For the fifth straight month, the digital collectibles (NFT) market continues to experience a significant decline, with sales falling to $495.6 million in July – the lowest level since April 2021.

According to data from NFT aggregator CryptoSlam, NFT sales have declined since February, when the industry saw a whopping $1.2 billion in revenue. Average sales in July were just $47, indicating diminished interest in high-quality “blue-chip” NFTs that remain completely inaccessible to the average consumer.

However, transaction levels have remained high, with June and July recording around 10.8 million and 10.4 million transactions respectively, the highest levels since February 2022.

Developers are still in it

Despite this downturn, developers continue to show interest in the space, deploying millions of smart contracts across Ethereum Virtual Machine (EVM)-enabled chains, indicating a continued interest in finding broader use cases for blockchain tokens.

This decline in revenue does not necessarily mean the end of NFTs. Instead, it points to the growing prevalence of low-key NFT sales and the space becoming more accessible to a general audience, who may not want to spend a lot on NFTs right away or are at the stage where they (finally) want to see something that is accessible , intellectual and practical for everyday use, aside from the mere “pump, dump, and flip” trading behavior we couldn’t seem to escape.

In the past 30 days, the top three blockchains selling the most NFTs were Ethereum at $293 million, Bitcoin at $56.2 million, and Solana at $35 million.

Who’s still on top?

Despite the downturn in the NFT market, several positive developments indicate continued resilience and innovation in the industry. Undeterred by pessimistic numbers, Web3 developers are consistently deploying a large number of smart contracts on EVM-compatible chains, demonstrating continued interest in decentralized applications and Web3 functionalities. In addition to Ordinals launching a non-profit organization to ensure developers are properly compensated, top sales and industry innovations keep the market stable.

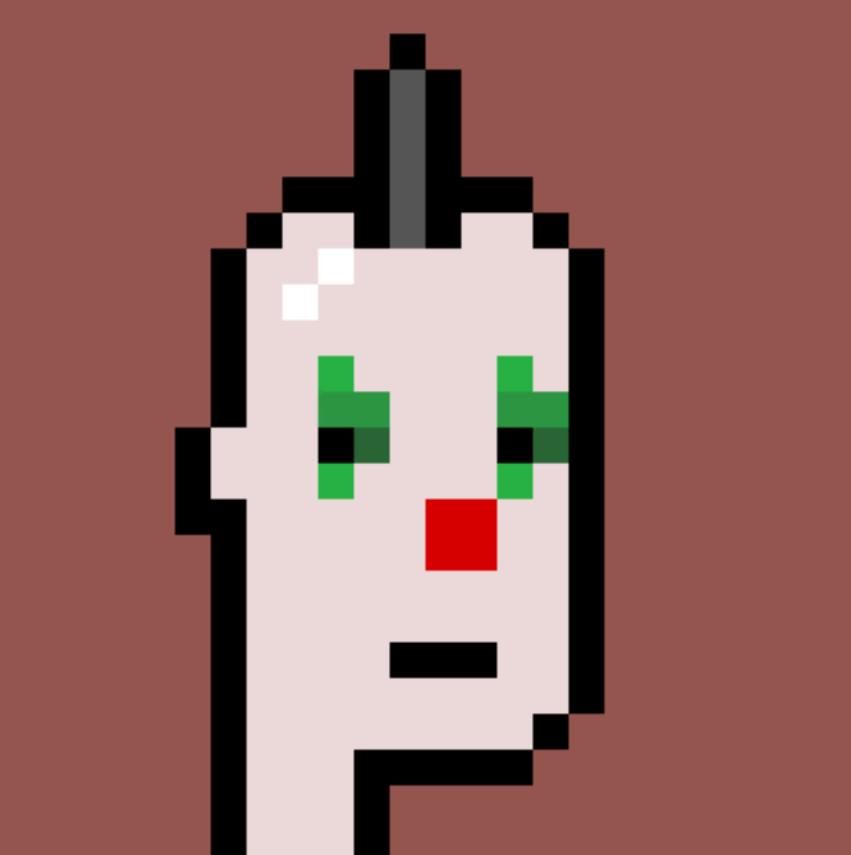

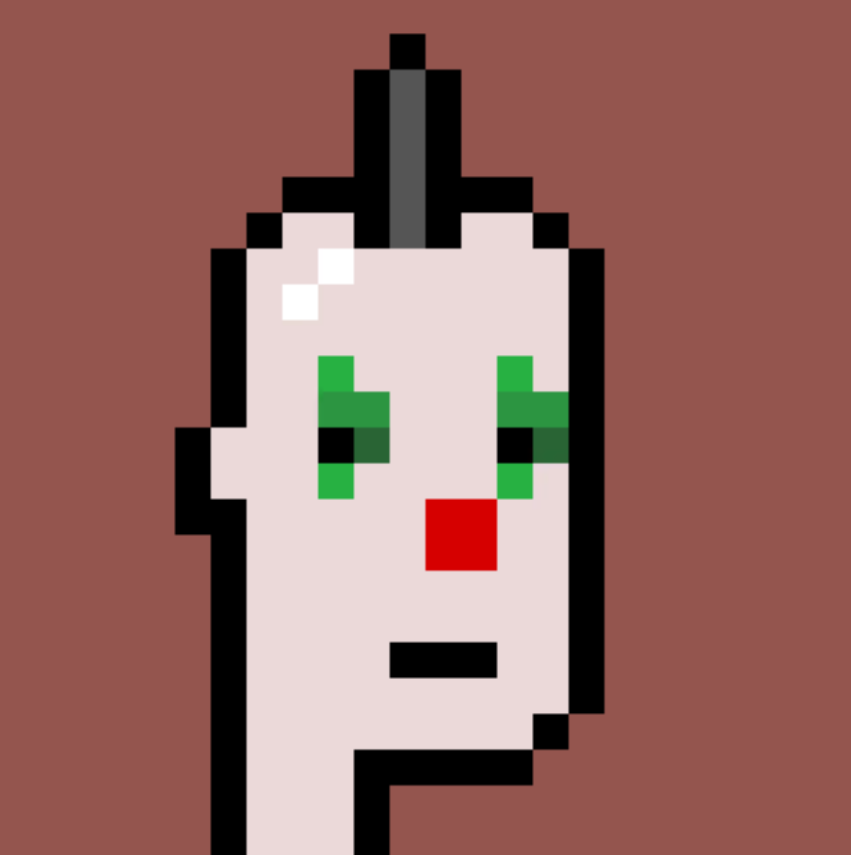

CryptoPunks, one of the earliest and most popular NFT projects on Ethereum, has seen a number of high-profile transactions recently, including one from Beeple, which just made its first-ever PFP purchase for $208,000.

Beeple bought CryptoPunk #4953 for about 113.7 ETH (about $208,000), according to data from Etherscan on Tuesday.

NFT’s declining sales have forced players and builders in the industry to look for new opportunities to grow again. It’s a critical time for the industry and the next steps will determine whether it sinks or swims.

Still, one thing remains clear: digital collectibles must have something more. Gone are the days of flexible hype and over-glorified popularity with no underlying substance.