On-chain data shows that the gap between Bitcoin’s long-term holders and short-term holders has recently grown to record levels.

The Bitcoin market has continued its shift towards HODLing

As an analyst at a after As X explained, the gap between speculators and HODLers in the market has only widened recently. The “short-term holders” (STHs) and the “long-term holders” (LTHs) are the two primary cohorts into which the entire Bitcoin market can be divided.

The STHs refer to all those investors who bought their coins less than 155 days ago, while the LTHs include the holders who held their tokens after that period.

Statistically, the longer an investor lets their coins sit idle, the less likely they are to sell them at any point. For this reason, the STHs tend to be the group with the weaker conviction of the two.

The LTHs often remain in the asset for volatile periods without moving an inch, earning them the popular name of “diamond hands.” The STHs, on the other hand, tend to sell quickly when FUD emerges in the industry or a profitable selling opportunity presents itself.

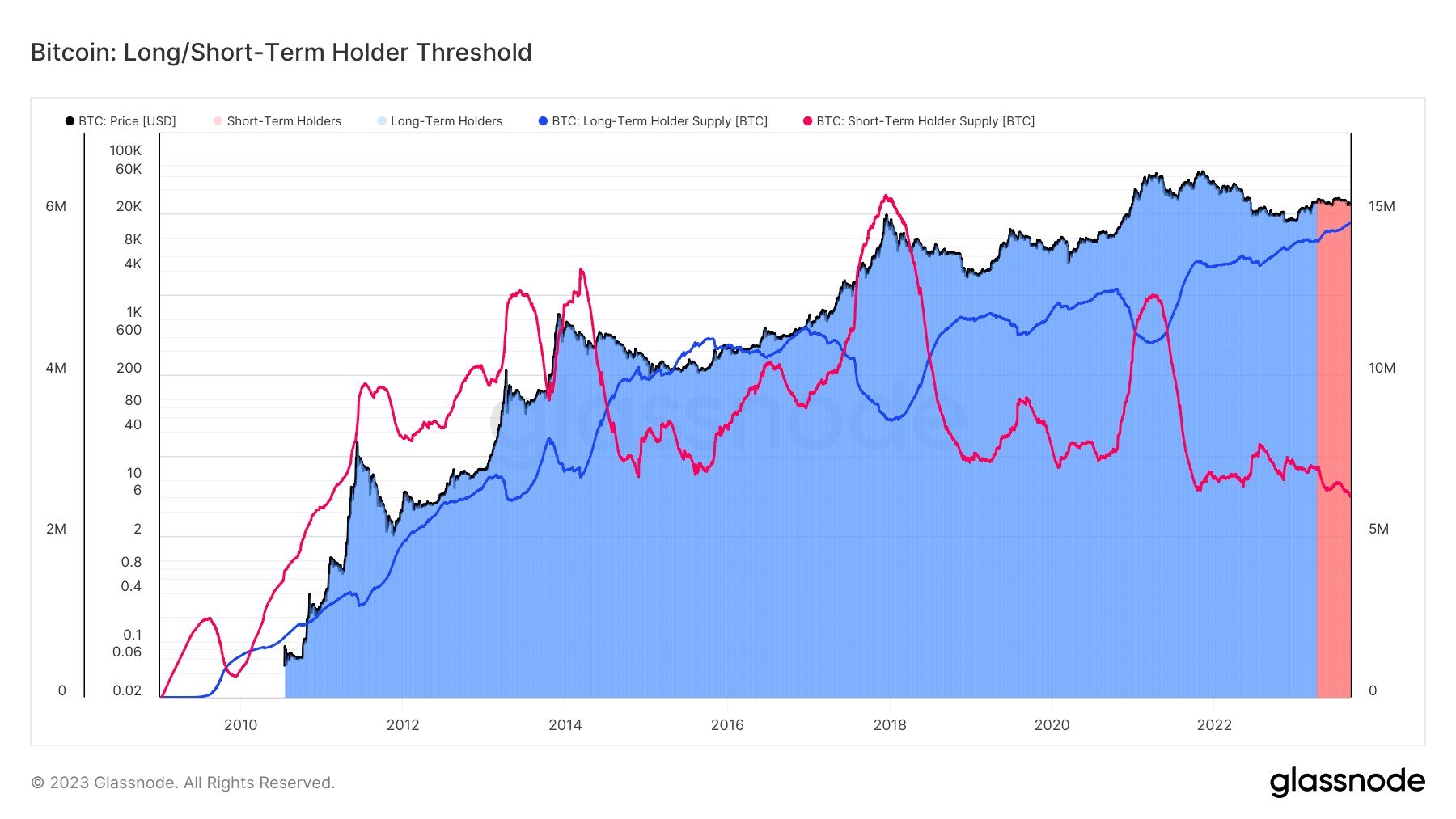

Here is a chart showing the trend in the supply of these BTC investor groups through the cryptocurrency’s history:

Looks like the two metrics have been going in opposite directions to each other | Source: @jimmyvs24 on X

The chart shows that the Bitcoin LTH supply has been on an upward trend for the past few years, while the STH supply has declined recently. This could indicate that the cryptocurrency’s overall supply is perpetually dormant.

The gap between these groups is the largest ever, as the LTH supply approaches the 15 million BTC mark, while the STH supply has fallen below the 2.5 million BTC level.

The latter’s latest value is the lowest ever since 2011, when the asset was in its infancy. It appears that short-term speculators in the market have thinned to a record low.

Last month, Bitcoin witnessed a sharp crash from above the $29,000 level to below the $26,000 mark, and the assets have not recovered. However, as the chart shows, LTHs have not cared at all about the asset struggles, as their supply has only continued to rise while STHs have continued to contract.

The fact that the LTH group remains strong and continues its growth may not affect the market in the near term, but over longer periods of time, the supply that remains tied up in the wallets of these HODLers could have a bullish impact due to the way in which the dynamics between supply and demand works. .

BTC price

At the time of writing, Bitcoin is hovering around $25,700, registering a 6% dip over the past week.

BTC remains unable to show a break in either direction | Source: BTCUSD on TradingView

Featured image of Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com