- dYdX launches V4, a fully decentralized perpetual trading platform on Cosmos.

- Despite an impending token unlock, dYdX’s token retains a relatively high price.

Due to the recent bullish sentiment in the crypto sector, several protocols, including dYdX [DYDX]have aroused considerable interest.

Is your portfolio green? View the dydx Profit Calculator

Despite new developments, uncertainty remains

The launch of the full source code of dYdX V4 was a pivotal moment, marking the transition to a fully decentralized perpetual trading platform. Unlike previous iterations, V4 operates as a Cosmos-based appchain, signaling a migration from the former Ethereum L2 base.

dYdX V4: a cushion for heavy releases

The launch of the full source code of dYdX V4 marks the beginning of a fully decentralized perpetual trading platform. Their latest V4 iteration launched as a Cosmos-based appchain, representing a migration from an Ethereum L2.

However,… pic.twitter.com/6Dc89YdgnV— A Monkey’s Prologue (@apes_prologue) October 26, 2023

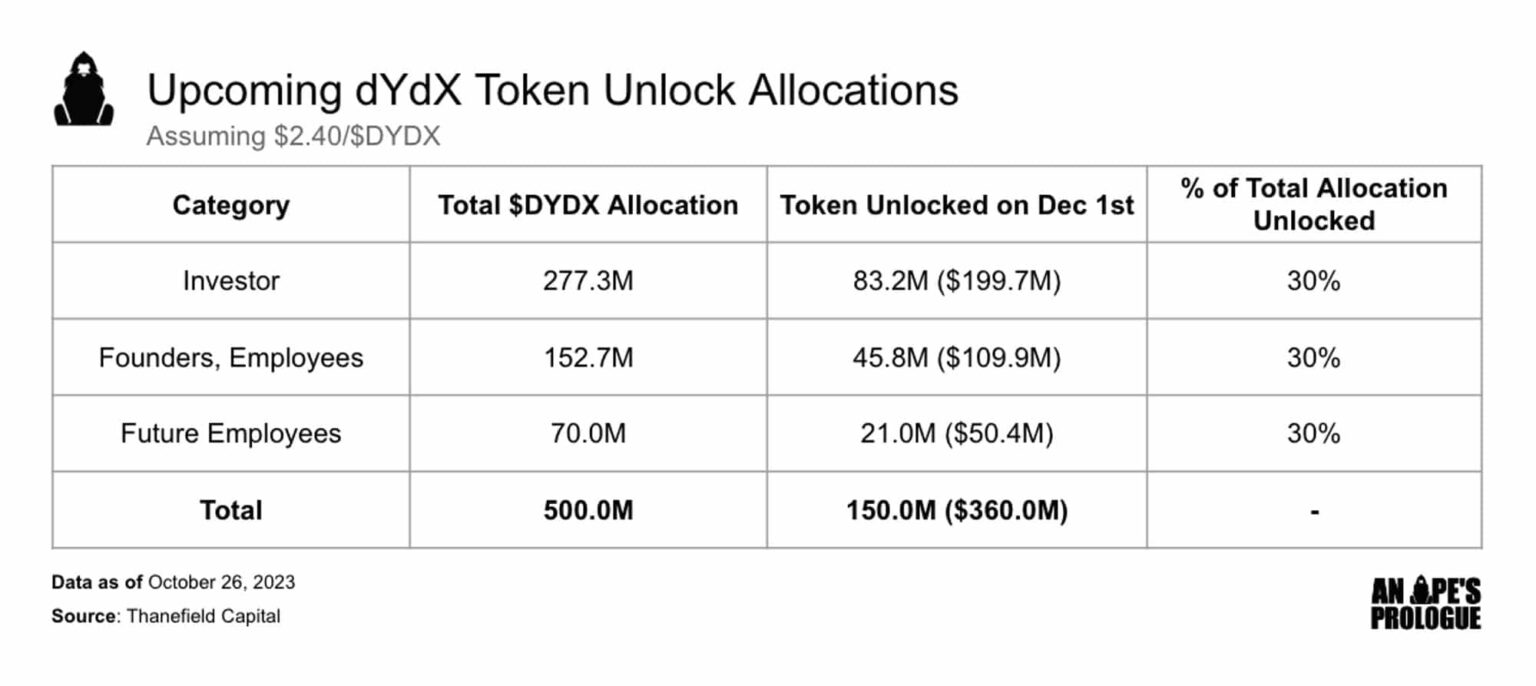

Despite the positive developments, there was a potential hurdle on the horizon, namely the upcoming token unlock.

More than 45% of the circulating DYDX supply, valued at $360.0 million, will become accessible, with investors receiving the largest allocation, accounting for 25% of the circulating supply, valued at $199.7 million.

Source: Thanefield Capital

To mitigate the impact of a substantial influx of tokens into the market, the dYdX team organized a series of events to stimulate demand for tokens. Chief among these is the reintroduction of DYDX staking and profit sharing for DYDX stakers.

Source: Thanefield Capital

Consider revenue sharing

Revenue sharing projections indicate that stakers can expect significant returns. Under the assumption of 10% annual revenue growth from the protocol and allocating all revenue to stakers, a DYDX staking ratio of 30% could yield a 35.5% return.

In previous iterations, all protocol revenue went to the team. However, with V4, the revenue will be sent to DYDX stakers. Stakers profitability is about to increase with decreasing betting ratios and/or increasing protocol revenues.

The team, while potentially less profitable due to staking, remains incentivized to generate higher trading volumes on the platform.

The dYdX team has strategically aligned announcements and events throughout the year with the launch of the V4. In an industry characterized by rampant derivatives speculation, dYdX positioned itself as a formidable competitor.

Realistic or not, here is the market cap of DYDX in BTC terms

Profits rise

Even despite the upcoming token unlock, the price of tokens has remained relatively high, trading at $2,282 at the time of this report.

However, the MVRV ratio has seen substantial growth, indicating greater potential for profit-taking and potential selling pressure in the future.

Source: Santiment