- Large holders of BTC are no longer in accumulation mode.

- While net recipient volume was deeply negative, traders’ sentiment remained upbeat.

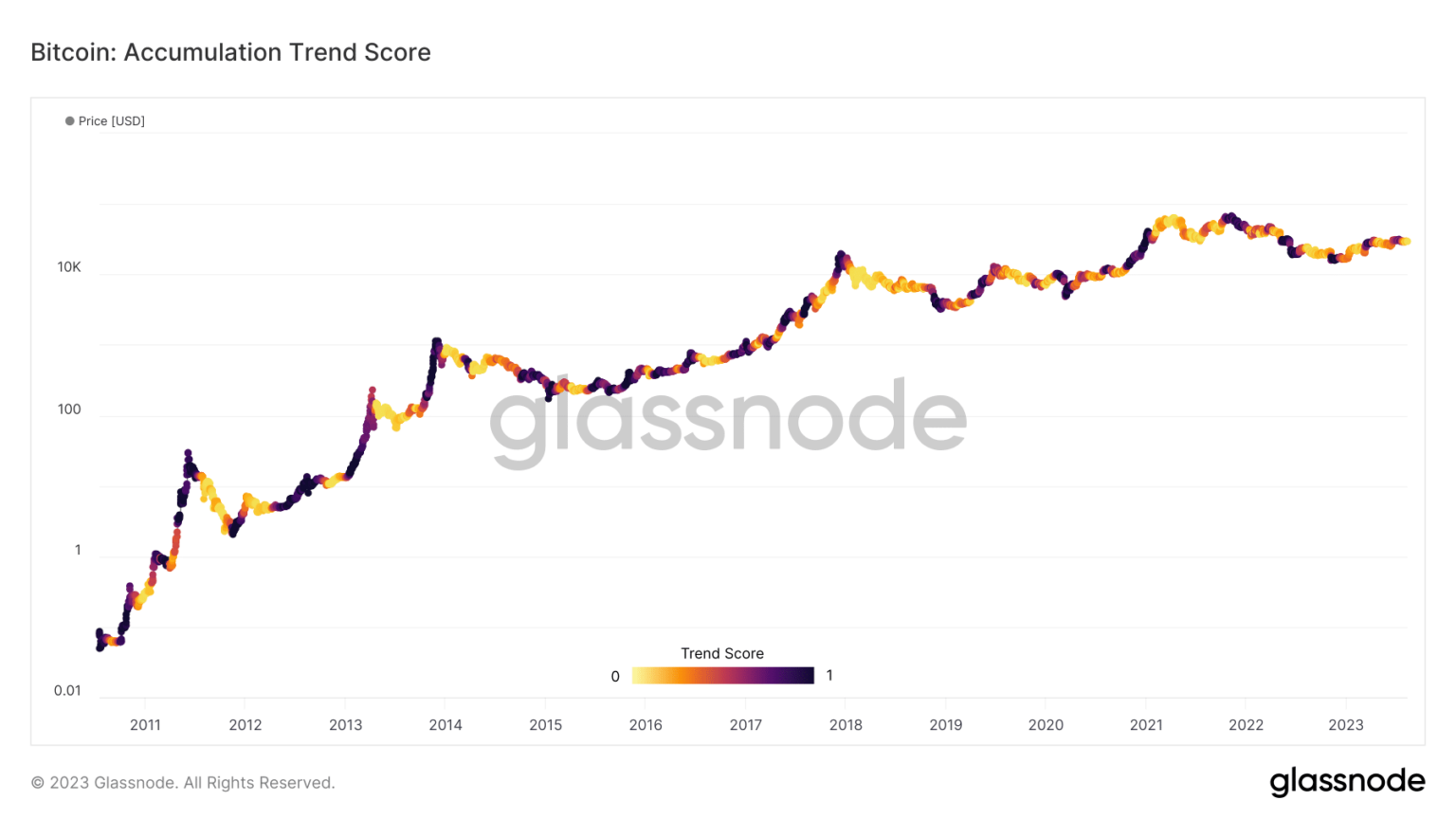

From Bitcoin [BTC] on-chain activity has undergone a noticeable shift recently, marking a departure from the previous accumulation trend. For BTC price action, the balance between accumulation and distribution is critical to understanding market sentiment. And one metric that explains this is the Accumulation Trend Score.

Read From Bitcoin [BTC] Price prediction 2023-2024

Analysis of the statistic suggests a move to more widespread distribution of Bitcoin. As an indicator of market behavior, the accumulation trend score displays the number of new coins collected or sold within a given period.

Power has changed hands

When the accumulation trend score is closer to one, it means that large entities are accumulating. But when the metric gets closer to zero, it indicates a shift toward selling. At the time of writing, the Bitcoin Accumulation Trend Score was 0.05, indicating that major holders’ sentiment was focused on the latter.

Source: Glassnode

Previously, AMBCrypto reported that whales were collecting Bitcoin in large numbers. And this action was instrumental in the coin’s rise above $30,000 at one point. Therefore, the change in sentiment could have influenced the recent consolidation that BTC has been facing.

If this statistic remains the same, BTC consolidation or decline may linger. Additionally, CryptoQuant analyst JA_Maartunn noted on Aug. 12 that BTC’s inability to rise could be linked to net taker volume.

The net purchase volume measure the difference between the to buy and sales volume of Bitcoin’s futures contracts. Taking the metric into historical use, the analyst referred to 2021 by saying that,

“In May 2021, Bitcoin was trading around $60,000, while Customer sales volume was $600 million higher than Taker buying volume. This indicates a lot of selling through market orders, even though the price was still high.”

So when the net buyer volume has very positive values and the price is relatively low, it means aggressive buying. But the case of Bitcoin was different. According to the chart shared by Maartunn, net buyer volume was negative, indicating heavy selling pressure.

Source: CryptoQuant

Either way, enthusiasm rules

Despite the heavy selling pressure, Santiment revealed that funding on Binance was 0.01%. A positive funding rate means that traders have a long position dominant and be willing to pay financing to short traders.

Conversely, a negative funding rate means that short traders pay a funding fee to buy longs to keep their positions open. Therefore, the press-time status of the statistic implies that bullish sentiment has been booming.

Is your wallet green? Check the Bitcoin Profit Calculator

Source: Sentiment

However, traders may need to be wary of the continued accumulation and distribution. If Bitcoin’s distribution continues to outpace the former, it’s only a matter of time before some desires are liquidated. That is if the BTC price falls sharply.