- Bitcoin’s vibrancy plummeted to its lowest point in the past two years.

- Confidence in Bitcoin’s long-term prospects could attract more players to the market.

Bitcoin [BTC] Recent months have seen a sea of change, driven by a dramatic shift in investor perception.

Rather than taking advantage of the wild swings to quickly acquire wealth, holders of the king coin began to come to grips with its qualities as a “store of wealth” and a potential refuge during economic downturns.

How much are 1,10,100 BTCs worth today?

Consequently, the HODLing mentality has taken over. Long-term holders (LTH) have increasingly sought to consolidate and increase their inventory lately.

Bitcoin was less vibrant

An effective, but less used, metric to understand investor hoarding behavior is the Liveliness metric. According to a recent post from Glassnode on social platform

📉 #Bitcoin $BTC Vibrance just hit a two-year low of 0.596

View statistics:https://t.co/nVxCWOijbO pic.twitter.com/nSHFssz1eF

— Glassnode Alerts (@glassnodealerts) September 9, 2023

For the uninitiated, Liveliness is the opposite of HODLed Bitcoins. Therefore, lower vibrancy implied that LTHs were strongly accumulating. In contrast, higher vibrancy would indicate that the cohort was aggressively selling its assets.

The vibrancy measure fluctuates between the two extremes of 0 and 1. As the data above shows, vibrancy has been on a steady downward trend since the collapse of the FTX last November. Notably, this was also the peak of the crypto winter of 2022, when Bitcoin fell below $16,000. It made economic sense for most holders to cease trading around this time.

However, despite a strong price rebound in 2023, HODLing sentiment has only become stronger. Bitcoin’s resilience during the US banking crisis in March, its insulation from the aggressive gaze of US regulators, and the… upcoming halving eventforced investors to assess its long-term growth potential.

