In the context of the ever-changing and complex cryptocurrency industry, Bitcoin is currently at a critical point in its trajectory as it faces a series of heightened price pressures that pose significant challenges.

The following halving event in 2024 has generated much anticipation and drawn attention to the complex interaction of various elements that contribute to the value and fate of the subject in question.

Bitcoin’s value is up 75% so far this year despite facing regulatory scrutiny and fraud. The leading cryptocurrency in terms of market capitalization and widespread adoption has shown surprising resilience in the face of US Securities and Exchange Commission enforcement action against major exchanges such as Binance.US and Coinbase.

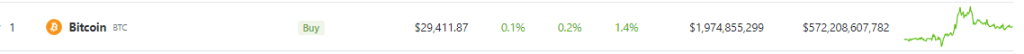

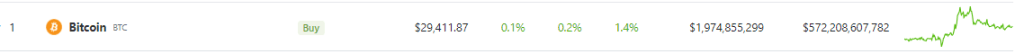

Price performance of Bitcoin

Currently, Bitcoin is trading around $29,411, down a measly 0.2% in the past day, but managed to gain a decent 1.4% over the past week, according to data from crypto market tracker Coingecko. Bitcoin is currently showing a neutral position in the market and is meeting resistance as it tries to cross the key $29,600 mark.

Bitcoin price flashing green in all timeframes. Source: Coingecko

If there is a bullish breakout above USD 29,600, it could potentially open the way for Bitcoin to reach the USD 30,200 level. The top coin has already reached the 61.8% Fibonacci retracement level, which is $29,200.

Bitcoin reached a market cap of $572 billion on the weekend chart: TradingView.com

On the other hand, Bitcoin’s price could change massively if it can break the $30,200 support level. This performance could act as a catalyst and push the coin’s value into a new range, which is believed to be between $30,600 and $31,000.

Such a breakthrough could make the market more hopeful and boost investor confidence, paving the way for more growth.

The critical zones to watch are $29,800 and $30,200. If the price of Bitcoin falls below these levels, it could indicate a bearish trend for the cryptocurrency.

Bitcoin price prediction

Meanwhile, Cypherpunk figure Adam Back has deployed Bitcoin hit six digits by March 2024. He made the bet on Twitter, predicting that Bitcoin will cross $100,000 before the March 31, 2024 halving. The bet is with the Twitter user “Vikingo”, with the winner receiving 1 million satoshis (0.01 Bitcoin).

the bet has started🚀: I bet #bitcoin reach or exceed $100k between now and the halving (March 31, 2024) with @vikingobitcoin9 1 million sats to the winner. https://t.co/Ij7iPEYjQW pic.twitter.com/PNpAaZvl8F

— Adam Back (@adam3us) August 5, 2023

For Bitcoin to reach this goal, it needs a 243% increase over the next eight months. Before the previous halving in May 2020, Bitcoin had a range-bound period with no major gains. The main price increase occurred about six months after the halving, starting an upward market trend in November of that year.

Understanding Bitcoin Halving

Bitcoin halving refers to the occurrence of halving miners’ rewards for validating blockchain transactions. This event occurs approximately every 210,000 mined blocks, which equates to roughly every four years.

Introduced by the creator of Bitcoin, Satoshi Nakamoto, in 2009, halvings serve the purpose regulation of the supply of assets. The mining reward is reduced by half every 210,000 blocks, in line with Nakamoto’s original vision as outlined in the white paper. This mechanism ensures controlled creation of Bitcoin and maintains incentives for miners.

The historical trend of halvings fueling price escalation underscores the intricate interplay between scarcity, demand and Bitcoin’s valuation, accentuating the anticipation surrounding the imminent halving’s impact on prices.

(The content of this site should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Deltec Bank & Trust