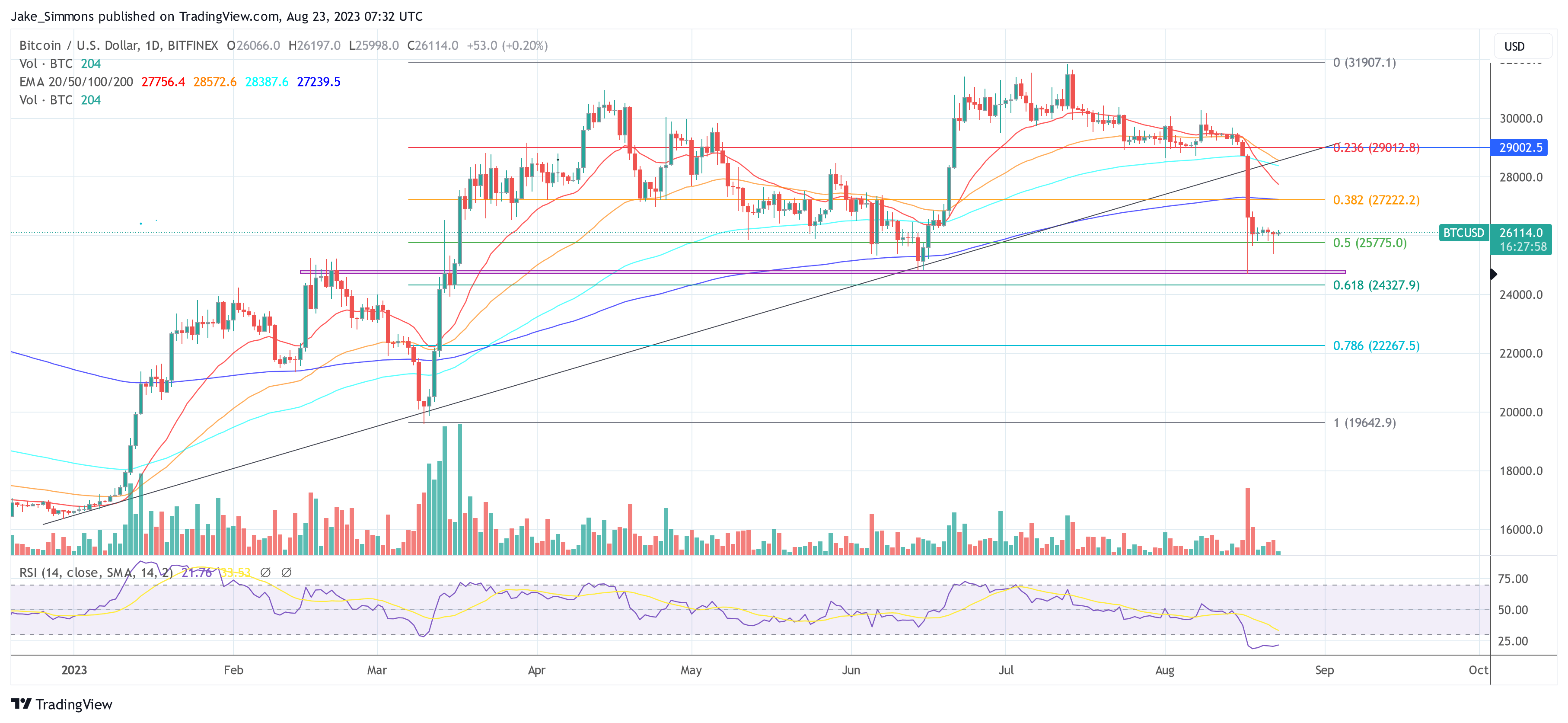

As the Bitcoin market navigates the choppy waters around $26,000, there are several metrics to keep an eye on. After hitting a low of $25,374 yesterday, the bulls have managed to push the price back up, although the market remains in a fragile state after last Thursday’s price crash.

