Bitcoin futures are financial derivatives, essentially agreements to buy or sell Bitcoin at a predetermined price on a specific date. These provide traders with a way to speculate on Bitcoin’s future price. Open interest refers to the total number of outstanding forward contracts that have not yet been settled. Futures contracts can be backed in a variety of ways, including using the contract’s original currency (BTC or ETH), USD, or USD-pegged stablecoins.

Monitoring the difference in open interest in crypto-margin and cash-margin futures is crucial to understanding market dynamics. When Bitcoin futures contracts are backed by Bitcoin, the risk of liquidation increases. If an investor is long Bitcoin with Bitcoin as collateral and the market goes through a sharp downturn, the net loss of the position and the value of the collateral decrease at the same time. This double loss makes the position more susceptible to liquidation or closure.

In simpler terms, using Bitcoin to support a long position on Bitcoin increases the risks. If the price of Bitcoin falls, not only does the value of the position fall, but the collateral itself loses value, creating greater risk.

On the other hand, collateralizing USD or stablecoin futures contracts can significantly reduce the risk of large leverage cascades during market downturns. By using a stable asset as collateral, the value of the collateral remains constant, even if the market price of the underlying asset fluctuates. This stability provides a buffer against sudden market movements and reduces the risk of forced liquidations.

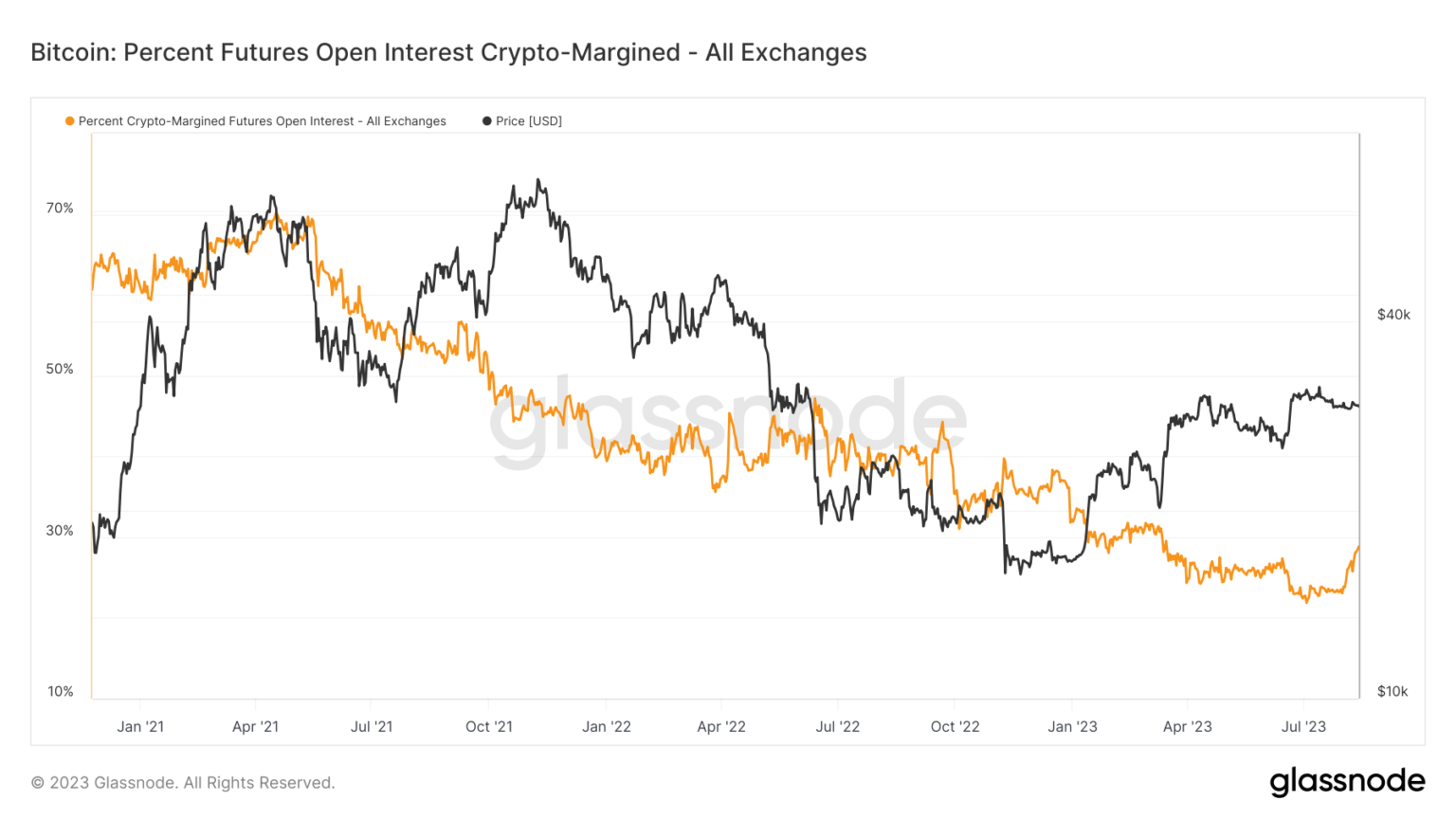

According to data from Glassnode, the percentage of open interest on futures marginalized in the original currency of the contract (e.g. BTC and ETH) currently stands at 28.8%. This figure hit an all-time low on July 3, dropping to 21.8%.

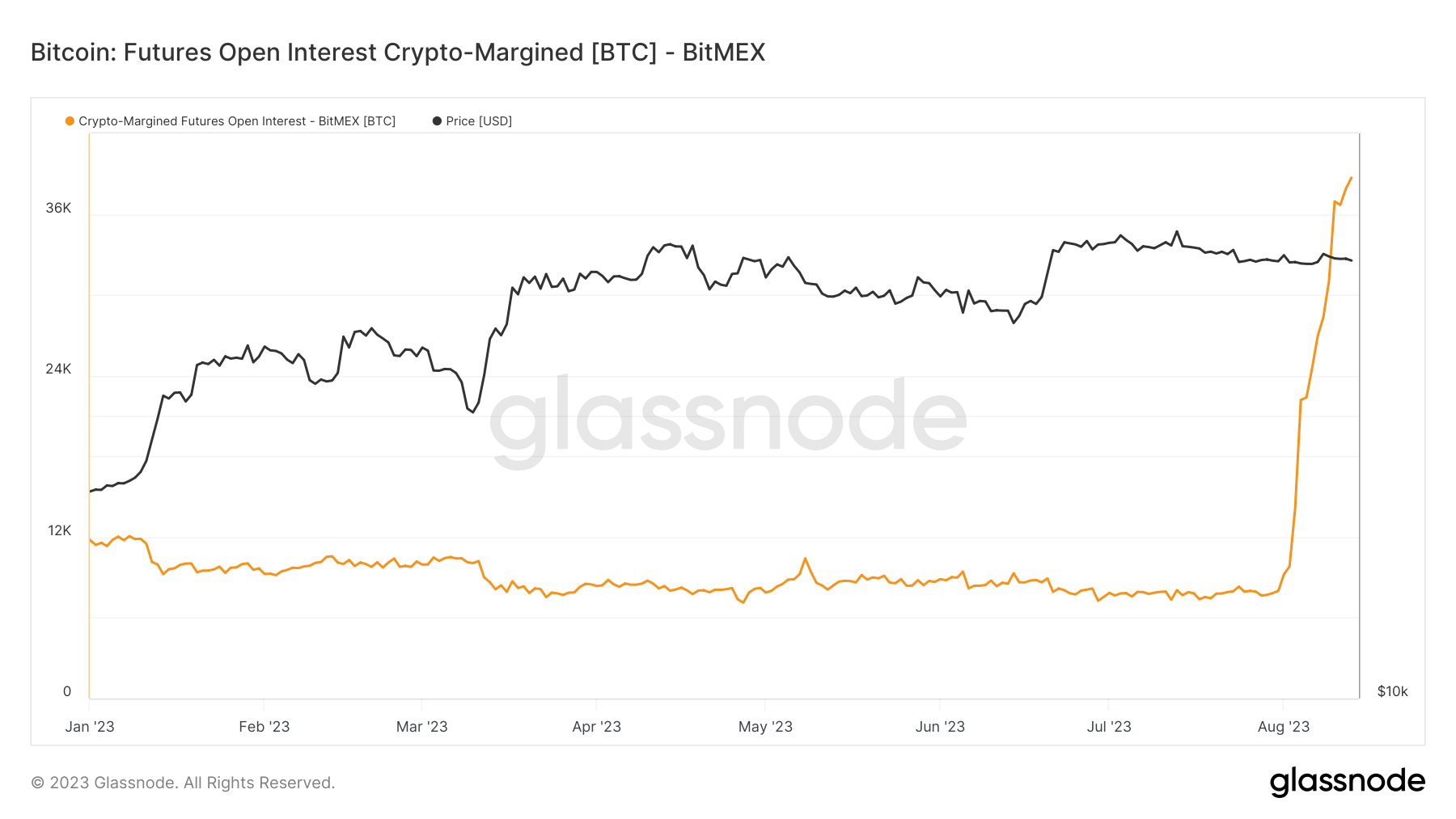

The recent increase in open interest with crypto margins can be attributed to BitMEX, which saw an aggressive spike in August. The total amount of open interest contracts in crypto increased from 7,998 BTC on July 31 to 38,712 on August 12, representing a 384% increase.

