In a turn of events within the non-fungible token (NFT) market, Bitcoin (BTC) has reached a major milestone by surpassing Ethereum (ETH) in 24-hour NFT sales volume. This is the first time that Bitcoin has outperformed Ethereum in this regard.

BTC’s NFT Breakthrough

Bitcoin’s recent performance to surpass Ethereum in 24-hour NFT sales volume signals a changing trend and growing interest in the NFT market.

While Ethereum has long been recognized as the dominant blockchain for NFTs, Bitcoin’s entry into the space demonstrates its increasing relevance and appeal to NFT enthusiasts and collectors.

The facts highlights that Bitcoin accounted for $17,291,694 in NFT sales, with 575 buyers participating. On the other hand, Ethereum recorded a total turnover of $26,689,252, with 11,225 buyers.

Despite Ethereum maintaining a higher overall sales figure, Bitcoin’s relatively lower wash rate indicates potentially healthier and more organic market activity.

However, when it comes to volatility, data from Deribit, the leading crypto derivatives exchange, shows that the spread between ETH and BTC volatility, commonly referred to as the ETH DVOL vs BTC DVOL spread, has narrowed significantly since October 23 from – 11.6. to just -0.6. This shift signals a change in investor sentiment and an increased focus on Ethereum and altcoins.

In light of this development, Ethereum has outperformed Bitcoin over the past fourteen days. ETH has seen significant price movement, rising over 2% in the last 24 hours, 6% in the last seven days and 4% in the last fourteen days, bringing its current price to $1,899.

Meanwhile, Bitcoin has shown a slowdown in its upward momentum and is currently consolidating above $35,400. There has been an increase of 2% in the past 24 hours, 3% in the past seven days and 1% in the past fourteen days.

However, it is important to note that BTC is up over 82% this year, while ETH is only up 30% over the same period, according to CoinGecko. facts.

Nasdaq 100 correlation with Bitcoin plummets

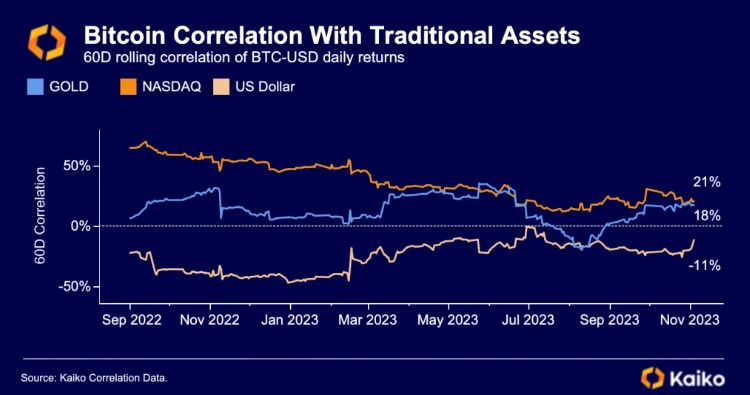

According to recent Kaiko factsBTC has witnessed a significant drop in correlation with traditional assets throughout the year. A notable development is the decreasing correlation between Bitcoin and the Nasdaq 100 index.

Over the past year, Bitcoin’s 60-day correlation with the Nasdaq 100 has decreased significantly, from over 70% in September 2022 to around 19% last week.

Bitcoin’s negative correlation with the US dollar, which ranged from 40% to 50%, has also weakened. Currently, the correlation stands at around 11%, indicating a reduced tendency for Bitcoin’s value to move in the opposite direction to the US dollar.

While Bitcoin’s correlation to gold has seen some upward momentum since August, the average correlation has remained relatively low at 12% throughout the year.

This suggests that the relationship between Bitcoin and gold has been modest in terms of price movements and points to a potential difference in investment characteristics between the two assets.