What does this mean for Bitcoin and the broader crypto market? In a startling move that has sent ripples through the financial world, billionaire hedge fund manager Bill Ackman recently announced that he is shorting 30-year Treasuries. Ackman predicts that yields could soon soar to 5.5%, a move he positions as a hedge against the impact of long-term equity rates in a world he believes will see sustained inflation at 3%.

“I am surprised how low long-term interest rates in the US have remained in the face of structural changes likely to lead to higher levels of long-term inflation,” Ackman wrote on Twitter. He cited factors such as deglobalisation, higher defense costs, the energy transition, growing rights and the greater bargaining power of workers as potential drivers of this inflation.

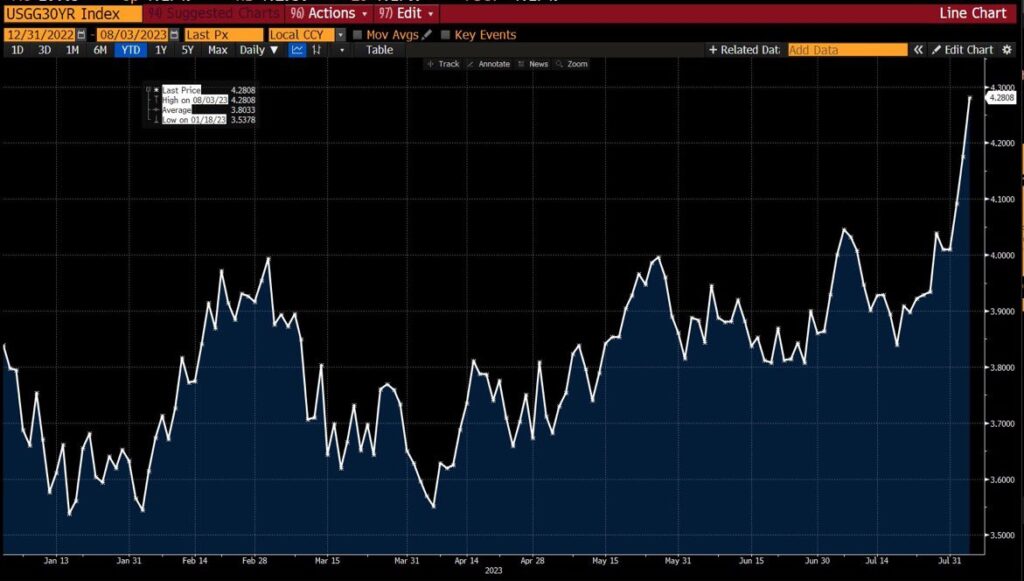

Ackman also pointed to the overbought nature of long-term government bonds and the increasing supply of these securities due to the US $32 trillion debt and large deficits. “When you tie new issues to QT, it’s hard to imagine how the market would absorb such a large increase in supply without significantly higher rates,” he added. Remarkably, the 30-year rate climbed to 4.28% yesterday.

However, not everyone agrees with Ackman’s perspective. Ram Ahluwalia, CEO of Lumida Wealth, suggested that Ackman’s views may already be priced into the market. “If anyone has an idea, especially a hedge fund manager, it’s good mental practice to assume it’s a consensus,” Ahluwalia wrote on Twitter. In fact, he suggested taking the opposite stance, advocating buying 10-year bonds in the 4.1 to 4.25% range and mortgage bonds from 6.5 to 7%.

Meanwhile, Lisa Abramowicz, a Bloomberg analyst, noted that the US Treasury sell-off was driven by long-term bonds, not those most sensitive to Fed policy. “This suggests two things: traders are expecting inflation to stay high for longer and they are wondering if the Fed is really going to raise rates high enough to reach 2% inflation,” she said.

Implications for Bitcoin and the crypto market?

Since opinions vary and Bitcoin and bond returns are connected in different ways, there are multiple possible scenarios.

Scenario 1: Revenue increases significantly

If Bill Ackman’s prediction comes true and 30-year Treasury yields rise significantly to around 5.5%, it could have several implications for Bitcoin.

Increased risk appetite: Higher bond yields may indicate greater risk appetite among investors. If investors are willing to accept higher risk for higher returns, they may also be more inclined to invest in Bitcoin, which is often seen as a riskier asset. This could drive up the price of Bitcoin.

Inflation hedge: If the rise in bond yields is driven by higher inflation expectations, Bitcoin could attract more investment as a potential store of value. Bitcoin, often referred to as “digital gold,” is viewed by some investors as a hedge against inflation. If inflation continues to rise and erode the value of fiat currencies, more investors may turn to Bitcoin, driving the price higher. However, that is a story that has yet to be proven over time.

Additionally, it’s important to note that if yields rise too quickly or too high, it could lead to a sell-off in risky assets, including Bitcoin, as investors move to safer assets. This could potentially put downward pressure on Bitcoin’s price.

Scenario 2: Yields remain stable or decrease

If, contrary to Ackman’s prediction, yields hold steady or fall, Bitcoin could also be impacted.

Risk aversion: Lower returns may indicate that investors are moving towards safer assets, which could negatively impact Bitcoin prices. If investors are less willing to take risks, they may move from Bitcoin to safer assets such as bonds.

Liquidity Conditions: Bond yields may reflect liquidity conditions in the market. If interest rates fall, it may indicate that liquidity is high. In such a scenario, more capital could be available for investment in assets such as Bitcoin, potentially supporting the price.

Scenario 3: Market uncertainty increases

If market uncertainty increases, for example due to concerns about US fiscal policy or rapid price revisions in the bond market, Bitcoin may serve as a hedge.

Hedge Against Uncertainty: In times of market uncertainty, such as during the March banking crisis, some investors may turn to Bitcoin as a potential hedge. Reinforcing Bitcoin’s perceived status as a “digital gold” or safe haven could potentially attract more investment and push its price higher.

However, it is important to note that Bitcoin’s response to market uncertainty can be unpredictable and dependent on several factors, including investor sentiment and broader market conditions.

In conclusion, the potential impact of movements in bond yields on Bitcoin’s price is complex and may depend on several factors. Investors should remain vigilant and consider a range of possible scenarios.

Otherwise, Bitcoin and crypto intrinsic factors, such as the approval of a Bitcoin spot ETF, an Ether futures ETF, or actions by the US Department of Justice (DOJ) against Binance, among others, have the potential to drive an increased cause volatility.

Featured image from CNBC, chart from TradingView.com