A new report shows that 95% of regular non-fungible tokens (NFTs) have recorded plummeting values, many of which are now nearly worthless.

On September 20 media outlet Rolling Stone highlighted a report from dappGambl “Dead NFTs: The Evolving Landscape of the NFT Market,” an analysis that explains why most NFTs have fallen in value without significant traction in recent months.

According to the report, out 73,257 NFT collections analyzeda staggering 69,795 out of a total of 95% would not make a single dollar in today’s market. This ‘completely worthless’ tokens are owned by approximately 23 million investors.

The story has sparked several reactions in the digital asset world, with many supporting the analysis as they are part of the 23 million users who own the worthless tokens.

Several crypto enthusiasts mentioned the development as worrying, and agree that their possessions are worthless. “Do people even buy these?” “That’s such a spectacular fall,” she added.

Others simply criticized the marketing of NFT projects as the main reason why many feel disappointed with the current reality and limited use cases, in addition to the hype leading to a rise in token prices.

On the other hand, pro-NFT takes advantage of highlighted inconsistencies in Rolling Stone’s position over the years after a user an article unearthed on their site from November 2021 to promote a Bored Ape Yacht Club Collection (BAYC).

Others felt that the crypto winter has impacted the price of NFTs and that a major reversal could occur as things improve.

“Some will make a comeback. Some will rise 1000% because of bull. People will get angry again because pixels are worth millions.”

Is there hope for a recovery? NFTs are drowning

The buzz of NFTs in 2021 attracted several adopters to blockchain technology as the niche was very different from the payment service model of traditional digital assets.

As more projects went mainstream, NFT trading volume soared by more than $17 billion during the 2021 bull run, but it has remained a shadow of its former self.

The crypto winter that has tightened the market has been raised as a factor, as many say the decline in usage and overall values captured on decentralized applications (dApps) is a major reason for the status quo.

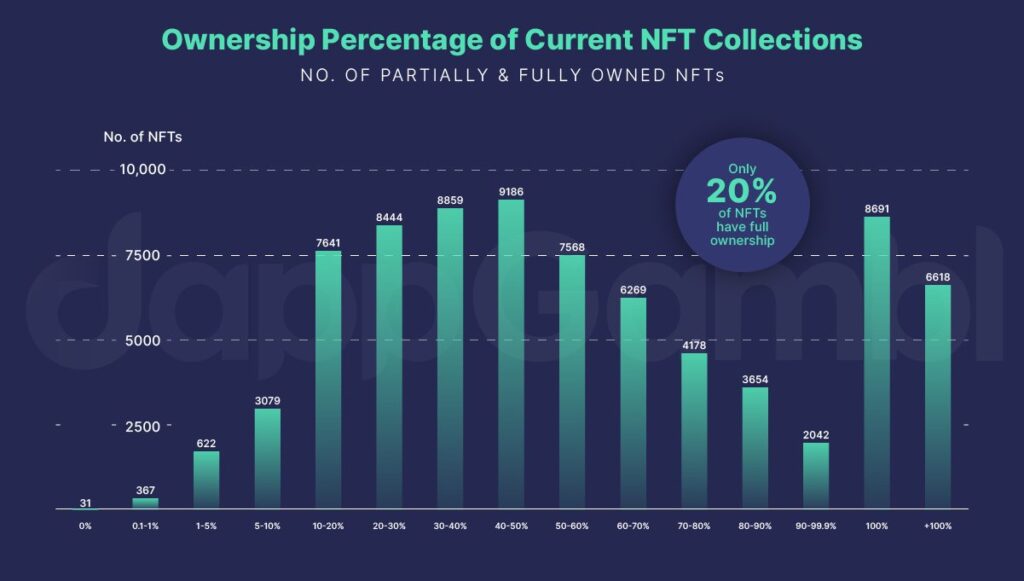

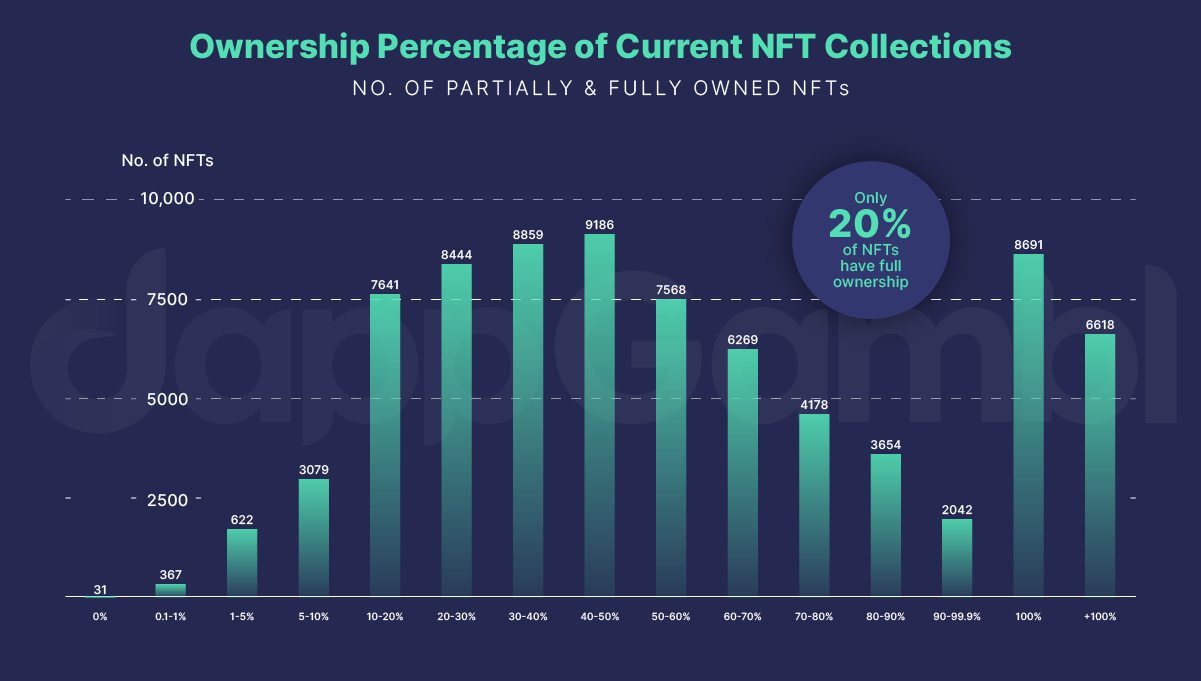

Making matters slightly worse for NFTs is that the ecosystem is registering less demand, as the highlighted report notes that only 21% of the collection is fully owned and most of it is unsold.

“projects without clear use cases, compelling stories or real artistic value are finding it increasingly difficult to attract attention and sales,” added to the report.

“projects without clear use cases, compelling stories or real artistic value are finding it increasingly difficult to attract attention and sales,” added to the report.

While it remains unknown whether most NFTs will stage a recovery, NFT bulls are holding on to a resurgence in the broader market as support for their prized assets.