- FTX co-founder Gary Wang’s testimony revealed wire fraud charges against Sam Bankman-Fried and associates.

- The extraordinary privileges of Alameda Research and the massive withdrawals from FTX detailed.

FTX [FTT] Co-founder Gary Wang’s testimony revealed major bank fraud allegations against Sam Bankman-Fried and his inner circle.

Realistic or not, here is the market cap of FTT in terms of BTC

Wang spills the beans

During his court appearance, Wang made a surprising revelation, stating that they had allowed Alameda Research, the trading desk founded by Bankman-Fried, to gain unlimited access to customer deposits of FTX, the crypto exchange, and its sister company.

Gary Wang, co-founder of FTX, found himself in a situation where he had to plead guilty and cooperate with authorities in their investigation into the exchange.

Despite being a longtime friend of Sam Bankman-Fried since high school and playing a key role in the founding of FTX, he maintained a much lower public profile compared to Bankman-Fried during the company’s meteoric rise in the crypto space industry.

Wang provided intricate details about the deal with Alameda Research and made it clear that the trading desk enjoyed significant privileges. This included a significant line of credit that enabled faster order execution on the FTX platform.

Alameda also had the remarkable privilege of withdrawing funds without restrictions. In fact, Alameda was even allowed to maintain a negative balance.

By the time FTX met its eventual demise, Alameda had withdrawn as much as $8 billion from the platform and used $65 billion from its line of credit, according to Wang’s disclosures.

This level of Alameda debt set the company apart from other FTX market makers. Typically, these market makers operated with millions of lines of credit, not billions, as was the case with Alameda.

it comes down to

In addition to the revelations about Alameda, Wang also released important information about his compensation and ownership within FTX. He said he was paid an annual salary of $200,000 and had a significant 17% equity stake in the company.

In stark contrast, Sam Bankman-Fried was the principal owner of FTX, controlling approximately 65% of the company. Meanwhile, in the case of Alameda Research, Bankman-Fried owned an astonishing 90% of the shares, leaving Wang with a 10% minority.

Additionally, during his tenure at FTX, Wang was granted several privileges, such as the ability to withdraw $200,000 from the company for the construction of his personal residence.

In addition, he gained access to a significant amount of up to $300 million for investments in other start-up companies.

Is your portfolio green? View the FTT profit calculator

State of the FTT

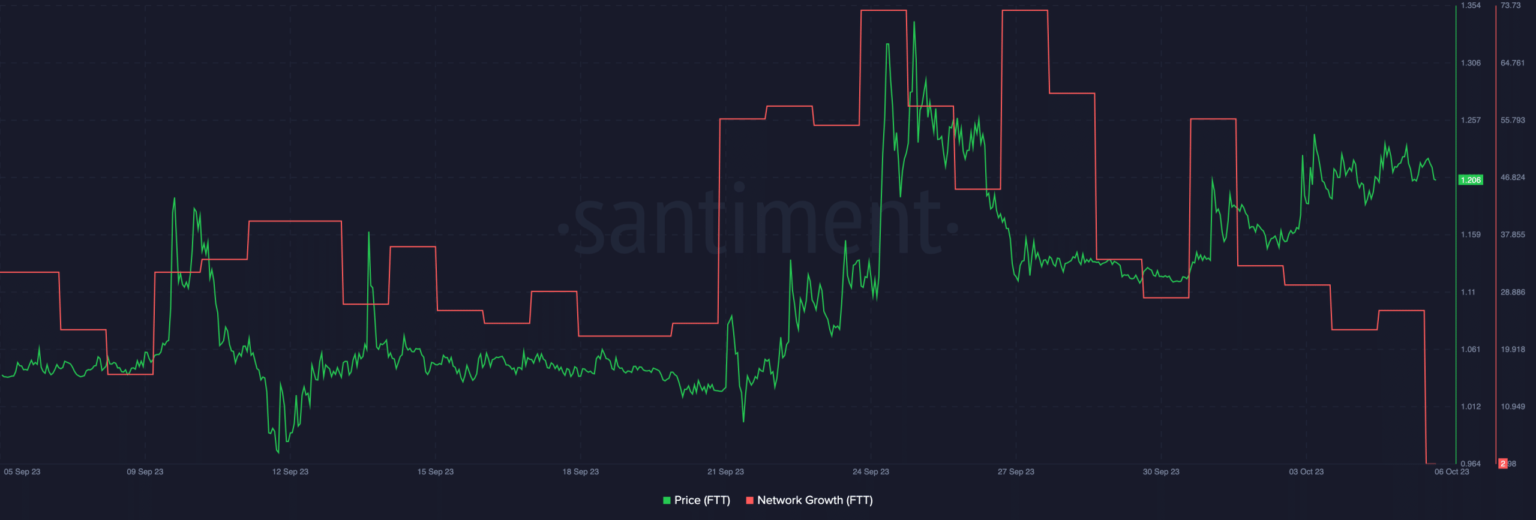

Notably, despite the ongoing legal turmoil surrounding FTX, the native token (FTT) showed resilience and continued to show growth over the past month.

At the time of last report, FTT was trading at $1,206. However, it is essential to highlight that FTT’s network growth has seen a notable decline, indicating less interest from new addresses.

Source: Santiment