Ethereum has seen the price of its native token ETH drop along with Bitcoin as the bear market continues to gain momentum. This has created fear among investors, leading to high selling pressure on the digital asset. Even the Ethereum whales are now dancing to the tune of the bear market as they have begun sending large amounts of ETH to centralized exchanges.

Ethereum whales aim for sales

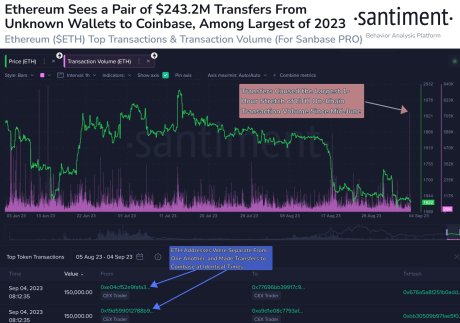

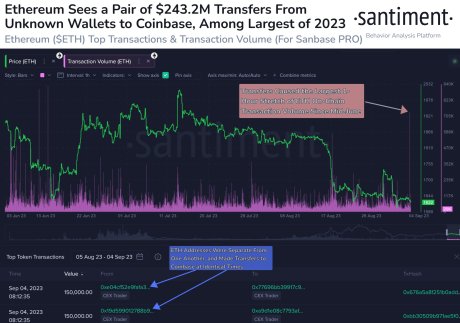

A recent Santiment report on the X platform (formerly Twitter) has shown that Ethereum whales may be looking to leave the stage left at this point. The chart posted by the on-chain data tracker shows that whales moved 300,000 ETH to the centralized exchange Coinbase.

The transfer was made in two transactions with 150,000 ETH each. At that point, each of the transactions brought ETH worth $243 million to the exchange. So, in total, both transactions moved a total of $486 million worth of ETH to Coinbase.

Whales send 300,000 ETH to Coinbase | Source: Santiment on X

Despite being such closely monitored transactions, there are no clues as to what the whales are planning to do. Normally, the movement of coins towards centralized exchanges means sell-offs, especially for large investors, who do this to minimize the impact of their sales as much as possible.

However, the price of Ethereum is still trading close to where it stood on Monday, and if these whales wanted to sell, such activity would have led to a rapid drop in the price of ETH.

There is also the fact that once the ETH was transferred to Coinbase’s hot wallet, it would be further broken down into smaller chunks of 4,282 ETH, which were then moved to other wallets. But even this doesn’t give a clear picture of why the ETH was moved to Coinbase in the first place.

Bears are taking over with negative sentiment

The selling pressure the Ethereum price has been under recently has not come out of the blue. The Crypto Fear & Greed Index had moved into fear territory after the market crash. This meant that investors were more inclined to sell their holdings than to bring new money into the market.

Related reading: On-chain Sleuth may reveal Shiba Inu founder with shocking partners

It has now become a battle for the bulls for ETH as the bears have successfully dragged the price below the 50-day moving average. This points to more bearish momentum for assets in the near term. However, it’s not all bad.

ETH price maintains $1,600 despite large transactions | Source: ETHUSD on Tradingview.com

Typically, when indicators have fallen this low, it can be a springboard for recovery. So while ETH may be looking for more bear moves in the near term, the digital asset could be close to another rally, potentially pushing the price above $1,700 once again.

The price of ETH is changing hands from $1,624 at the time of writing. It is down 0.90% and 1.31% on the daily and weekly charts respectively.