Currently, the Fear and Greed Index for Bitcoin stands at 37, indicative of strong fear permeating the market. Typically, such a low level on this index suggests that market participants are anxious about the near future, often leading to a kind of self-fulfilling prophecy where selling pressure builds.

An in-depth look at Bitcoin CVDs and Delta

Renowned analyst Skew has done just that marked the role of Cumulative Volume Delta (CVD) in understanding current market dynamics today. “BTC Aggregate CVDs & Delta Reveal Spot Seller Limit Here, With Shorts Pushing for Control.” This means that even if traders want to buy at market prices (takers), those willing to sell will set limits, adding a cap to any near-term bullish momentum.

The specific price point to note here is $26,100. “This level has acted as a magnet for limit sellers,” notes Skew, “and is supported by the pattern seen in spot CVD versus price so far.” In other words, spot takers are absorbed by limit sellers at this price, limiting the upward movement.

Perpetual CVD (Perp CVD) also deserves attention as it “moves lower in line with longs closing and new shorts coming in.” This suggests that traders are not only covering their long positions, but also opening new short positions, in line with the current bearish price action.

Examining specific exchanges like Binance and Bybit gives further granularity to the analysis. According to Skew, “Longs flushed below $25,800 during that period, marking that level as a major pivot point.” Open Interest (OI) on Binance saw a drop of 6,000 BTC, and Bybit OI fell by 3,000 BTC – all in long positions being liquidated.

The liquidation of long positions at these levels poses a clear risk to any bullish scenario. “The clear risk to longs is below $25,800,” claims Skew, making it an essential level to watch for traders who are net long.

MacroCRG, a renowned market analyst, added on the analysis that a large number of longs were re-liquided during yesterday’s BTC dip: “More pain for #Bitcoin longs as another $300M+ in outstanding interest was wiped out overnight in a downward sweep. When will it end?”

