- At the time of writing, buying pressure was stronger than selling pressure in the market.

- The OI in Bitcoin futures is up 7.28% over the past 24 hours.

The world’s largest cryptocurrency, Bitcoin [BTC]broke the $28,000 mark for the first time in more than six weeks, and investors hoped the breakout would pave the way for more substantial gains in the coming days.

Is your portfolio green? Check out the BTC profit calculator

Buyers dominate the market

The rally pulled Bitcoin out of the narrow trading range it has been in since the biggest market crash of mid-August 2023. At the time of writing, the king coin was exchanging hands at $28,065, with a gain of 3.75% in the 24-hour period, per CoinMarketCap.

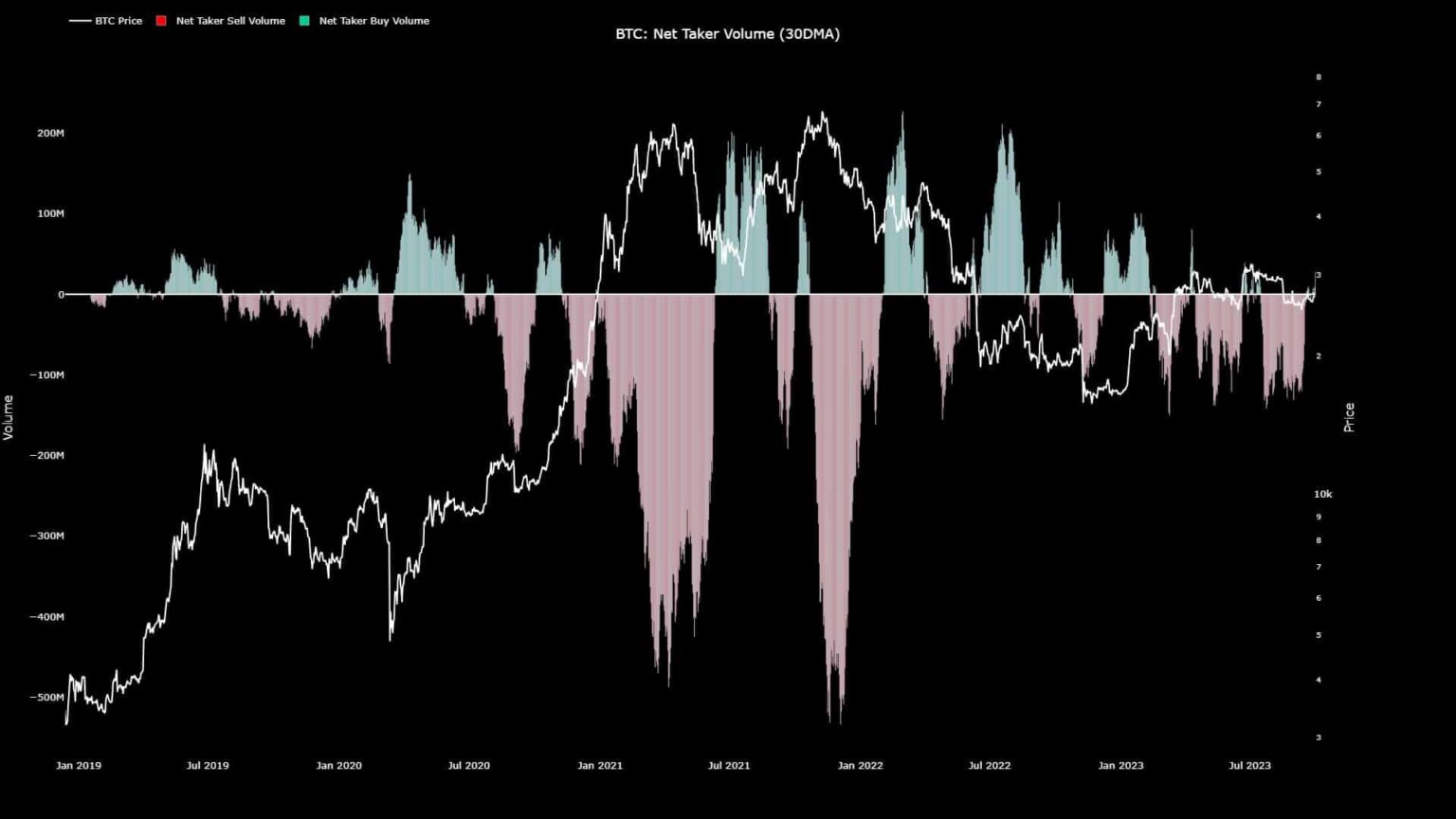

According to CryptoQuant author MaartunOn October 1, the buying pressure on the market was stronger than the selling pressure. This was because the Net Taker Volume turned positive after a period of almost four months.

Historically, Net Taker Volume has been considered a reliable indicator for predicting Bitcoin’s next moves.

If Bitcoin’s price is low and there is aggressive buying, it means a bottom is around the corner. Therefore, market press time indicated a dominant bullish sentiment.

Problems for traders with bearish leverage

The rally also affected traders who were in a bearish position. Short positions worth nearly $6 million have been wiped out on cryptocurrency exchange Binance, according to a recent update from Glassnode. This was the largest short liquidation in more than a month.

📈 #Bitcoin $BTC Futures Contracts Short liquidations just hit a one-month high of $5,977,638.92 on #Binance

The previous one-month high of $3,391,945.27 was observed on September 18, 2023

View statistics:https://t.co/gx84oO3b8c pic.twitter.com/LIhigoB5Ou

— Glassnode Alerts (@glassnodealerts) October 2, 2023

Read Bitcoin’s [BTC] Price forecast 2023-24

Additionally, Open Interest (OI) in Bitcoin futures has risen to $12.31 billion, marking a 7.28% increase over the past 24 hours, according to Coinglass. An increase in OI that accompanies a price increase is interpreted as new money entering the market and is therefore a bullish sign.

Source: Coinglass

Surprisingly, despite the price cracks and short liquidations, the majority of traders were betting on future price declines. At the time of writing, the number of shorts exceeded the number of longs in the futures market.

Source: Coinglass