Bitcoin price continues to fall around its current levels, but there was an increase in volatility during today’s trading session. The rise in this metric could indicate a shift in the narratives influencing BTC price action.

At the time of writing, Bitcoin is trading at USD 29,300 with sideways movement in the past 24 hours. Over the past seven days, the cryptocurrency has seen similar action pushing other assets in a similar or no direction to the sector’s near-term flatlines.

Bitcoin ETF Becomes Dominant Story in Crypto Market?

In a recent market update, crypto analytics firm Blofin pointed to an uptick in market sentiment. Coupled with an increase in volatility, market participants are reacting to the U.S. Securities Exchange Commission’s (SEC) potential announcement surrounding a spot Bitcoin ETF.

The Commission will rule on asset manager Grayscale’s petition to convert their Grayscale Bitcoin Trust (GBTC) into an ETF. The decision was supposed to come out today, Blofin said, but it could take until next Friday, August 18e.

If the SEC delays the decision for any reason, as with Ark’s petition, the market will likely continue to move sideways. In that sense, the development surrounding the ETF decision is gaining momentum over macroeconomic dynamics.

This change in dynamics is more apparent in the derivatives industry, where options traders are becoming more optimistic in the coming months. Blofin noted the following about this dynamic:

(…) The above news (about the approval of the Bitcoin ETF) has fueled the rapid rise in short-term bullish sentiment and uncertainty in the market (…). It seems that investors are waiting for some good news regarding the spot Bitcoin ETF.

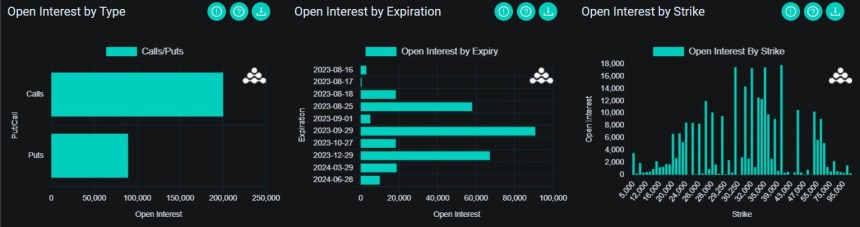

And “smart” traders position themselves accordingly. The report notes that open interest for option contracts is skewed toward the call (buy) side.

As data from derivatives platform Deribit shows, traders are betting that Bitcoin’s price will surge above $30,000 by the end of August or September. As can be seen in the chart below, 57,000 contracts will expire at the end of this month and 90,700 next month.

Coupled with the rise in open interest to the call side, the chart above shows traders betting on a Bitcoin rally above $30,000 to $40,000. The spot BTC ETF decision will move the market, especially in late August and September.

Cover image of Unsplash, chart from Tradingview