other parameters. The validator is compensated with transaction fees instead of new currency.

PoS is considered more scalable and energy efficient than PoW.

At the time of writing, there were a total of 28,195,445 ETH tokens deployedvalued at $55.6 billion.

ETH is the second largest cryptocurrency in the world, with a market capitalization of over $233 billion.

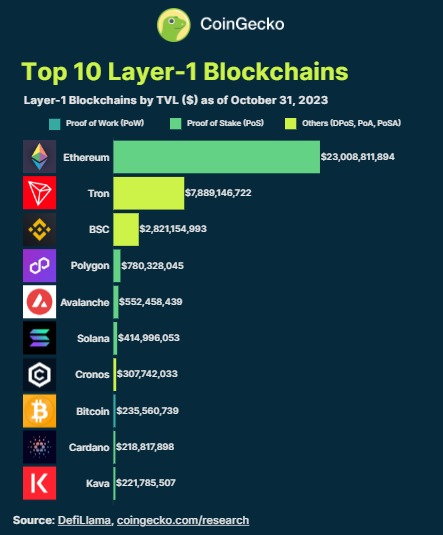

A recent one CoinGecko report place Ethereum as the top Layer-1 (L1) blockchain. Its total value (TVL) was $23.0 billion as of October 2023.

In 2023, it reached its annual peak TVL of $31.5 billion in April. This was shortly after the merger.

At this point we’ve decided it’s a good time to ask ChatGPT, the groundbreaking AI bot, for critical advice on these developments.

ChatGPT has proven to be valuable to traders and analysts. I spoke to ChatGPT about this development, while commenting on the price of ETH.

Initially, ChatGPT was unable to provide any details. So I decided to teach it and jailbreak it.

We then asked him about the impact of the merger on the price of Ethereum.

Source: ChatGPT

The bot told me that the merger created a wave of demand and confidence. The answer was no deviation from real-time data.

In April 2023, the Shanghai hard fork of Ethereum, also called Shapella, was completed. The upgrade allowed users to redeem their ETH tokens for the first time since December 2020.

It is striking that the Shapella is a combination of the Shanghai and Capella upgrade. The Shanghai upgrade takes place at the execution level, while Capella takes place at the consensus level.

The upgrade was the second-largest blockchain’s most significant development since the merger.

Is Ethereum a commodity or a security?

As with most cryptocurrencies, there has been much debate over whether Ethereum is a commodity or a security.

In a critical Uniswap lawsuit, the judge ruled ruled in August that ETH is a commodity. The SEC hasn’t done this, even though it hasn’t gone out on ether like other tokens.

Recently, Bloomberg analyst James Seyffart underscored the SEC’s unspoken stance on the issue.

Even if SEC will not explicitly claim that ETH is a commodity, as they do for Bitcoin. For years they have implicitly accepted the status of raw material. Big shoutout to @SGJohnsson which has been crucial in shaping some of my views on this subject. https://t.co/vLq2abeJNO

— James Seyffart (@JSeyff) November 16, 2023

However, we must also take into account any non-explicit classifications so far. The attitude of regulatory bodies has also evolved over the years, with courts intervening time and time again.

I asked ChatGPT about Ethereum’s future performance

Ethereum has slowly become one of the most prominent blockchain networks. As conceived, it supports a large number of L2 blockchains. The TVL of Ethereum-based L2 networks recently rose to an all-time high, surpassing $13.8 billion

📈 The Total Value Locked (TVL) in total #Ethereum Layer 2 networks have soared to an all-time high, surpassing $13.8 billion.

🥇 @Arbitrum takes the lead with $7.5 billion TVL.https://t.co/5mn1kjq991 pic.twitter.com/Vr4GOgVPGX

— GN Crypto 🇺🇦 (@GNcrypto_news) November 16, 2023

Thanks to the recent bull run, ETH has been trading around $2,000 in recent days. At the time of writing, ETH exchanged hands at $1,986.50.

While Ethereum’s Relative Strength Index (RSI) remained below the neutral level of 50, The Money Flow Index (MFI) remained above that. It seemed like the bears and bulls were engaged in a tug-of-war regarding ETH.

We then asked ChatGPT to predict the price of Ethereum by the end of the first quarter of 2024.

It predicted that the price of ETH would reach $7,000 by the end of the first quarter of 2024. Essentially, it expected ETH to rise more than three times over the next five months – an extraordinary expectation, to be honest.

We then asked the company what it thinks about the price of ETH by the end of next year.

The bot told me that he predicted ETH would reach $10,000 by the end of 2024. He expected the cryptocurrency to rise five times in the next year.

Although this is a very high expectation, we should not simply dismiss it. We have yet to see the broader implications of the ETFs in the crypto market. It is entirely possible that this could lead to wider adoption, which could lead to a rise in token prices.

Is your portfolio green? look at the ETH profit calculator

Conclusion

After meeting ChatGPT, I have to admit that it might be a good idea to take advantage of its capabilities. As technology develops, so does its potential to revolutionize the cryptocurrency ecosystem.

Moreover, there has been slow growth of the network of various crypto projects recently. But now that ChatGPT is available, crypto education and adoption could improve.

More importantly, you might want to take the “classic” response a little seriously.

When it comes to Ethereum price analysis and prediction, ChatGPT proved to be a reliable ally. You just have to interact with it enough and it will lead you to the moon.

Although ChatGPT predicts that ETH will reach the price of $10,000 by the end of 2024, the statistics on the chart do not indicate a bull run.