Despite its less-than-impressive performance in recent months, Bitcoin investors are still digging deeper into the digital asset. This is evident from the continued increase in wallet activity recorded during this period.

Bitcoin Wallet Activity Reaches Highest Level in 5 Months

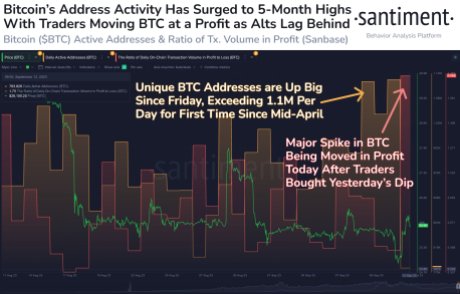

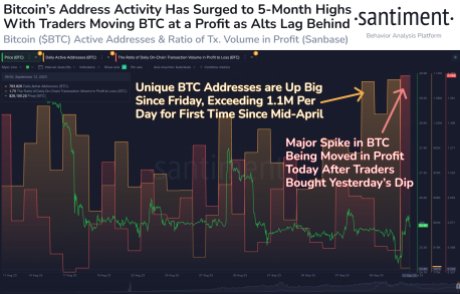

In a post on Tuesday, on-chain data aggregator Santiment revealed that there has been a significant increase in Bitcoin wallet activity, despite the downward trend in the BTC price. Although the market fluctuated widely due to regulatory uncertainties, Bitcoin investors apparently held their ground, especially in terms of new wallet address activity.

The Santiment reports show fluctuations in this metric over the months. The one consistent thing, however, was its tendency to bounce back up even after a significant dip. In September alone, the value rose from a low of around 860,000 to over 1.1 million unique daily active Bitcoin addresses.

Unique daily addresses hit 5-month high | Source: Santiment on X

Interestingly, this figure is the highest since April, proving that the downward trend in BTC price has not served as a deterrent for Bitcoin investors. Rather, it appears that investors are using the current low prices as a way to expand their footprint.

The upswing can also be explained by the euphoria caused when asset manager Franklin Templeton filed for a Spot Bitcoin ETF. While the hype surrounding the filing was short-lived, it caused a brief surge in the digital asset’s price, and likely contributed to rising portfolio activity as investors rushed to take advantage of the growth.

Will BTC Price Follow Wallet Activity?

Even though wallet activity has increased, the BTC price is still below $26,000. This could indicate that this metric does not really have much influence on the price of Bitcoin. Rather, it indicates that investors are not delaying the use of the network despite the low prices.

BTC price recovers above $26,000 | Source: BTCUSD on Tradingview.com

Currently, investors are still eagerly awaiting a decision on the numerous Spot BTC ETFs filed by fund managers. The outcome of these applications, whether rejected or accepted, will likely be the determining factor of the future Bitcoin price.

For now, no major moves are expected for the digital asset, especially given that it is still below the 50 and 100 day moving averages. The rising resistance between $26,000 and $27,000 suggests that Bitcoin could continue trading sideways for most of September.

At the time of writing, Bitcoin is treacherously holding over $26,000, with a paltry gain of 0.64% in the past day.