- Unibot’s growth could revitalize Ethereum amid market challenges.

- Reduced interest in whales and declining sales of NFT are hurdles to Ethereum’s resurgence, impacting the broader ecosystem.

The current bear market has cast a heavy shadow over Ethereum[ETH], impacting activities across industries and dampening overall performance. Amidst this gloom, the rise of Unibot offered a glimmer of hope for the Ethereum ecosystem.

Realistic or not, here is the market cap of ETH in terms of BTC

Unibot, a Telegram bot designed for seamless cryptocurrency trading within the app, attracted a lot of attention for its easy-to-use features such as decentralized copy trading, DEX-based limit orders, and protection against MEV bots.

More hope for ETH?

This sudden surge in Unibot’s popularity was reflected in the numbers, as data from the token terminal showed a remarkable 97% increase in Unibot’s gas consumption over the past 30 days. This uptick could potentially breathe new life into the Ethereum ecosystem, providing users with a convenient and efficient trading tool.

Looking at the most gas consuming entities @ethereum… @TeamUnibot grows the fastest! pic.twitter.com/gzYzSAGMrR

— Tokenterminal (@tokenterminal) August 26, 2023

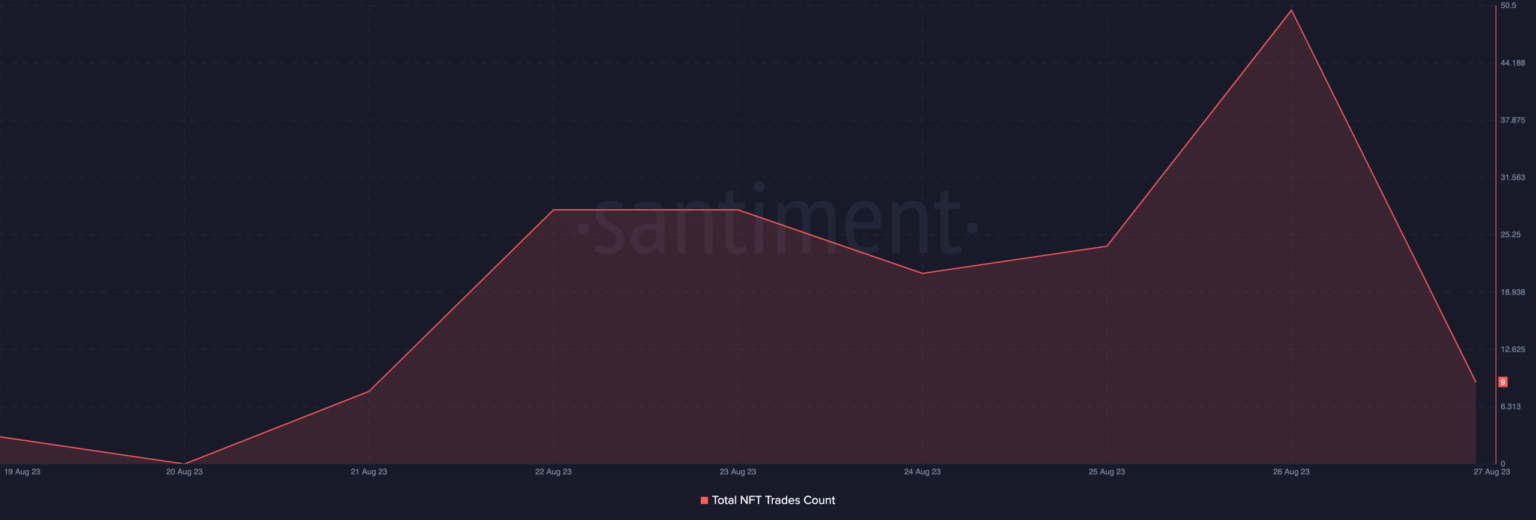

However, it is important to note that while the rise of Unibot is promising, it may not be a panacea for Ethereum’s challenges. Despite Unibot’s growth, NFT sales on the Ethereum platform continue to fall, as shown by Santiment’s data. This suggests that while certain areas show promise, the broader landscape of Ethereum remains complex.

Source: Sentiment

Whales don’t feel it

Shifting focus to the broader health of Ethereum, whale interest in the token has faced a downward trajectory. Glassnode’s data pointed to a worrying trend: the number of addresses holding 10,000 or more ETH hit a two-year low of 1,082.

The decline in interest in whales may negatively impact the price of ETH in the future. However, decreased interest from whales could also have positive benefits for ETH. The lack of interest in whales could reduce the vulnerability of retail investors holding ETH.

Source: Glassnode

Is your wallet green? Check out the Ethereum Profit Calculator

Further analysis of Ethereum’s performance revealed a low MVRV ratio, indicating that a significant portion of ETH holders are currently in an unprofitable position. These dynamics can influence market sentiment and trading behavior, potentially contributing to the challenges ETH faces in its recovery.

Source: Sentiment

In the trading arena, Ethereum experienced a rise in implied volatility (IV), which measures the market’s expectations for future price movements. Increased IV often leads to more cautious trading strategies as investors brace for greater price swings and uncertainty.

Source: The Block