- On-chain indicators suggest that SHIB’s price hit a local low on October 5.

- However, demand for the altcoin remains low.

The price of the leading meme coin Shiba Inu [SHIB] could be poised for a rally after reaching a local price bottom during the intraday trading session on October 5, according to on-chain data sourced from Santiment.

Read Shiba Inu’s [SHIB] Price forecast 2023-24

Does the dog have its “woof” back?

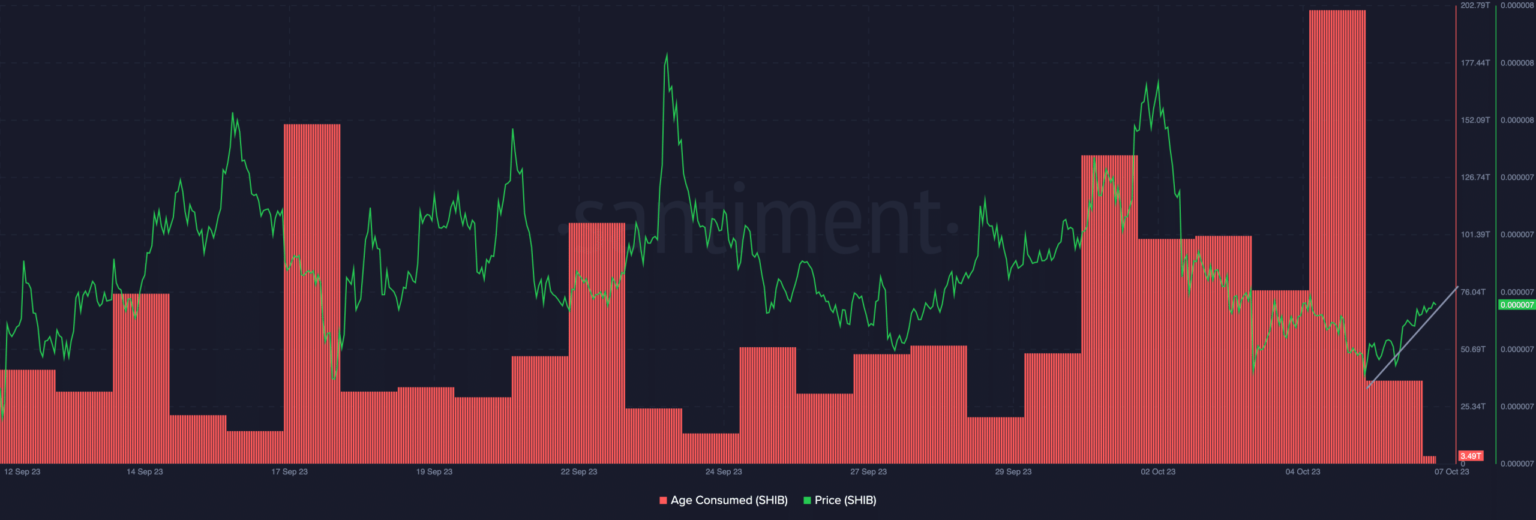

When timing local bottoms, the Age Consumed metric has proven effective. This metric tracks the number of tokens that change addresses on a given date, multiplied by the time since they were last moved.

When this metric witnesses a rise, it typically suggests that a significant number of once-inactive tokens have changed addresses, indicating a sudden and sharp shift in the behavior of long-term holders.

Conversely, when the Age Consumed metric drops, long-held coins remain in wallet addresses without being traded.

This metric is an excellent tool for tracking asset bottoms, as long-term holders are not often susceptible to rapid moves in their dormant coins. Therefore, when this happens, it results in major shifts in market conditions.

According to Santiment data, SHIB’s Age Consumed increased to 200.78 trillion on October 5, which is the highest daily value in the past month. The price of the altcoin closed the trading day at $0.0000071 and has risen slightly since then.

At the time of writing, SHIB was exchanging hands at $0.000007252, registering a 2% price growth since October 5.

Source: Santiment

Weak hands are in

Another on-chain metric that suggested SHIB registered a price bottom on October 5 was the Network Profit and Loss (NPL) metric.

This metric tracks the average profit or loss of all coins that change addresses daily to determine the holder’s periods of profit-taking or capitulation in the chain.

Therefore, when an asset’s NPL dips, it signals a short-term capitulation of ‘weak hands’ and the return of ‘smart money’. This is followed by a price increase as this new group of traders and investors engage in coin accumulation.

This happened with SHIB on October 5. According to Santiment data, SHIB’s NPL fell to -1.2 million that day, after which the alt’s price quickly started to rise.

Source: Santiment

Realistic or not, here is SHIB’s market cap in BTC terms

Demand for SHIB remains low

Among spot traders, SHIB’s daily distribution exceeds accumulation. At the time of writing, the key momentum indicators were below their respective neutral lines. For example, the coin’s Relative Strength Index (RSI) was 43.70, while the Money Flow Index (MFI) was 37.28.

Similarly, the Chaikin Money Flow (CMF) was below the zero line of -0.00. A negative CMF value is a sign of weakness in the market as it indicates an exit from liquidity.

Source: SHIB/USDT on Trading View