- Aave DAO has passed a proposal to buy $2 million CRV tokens.

- The majority of AAVE investors continued to lose money.

Into a new one proposalthe governing body of the Aave [AAVE] loan protocol approved the $2 million acquisition of Curve [CRV] Coins.

Is your wallet green? Check out the AAVE Profit Calculator

This decision was necessary due to the protocol’s exposure to Curve’s hack. As stated in the proposal,

“The acquisition aims to support the DeFi ecosystem and strategically position Aave DAO in the Curve wars, benefiting GHO’s secondary liquidity.”

Day traders remain unmoved

While this was an important development that could affect the trajectory of the protocol in the coming months, holders of the AAVE tokens seem unimpressed.

An assessment of trading activity over the past 24 hours revealed that sentiment remained negative amid easing accumulation pressures. In fact, the decline in interest in governance tokens preceded Curve’s hack.

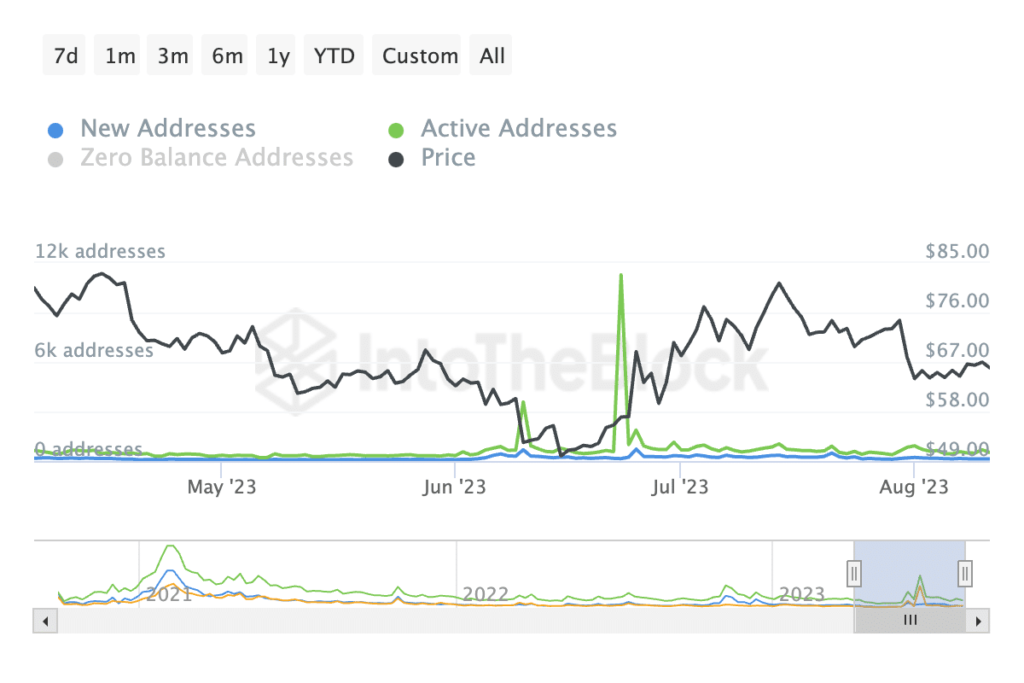

According to data from IntoTheBlock, AAVE’s network activity has declined since the end of June. The number of daily active addresses trading the altcoin has since dropped by 94%. For context, on August 11, only 514 addresses completed AAVE transactions. On June 23, that was 11,280 addresses.

Similarly, daily new addresses have also plummeted. With only 125 new addresses created as of August 11, new demand for AAVE is down 14% over the same period.

Source: IntoTheBlock

As interest in AAVE waned, so did whale activity. According to IntoTheBlock, the daily count of large transactions over $100,000 has been reduced by 94% since June 23.

With a continued decline in value and token accumulation, many AAVE holders have remained “out of money”, according to IntoTheBlock’s In/Out of the Money metric.

How much are 1,10,100 AAVEs worth today?

This metric calculates the average price at which investors purchase tokens. It then contrasts it with the current market value of the asset. If this value is higher than the average cost for an address, the address is said to be “in the money”, i.e. the account is making a profit.

Conversely, if the current price is less than the calculated average cost, the address will be categorized as “Out of the Money” because it is loss-making.

At the time of writing, 78.48% of all AAVE holders hold below average cost.

Source: IntoTheBlock

Among day traders, AAVE accumulation slowed. At press time, key momentum indicators remained below their respective neutral lines, suggesting selling pressure outweighed buying momentum.

At 21.43%, AAVE’s Aroon indicator showed that the token’s most recent high had been reached a long time ago.

Source: LINK/USD, TradingView