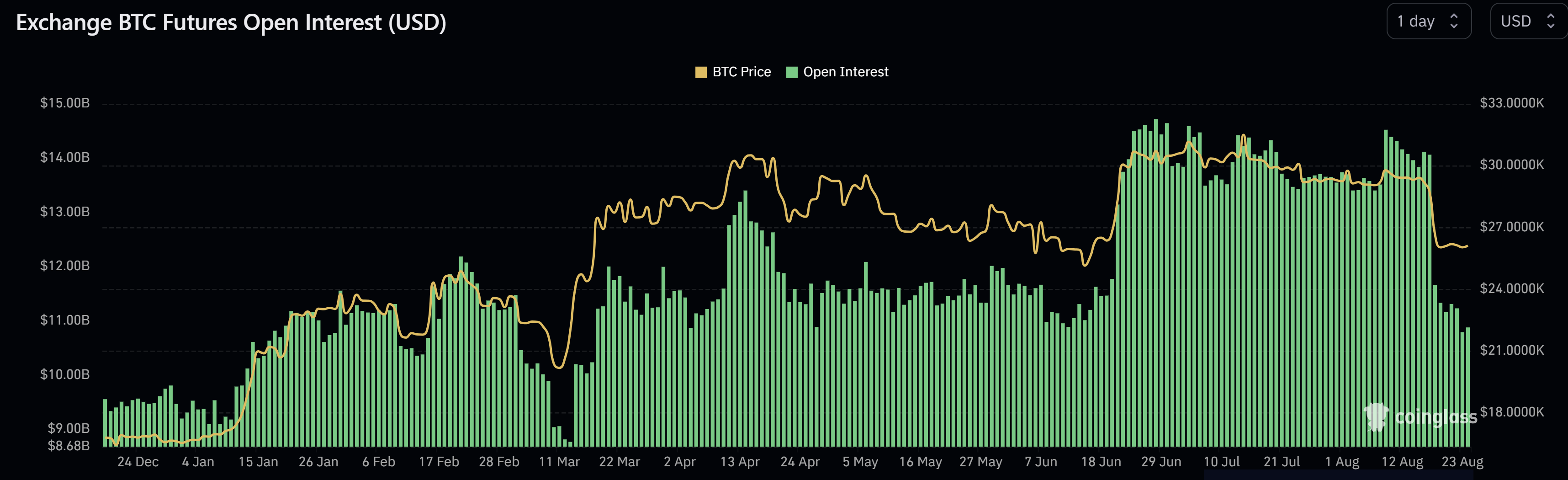

There could be a bright spot, however, as Skew puts it: “We’ll probably soon see monkeys raging furiously.” But so far, Bitcoin’s open interest (OI) remains flat after Thursday’s flush. OI currently stands at $10.88 billion (after over $14 billion).

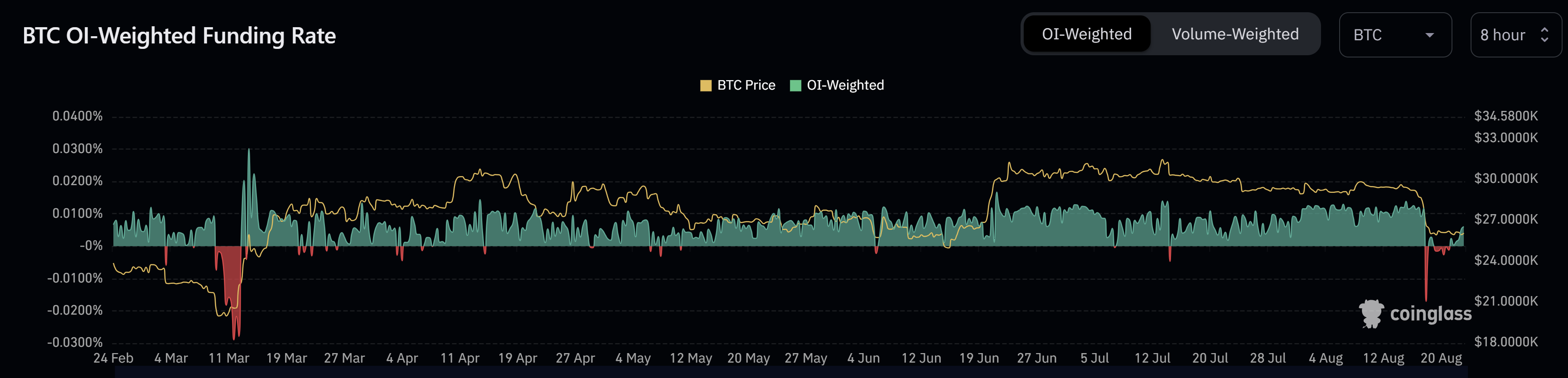

BTC’s OI-weighted financing rate has already turned positive again at +0.0060. If the value turns negative for a few days, as it did before the March 2023 rally, it could be a sign that a short squeeze is on its way. However, after Thursday’s crash, the benchmark remained in negative territory for only a short time.

BTC short term holders and speed

On-chain specialist Axel Adler Jr. points shows that the cohort of Bitcoin holders (STH) has reduced their holdings by a significant 400,000 BTC in the short term. This mass exodus has put significant selling pressure on the market, leaving many STHs “underwater” and therefore less likely to engage in bullish behavior.

In addition, Adler highlights the BTC Velocity metric, saying, “Early this year, BTC Velocity metric dropped to the minimum level.” This extremely slow speed indicates not only low volatility, but also a lack of activity from market participants – a worrying sign of an imminent bullish turn. Therefore, Adler concludes:

Taking into account these two factors, as well as the fact that the STH cohort has traditionally been the main player that caused the volatility in the BTC market, the recovery from this drop will take longer than usual and could take an indefinite period of time to take.

At the time of writing, BTC was trading at $26,114.

Featured image from iStock, chart from TradingView.com