- Bitcoin and Ethereum liquidity has continued to decline on US crypto exchanges.

- There is still regulatory uncertainty, which could lead to more declines.

Navigating the regulatory environment in the US has proved challenging for most cryptocurrency projects. And the consequences are visible. The Securities and Exchange Commission (SEC) published lists of cryptocurrencies classified as securities months ago.

Nevertheless, assets like Bitcoin [BTC] and Ethereum [ETH]that were not categorized as impacts appear to be affected by these regulatory developments.

Bitcoin Ethereum liquidity is declining

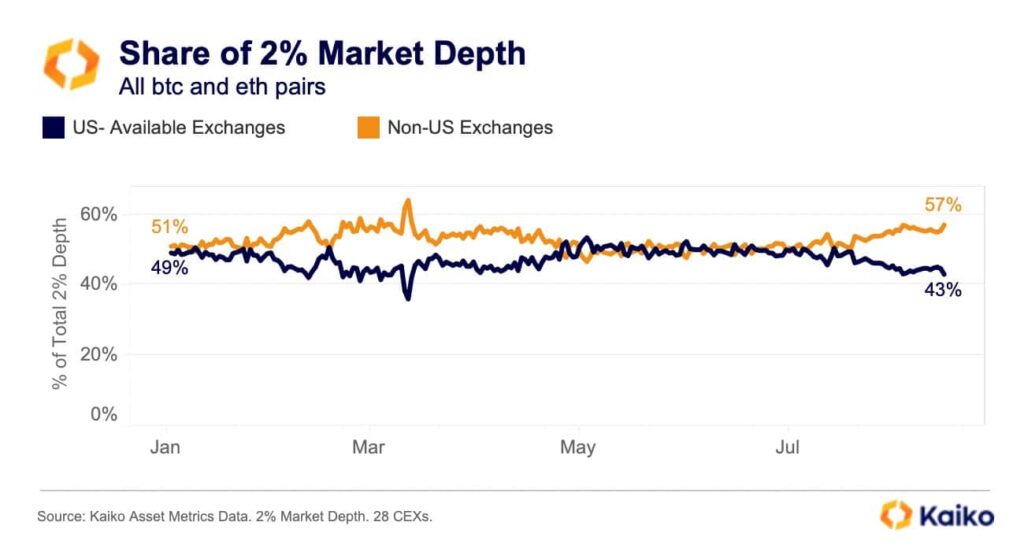

This is according to a recent report by Kaiko, Bitcoin and Ethereum liquidity in the US fell. The data showed that the share of liquidity for these assets on US exchanges fell to about 43%.

This was lower than the 49% recorded in early 2023. Conversely, the liquidity depth on exchanges outside the US had increased to 57% from the original 51%.

Source: Kaiko

Possible causes of the decrease in Bitcoin Ethereum liquidity

The ongoing legal action taken by the CFTC and SEC against Binance and Coinbase could contribute to the liquidity drop. Lawsuits were filed in March alleging that Binance had operated a derivatives trading platform in the US, facilitating trading of cryptocurrencies classified as commodities.

In addition, in conjunction with the CFTC’s lawsuit, the SEC has sued Binance and Coinbase. This was, among other things, on grounds of offering unregistered securities to the general public.

In addition, these legal actions referenced multiple tokens. The allegations that US exchanges should also refrain from trading these tokens. Given that Binance and Coinbase are the largest exchanges in the US and globally, halting trading of these exchange-traded tokens could significantly impact liquidity, even for flagship cryptocurrencies such as BTC and ETH.

In addition, the US faced the collapse of the Silvergate and Signature banks earlier that year. These banks were crypto-friendly and played an important role in facilitating liquidity flows to exchanges. Their demise created greater difficulties for institutional players to acquire Bitcoin, Ethereum and other cryptocurrencies using fiat currencies. After their collapse, most crypto exchanges temporarily suspended USD deposits.

Decline is likely to continue

While the 6% reduction in Bitcoin and Ethereum liquidity on US exchanges seems modest, there is a chance that this trend will intensify. This potential increase can be attributed to growing uncertainty about the regulatory landscape in the country.