- MKR whales have reduced their transactional activity over the past week.

- This has put pressure on MKR’s value.

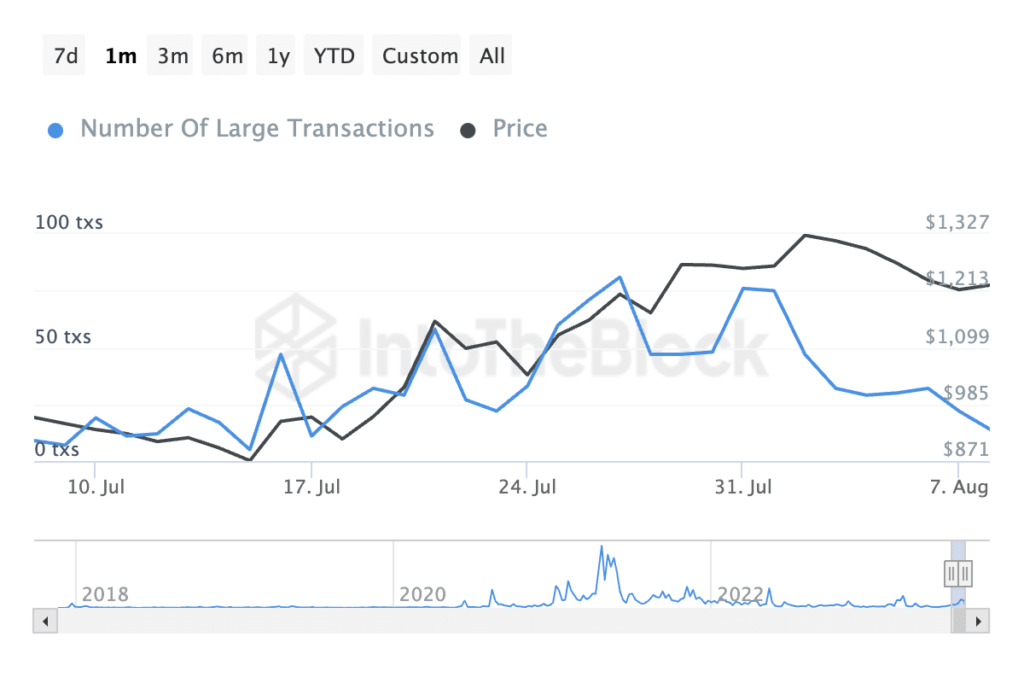

MakerDAO’s native token MKR has seen a notable drop in the number of large transactions since the beginning of August. This has happened despite the jump in the token’s value last month, on-chain data from IntotheBlock revealed.

Source: IntoTheBlock

Realistic or not, here is MKR’s market cap in BTC terms

This metric tracks on-chain transactions where more than $100,000 has been transferred. Institutional investors and whales often execute these trades, and their trades can often influence the price of an asset.

According to data from IntoTheBlock, the number of large MKR trades executed daily has fallen by 81% since August 1. As of August 8, only 14 major transactions had been completed. Meanwhile, 75 of these trades were executed at the beginning of the month.

The whales have shaken up the MKR market

Trading at $1,203 at time of press, MKR’s value was up 29% over the past month, data from CoinMarketCap showed. The altcoin price is down 10% in the past seven days as whales cut their MKR trades.

Source: CoinMarketCap

The corresponding fall in the value of MKR due to a decline in whale activity was not surprising. The activity of this cohort of investors often determines the direction of an asset’s price. When they reduce their trading activity, retailers often take it as a sign of an impending negative price correction and react accordingly.

Whales also provide liquidity to the market by buying and selling large amounts of assets. When they reduce their trading activity, this often leads to reduced liquidity, which can make it more difficult to buy and sell assets, putting downward pressure on the prices of those assets.

How much are 1,10,100 MKRs worth today

In addition, since the daily count of large MKR trades started to drop when August started, the daily ratio of the token’s on-chain transaction volume in profit to loss has also plummeted. Per data from Sanitationthis has fallen from 2.48 at the start of the month to 0.957 at the time of writing.

Source: Sentiment

This meant that for every trade completed on August 1 that produced losses, 2.48 trades returned profits. However, at the current ratio, for every 1000 MKR tokens moved along the chain with a profit, 957 were moved at a loss. This indicates more selling pressure on the altcoin than buying pressure.