- LINK is down over 4% in the past seven days.

- Selling pressure on Chainlink was high, but a few indicators looked bullish.

Like most cryptos, Chainlink’s [LINK] the price chart remained red, thanks to the bearish market conditions. However, Chainlink has launched a new update to its staking ecosystem, which has the potential to help LINK investors enjoy profits.

Realistic or not, here it is LINK market cap in BTC‘s conditions

Chainlink has launched Strike v0.2

After the launch of Chanlink staking v0.1 in December last year, the blockchain has now unveiled the next update, v0.2. The first version consisted of a LINK stake pool of 25 million. With the new release, the betting pool has been increased to 45 million CLUTCH.

V0.2 has been redesigned into a fully modular, extensible and upgradable staking platform.

The next version of #Chain link Strike (v0.2) is on track for launch later this year.

Learn more about how v0.2 introduces greater staking flexibility, enhanced security assurances for Oracle services, a modular architecture for iterative upgrades, and more.https://t.co/4SodK1iuv1

— Chainlink (@chainlink) August 25, 2023

The update would not only provide more flexibility, but also improve security and introduce a dynamic reward mechanism. According to the official announcement, the launch of the v0.2 beta upgrade will gradually expand access to a wider range of participants.

Starting with a priority migration period for existing v0.1 stakers before entering Early Access and then General Access.

Will this help Chainlink investors?

At first glance, it might not seem like the release could have an impact on LINK’s price, but a deeper dive into the scenario suggests otherwise. Since the update would significantly increase the betting pool, it can be expected to be even more CLUTCH tokens in circulation are locked during staking.

This can cause a shortage of supply and increase demand. And according to supply and demand theory, prices tend to rise when demand increases and supply decreases. Therefore, there were chances that the new staking update would have a positive impact on LINK as it struggled to push its price upwards.

According to CurrencyMarketCapLINK fell over 4% last week. At the time of writing, it was trading at $5.91 with a market cap of $3.1 billion. A possible reason behind the downtrend could be an increase in selling pressure.

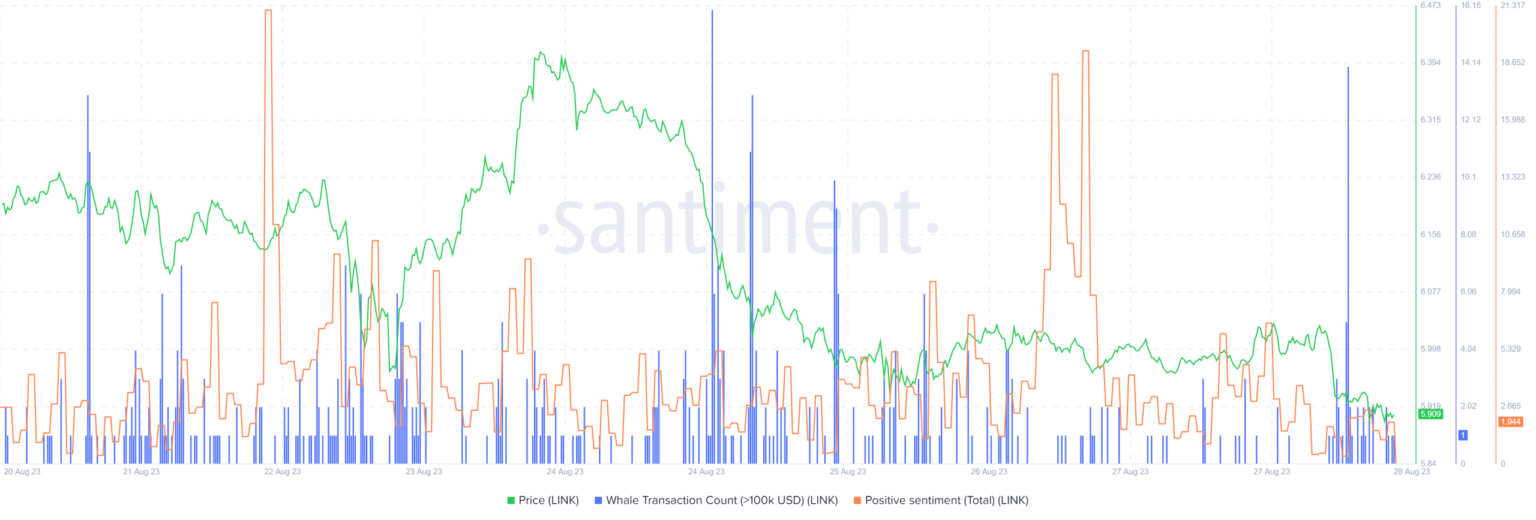

This was revealed by LINKs exchange grid current, as net deposits to the exchanges were high compared to the seven-day average. Nevertheless, Chainlink’s positive sentiment spiked a few times, reflecting investor confidence. Whale activity around LINK also remained relatively high over the past week.

Source: Sentiment

How many Worth 1,10,100 LINKs today

Some market indicators also seemed optimistic CLUTCH. For example, both the Relative Strength Index (RSI) and the Money Flow Index (MFI) are entering the oversold zone, which can increase buying pressure.

In addition, the MACD showed the possibility of a bullish crossover. However, the On Balance Volume (OBV) remained low, which was worrying.

Source: TradingView