- Bitcoin’s recent surge above $30,000 has challenged short positions.

- Open Interest increased along with the MVRV ratio.

The cryptocurrency arena has been a battlefield of sentiment, with Bitcoin [BTC] experienced a dip below the crucial $30,000 benchmark over the past month. This shift in market dynamics sparked skepticism and spawned a wave of short positions against the king coin.

Read Bitcoin [BTC] Price forecast 2023-2024

In a recent turn of events, Bitcoin’s price soared and crossed the $30,000 threshold in the past 24 hours before undergoing a correction. Traders who had positioned themselves for an upward move benefited from the rise, leading to profit-taking.

The influential role of whales in the crypto landscape came to the fore when significant long positions were taken at the $29,000 level. The strategic move underlined the whales’ anticipation of possible price increases and demonstrated their impact on market sentiment.

#Bitcoin whales opened huge long positions at $29k.https://t.co/WulPUE47ab https://t.co/GNmIiRJ7EJ pic.twitter.com/CbJsn06plF

— Ki Young Ju (@ki_young_ju) August 8, 2023

Short sellers are feeling the heat

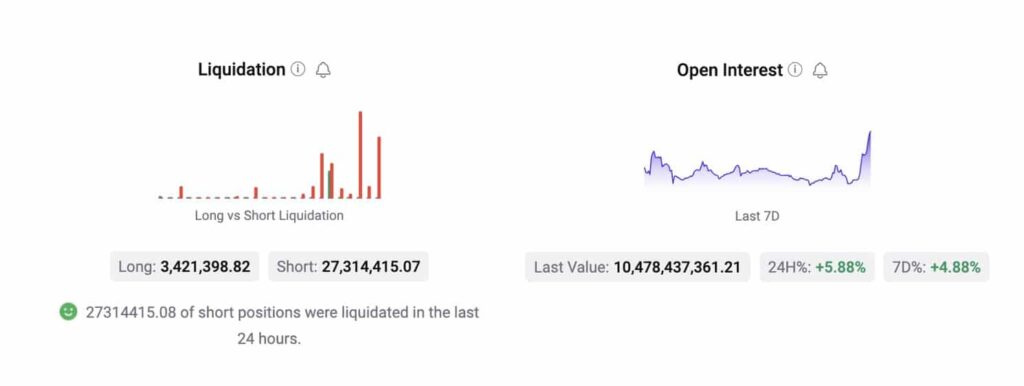

While Bitcoin showed an unexpected rebound, short sellers found themselves in a tough spot. In the past 24 hours, the crypto market has witnessed the liquidation of a whopping $27 million in short positions.

The substantial liquidations could pave the way for a compelling short squeeze narrative, where the unwinding of short positions could fuel a rapid rise in Bitcoin’s price.

Source: CryptoQuant

Profit taking is increasing

In addition, within the same 24-hour time frame, a significant increase in outstanding interest unfolded, amounting to $616 million. This increase in outstanding interest can also amplify market volatility. Along with the increase in Open Interest, there was also an increase in the MVRV ratio.

The rising MVRV ratio suggested that most Bitcoin addresses became profitable. This could incentivize holders to sell their holdings and take a profit, which could affect the price of BTC.

Source: Sentiment

Is your wallet green? Check out the Bitcoin Profit Calculator

A nuanced shift in the put-to-call ratio added another layer of complexity. Dropping from 0.45 to 0.43 last week, this ratio eased positive evolving investor sentiment towards BTC and potential hedging strategies that could affect Bitcoin’s short-term path.

Source: The Block

In addition, decreasing implied volatility meant reduced anticipation of significant price swings. While this could create a sense of stability, it also pointed to a potential reduction in profit opportunities for traders who thrive in volatile conditions.

Source: The Block