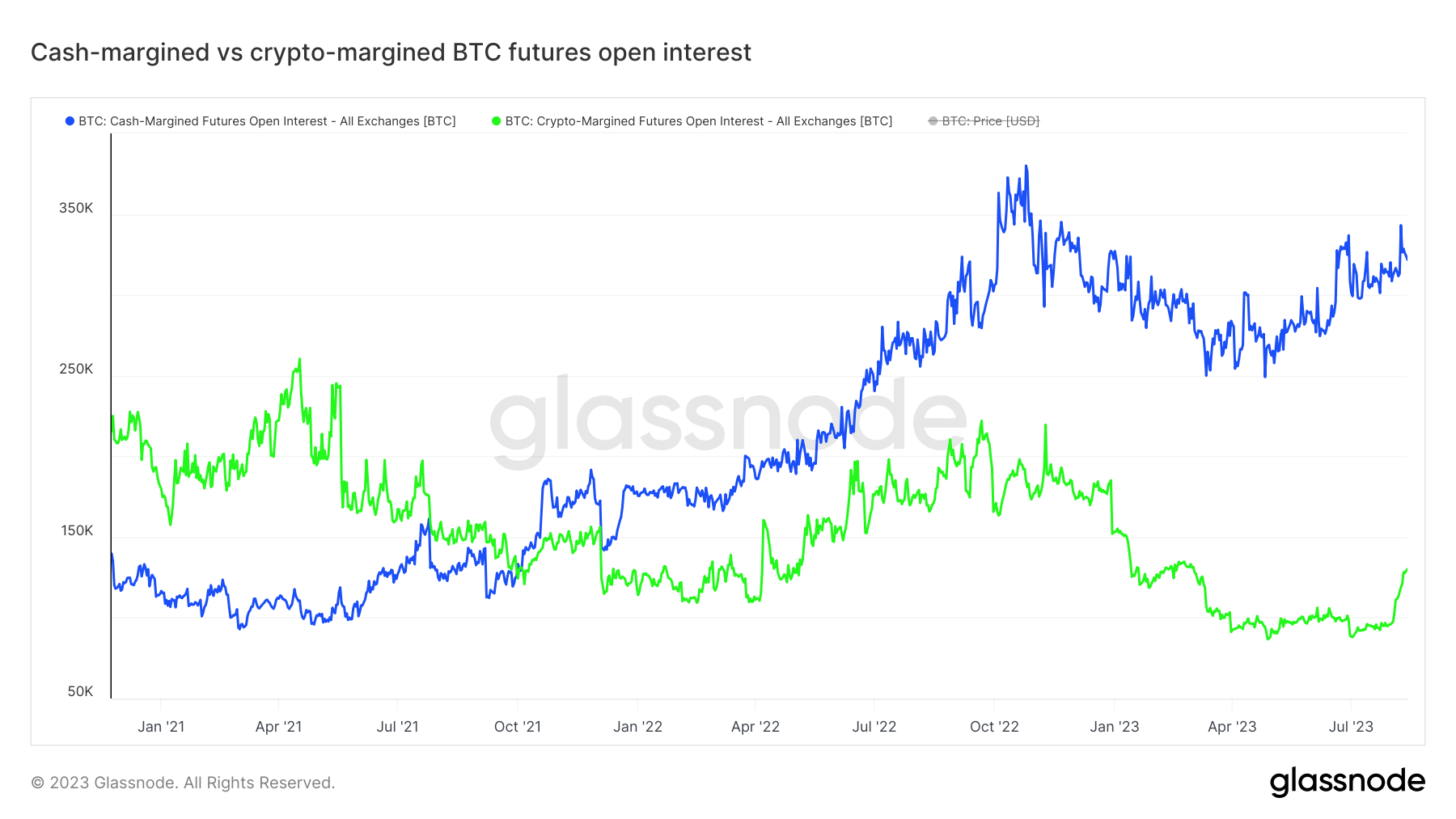

Comparing the open interest of the crypto-margined and cash-margined futures reveals a discrepancy that has never been greater. This divergence indicates a growing market preference for stability and risk mitigation as more traders choose USD or stablecoin collateral.

The shift to cash margin futures may indicate a new, more cautious approach by market participants, reflecting concerns about potential volatility and a desire to minimize liquidation risk exposure.

The post Decline in Crypto Margin Futures May Indicate Market Maturity appeared first on CryptoSlate.