Ethereum (ETH), a forerunner in the decentralized finance (DeFi) ecosystem, has seen a notable increase in its staking activity. This boom in strikes has raised eyebrows among experts at JPMorgan Worried about the increasing centralization of ETH and the consequences that may arise.

Ethereum, aiming to transition to a proof-of-stake consensus mechanism, opened the floodgates for staking. This meant that holders could ‘stake’ or lock their tokens to support network operations such as block validation. However, wWhile this promises rewards for the stakers, JPMorgan analysts have done just that reported that ripple effects may occur.

Concerns about Ethereum’s centralization are surfacing

JPMorgan analysts, led by Nikolaos Panigirtzoglou, highlight the unintended increase in Ethereum’s network centralization, especially after the Merge and Shanghai upgrades. The Ethereum network became “more centralized as total staking returns decreased,” they noted.

According to the analyststo which this centralization can be attributed liquid staking providers. Lido, a notable player, has been singled out for his dominant role. The JPMorgan report noted:

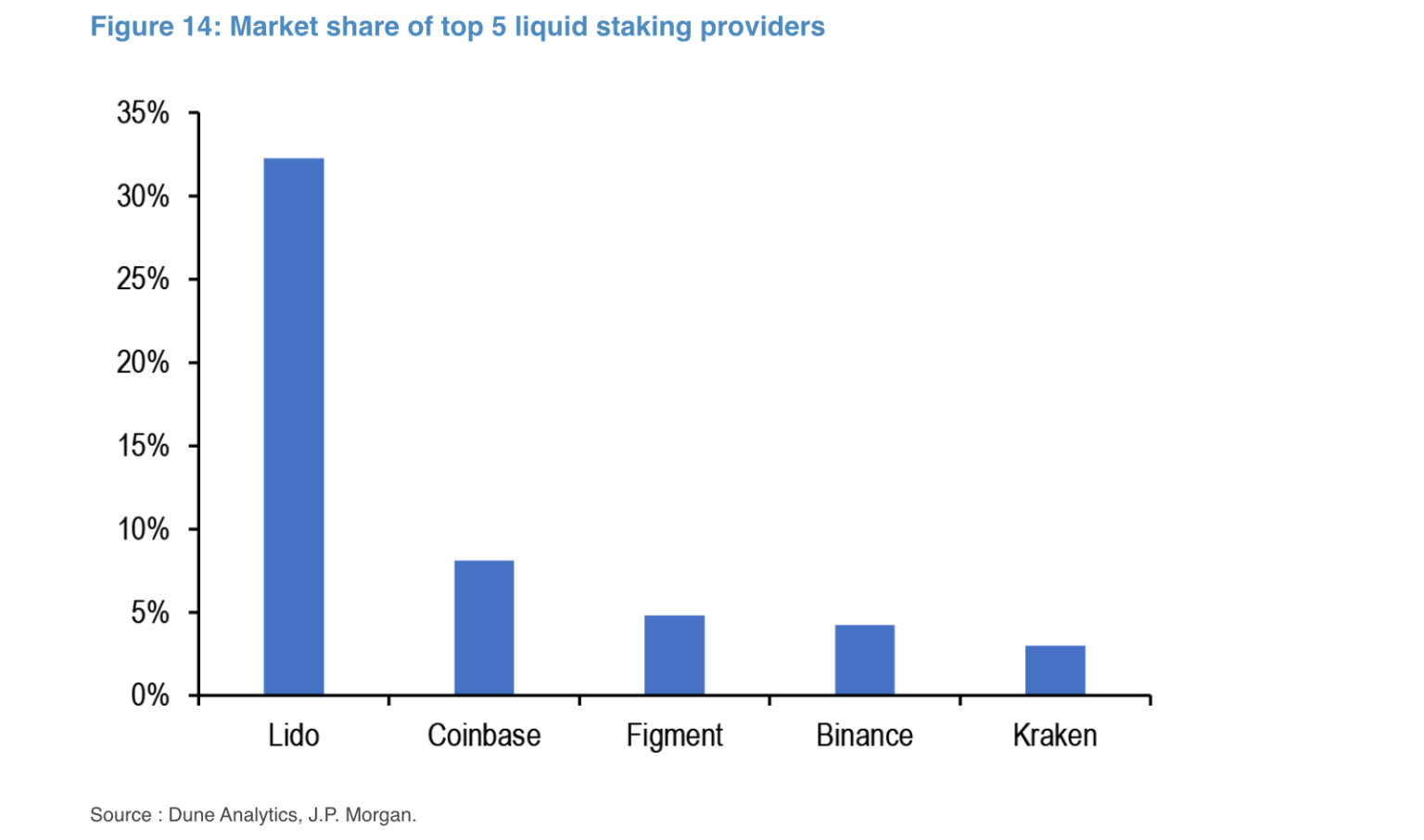

The top 5 liquid staking providers control over 50% of the staking on the Ethereum network, with Lido specifically accounting for almost a third.

The analysts further revealed that while platforms like Lido retain their decentralized nature, the underlying reality looks different. The analysts said these platforms “entail a high degree of centralization.”

According to the analysts, the consequences of such centralization cannot be underestimated. They mentioned that “a concentrated number of liquidity providers or node operators” could compromise the integrity of the network, leading to potential failures, attacks or even collusion, resulting in an “oligopoly.”

They further emphasized that such centralized entities could censor or exploit user transactions, undermining the interests of the community.

The remortgage risk and diminishing rewards

Another dimension of the strike story is the looming threat of ‘rehypothecation’. Simply put, it is the act of deploying staked assets as collateral on various DeFi platforms. According to JPMorgan analysts:

Remortgaging could then result in a cascade of liquidations if a deployed asset plummets in value or is hacked or sliced due to a malicious attack or protocol error.

Additionally, staking rewards appear to be decreasing as Ethereum continues its journey on the staking path. The report indicated a drop in total strike yield from 7.3% before the Shanghai upgrade to around 5.5% recently.

Regardless, Ethereum has shown a slight upward trajectory of 1.5% over the past 24 hours, with its market price currently at $1,643 and a market cap of around $9 billion, at the time of writing.

Featured image from Unsplash, chart from TradingView