- Long-term holders gained more than 21% during the last price correction.

- The price of BTC was still below USD 30,000 and a few indicators were bearish.

Bitcoin [BTC] has seen quite a few price corrections this year, which has resulted in the price of BTC hovering below the $30,000 mark. While the price corrections frightened many investors, long-term holders of BTC acted differently.

Is your wallet green? Check the Bitcoin Profit Calculator

CryptoQuant’s latest analysis pointed to the state of long-term holders during the 2023 price corrections. Moving on to the current state of BTC, a huge drop in transaction volume has been noticed recently.

Bitcoin Long-Term Holders Make Profits

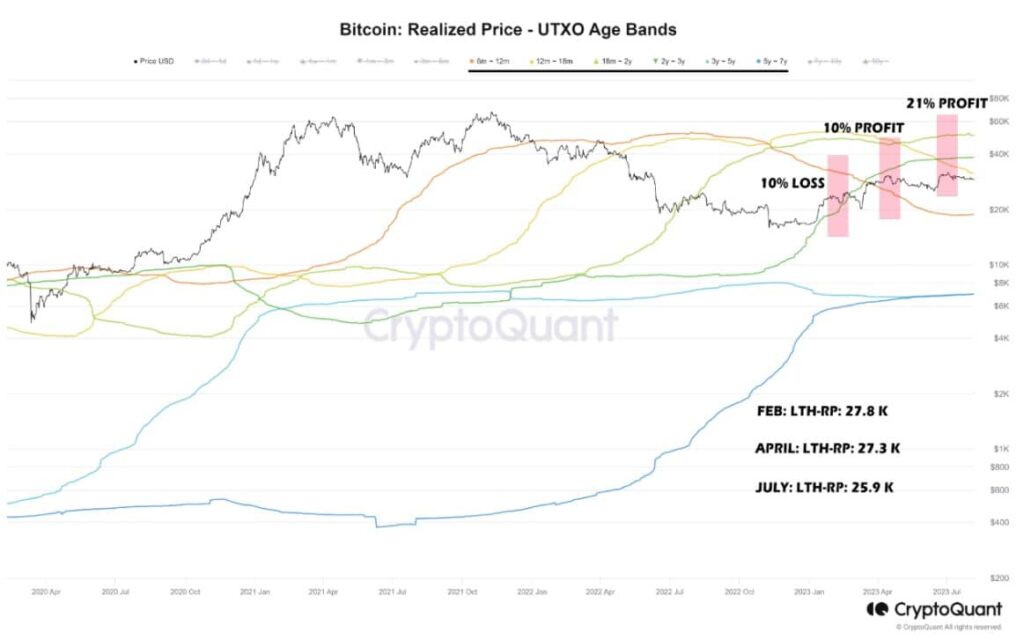

Crazzyblockk, an author and analyst at CryptoQuant, spoke in a latest analysis about how long-term holders have behaved in the past. Before the three Bitcoin price corrections in February, April and July, the analysis examined the sum of long-term holders’ realized price.

According to the analysis, during the February price correction, BTCThe market price of the company was close to $24,800, while long-term holders realized the price was $27,800. However, during the next two corrections, the realized price of long-term holders was below the market price, giving them gains of 10% and more than 20% respectively.

Source: CryptoQuant

The said analysis,

“This definition shows the accumulation of bitcoins by these holders over the past few months and the reduction in their average price by buying more bitcoin.”

A look at Bitcoin’s current scenario

Bitcoin’s on-chain stats revealed that long-term holders were still willing to hold their assets. The cryptos Binary CDD stayed green. This meant that long-term shareholders’ movements over the past seven days were lower than average, demonstrating their willingness to hold on to their assets.

It was also interesting to see that the whales did not sell their possessions, such as the graph of addresses with a significant number of BTC stayed flat. Wallets with balances between 0 BTC and 1 BTC actually rose, reflecting the increased accumulation of fish and shrimp.

Source: Sentiment

Glassnode Alerts’ tweet pointed out that on August 7, BTC’s transaction volume hit a one-month low of $815,291,038.84. A drop in the statistic suggested that investors are less willing to move their assets.

However, investor confidence in BTC has yet to be reflected in the price chart as it still remains below $30,000. At the time of writing, BTC was trade at $29,027.52, with a market cap of over $564 billion.

Read Bitcoins [BTC] Price prediction 2023-24

A look at BTC’s stats suggested that investors may have to wait a bit longer to see a bull rally. Bitcoin net deposits on exchanges were high compared to the past seven days, which was bearish.

The aSORP of the king of cryptos was red, meaning more investors sold at a profit. However, BTC‘s open interest is waning, which could result in a trend reversal in the coming days.

Source: Coinglass