The dormant supply is reaching new peaks

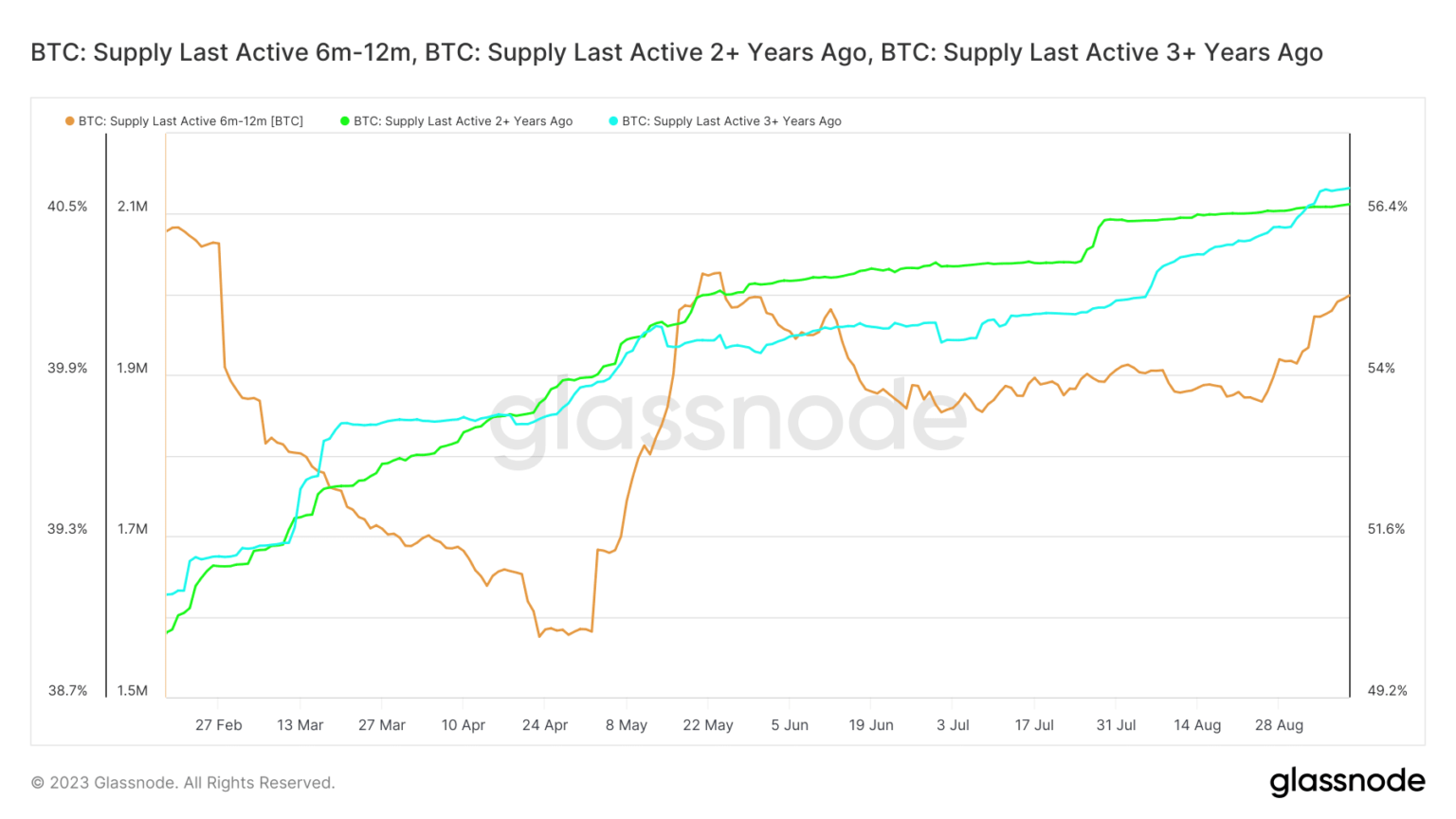

Investors’ lack of willingness to sell BTC was also illustrated by the token’s growing dormant supply. Most age groups recorded an increase in HODLing activity.

Notably, the portion of Bitcoin’s supply that is held for at least two years is 56%, while the stock that has not been traded on-chain for at least three years is 40%.

Source: Glassnode

Interestingly, some of the coin’s recent buyers also showed hoarding tendencies. Coin supply that was older than six months but younger than 12 months soared to a three-month high.

Whales keep their distance from exchanges

Bitcoin also witnessed a significant drop in transfer volumes settled on the network. While the number of low-volume transactions clearly boomed, transactions that moved a large number of tokens decreased, as shown by Glassnode.

Source: Glassnode

This primarily reflected the muted interactions between whale investors and exchanges. Note the massive drop in transfer volumes in 2023 compared to the period prior to the start of the crypto winter. At the time, whales were unloading their bags to rake in huge profits on their initial investment.

Looking back at 2023, things have changed. Evidence on the chain suggested that whales were stockpiling supplies for big game.

Exchange Whale Ratio, which is the The relative size of the top 10 inflow transactions compared to the total inflow on an exchange was a value of 0.42 at the time of writing. In other words: of the total inflow on the stock exchanges, the share of whales was only 42%.

Source: CryptoQuant

Whales’ reluctance to take their assets to exchanges affected the total number of on-chain exchange deposits. According to the latest updates from Glassnode, transfers to exchange addresses have fallen to the lowest level in three years.

📉 #Bitcoin $BTC Number of exchange deposits (7d MA) just reached a three-year low of 1,806,756

View statistics:https://t.co/v3uKq4dCjX pic.twitter.com/dsE1wTQI45

— Glassnode Alerts (@glassnodealerts) September 9, 2023

Is your portfolio green? Check out the BTC profit calculator

Will more participants enter the market?

After observing the above trends, it became clear that HODLing was indeed the dominant sentiment in the market. However, it begs the question: will the increased hoarding mentality ultimately lead to an increase in Bitcoin’s economic value?

Glassnode’s reserve risk indicator dropped dramatically in 2023, indicating that long-term investors had high confidence in Bitcoin. Someone observing from the outside would see this as a signal to enter the market, paving the way for greater network adoption.

The steady increase in the number of addresses with a positive value of Bitcoin was a testament to this story.

Source: Glassnode