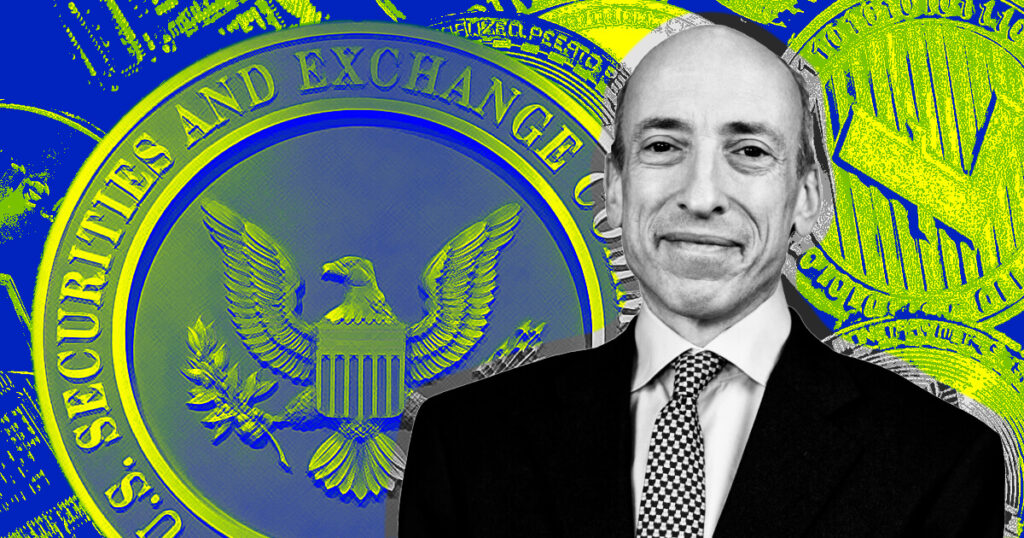

Securities and Exchange Commission (SEC) Chairman Gary Gensler continues to insist that most cryptocurrencies fall under the agency’s securities regulations, despite continued criticism from the crypto industry.

In written testimony on September 12 before the Senate Banking Committee, Gensler reiterated the SEC’s strict position that crypto trading platforms and intermediaries must register with the agency as exchanges, broker-dealers and clearing agencies.

Gensler stated:

“There is nothing about the crypto asset markets that suggests investors and issuers are any less deserving of the protections of our securities laws,”

The SEC chairman argued that because the 1930s securities laws broadly define securities to include “investment contracts,” most cryptocurrencies and crypto tokens meet the definition of securities subject to SEC regulation.

Gensler justified the SEC’s recent wave of enforcement actions against major crypto companies. He said,

“Given the widespread non-compliance with securities laws in this sector, it is not surprising that we have seen many problems,”

However, the crypto industry has argued that sweeping regulations do not take into account the unique nature of digital assets.

Others have accused the SEC of overreach in attempts to extend decades-old securities laws to emerging crypto finance models such as decentralized autonomous organizations (DAOs) and decentralized finance (DeFi) protocols.

However, Gensler’s strict regulatory approach faces ongoing legal challenges that could undermine the SEC’s ability to bring crypto companies into compliance. The court’s recent ruling in the Ripple case handed the company a partial victory, as it ruled that some sales of XRP tokens did not constitute unregistered securities.

Specifically, the judge determined that retail sales and free distributions of XRP did not meet the statutory test for securities. Although Ripple’s institutional sales were declared to be securities offerings, the nuanced statement suggests that crypto assets may not fit neatly into 1930s regulations. Some industry experts argue that this shows gaps in the SEC’s conceptual approach to crypto finance. Nevertheless, Gensler expressed disappointment, and the SEC has since challenged the judge’s conclusions on retail XRP sales.

The post Despite industry objections, SEC’s Gensler continues to classify crypto as securities first appeared on CryptoSlate.