- USDT is becoming the most dominant cryptocurrency by demand and activity in the Tron ecosystem.

- Tension rises among traders as USDT moves closer to key support level, but will it hold?

The demand for cryptocurrencies has led to robust utility for most of the top blockchains, stablecoins are responsible for most on-chain transactions. Tron is leading the way by responding to the huge need for stablecoins in the market.

Is your wallet green? Check out the Tron Profit Calculator

USDT on the Tron is like a match made in heaven. This is because the stablecoin issued by Tether accounts for the majority of stablecoin volumes on the Tron network. According to an analysis by Pundi X Labs, TRX transactions through Tron have grown by 47% in the past 4 months.

1/ 🧵 📈 We are witnessing a remarkable surge, a 47% increase in the last 4 months, in USDT transactions on the TRON blockchain through merchants using #PundiX XPOS.

This trend underscores the growing adoption of stablecoins in the TRON ecosystem among physical stores. pic.twitter.com/GqZGjIwqdr

— Pundi X Labs | We’re Hiring (@PundiXLabs) August 16, 2023

The same analysis showed that USDT managed to gain dominance in terms of usage on the Tron network. It even managed to surpass Ethereum [ETH] which currently accounts for 43% of usage on Tron. The USDT stablecoin is the most dominant asset on the network at 48.6%.

Pundi X Labs cited lower fees and faster transactions as some of the main reasons for Tron’s adoption of stablecoins. But how much has this affected Tron’s network costs?

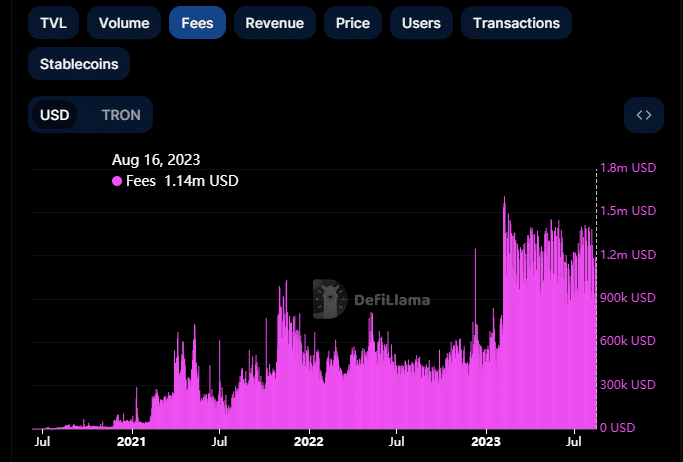

Well, fees on the network have averaged over $1 million in the past few months since February.

Source: DeFiLlama

For reference, the Tron network fees only briefly managed to break above $500,000 at the height of the 2021 bull market. Note that this represents the daily fees collected on the network.

TRX goes for a support line retest

Capitulation is the name of the game and that is exactly what has happened with TRX over the past few days. The bears regained control after TRX failed to rescue the price from the consolidation phase seen in the first half of August.

The price moved closer to its long-term support line after a low of $0.075. Interaction with the support line is likely to occur near the $0.073 price level.

Source: TradingView

Will TRX bounce back after interacting with support or will it extend its bearish trajectory? Investor sentiment has returned to signal bearish expectations.

However, traders should be aware of whaling activities. The supply of top addresses remained the same, which is why whales do not contribute to selling or buying pressure.

Source: Sentiment

Read more about the Tron (TRX) price prediction for 2023/2024

While the world ponders the fate of TRX, perhaps we can look to its Bitcoin counterpart [BTC] which recently broke under its support.

TRX could follow a similar path, but it is also fast approaching oversold territory. Thus, traders should watch for signs of strong accumulation that could put TRX back on a bullish trajectory.