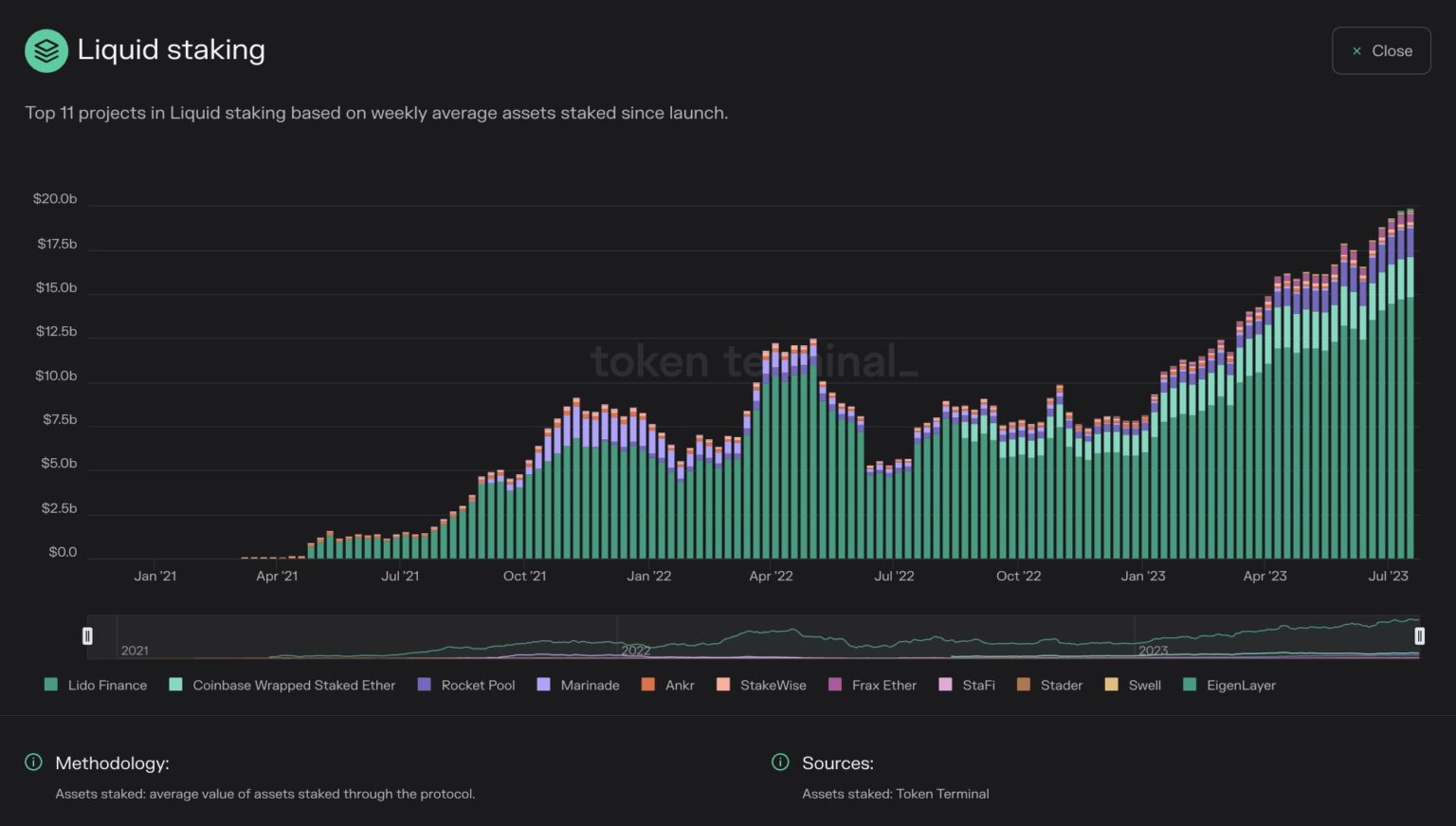

- ETH deployed through liquid staking platforms has gradually increased since early 2023.

- Liquid staking held 36% of the total ETH staking market share.

Ethereum [ETH] staking began in December 2o2o and offered investors the opportunity to lock in their positions and earn passive income from it. Interest was fueled by the rising chart of the crypto market where ETH, like other cryptos, hit new all-time highs on a daily basis.

Realistic or not, here is the market cap of LDO in terms of BTC

Strike to keep shine in 2023

Cut to 2023 and ETH is down more than 60% from its peaks. The market was in a rebuilding phase at the time of writing after the carnage of the 2022 crypto winter. Despite these headwinds, the demand for staking has only gone north.

According to a Twitter user citing Token Terminal data, the total amount of ETH staked through liquid staking platforms has gradually increased since the beginning of 2023.

Source: Token Terminal

The excitement surrounding the long-awaited Shapella upgrade and its eventual 2023 rollout played a big part in keeping user interest in staking. With the addition of the recording feature, staking became more reliable.

Liquid staking is taking the market by storm

Liquid staking protocols extended their dominance after Shapella and outperformed other staking options such as centralized exchanges (CEX) and staking pools. Of a non-existent category in December 2020, liquid staking controlled 36% of total staking market share at the time of writing, according to Dune facts.

Source: Dune

Liquid staking surpassed decentralized exchanges (DEXs) and lending protocols to become the largest subsector in the DeFi landscape by 2023, according to DeFiLlama. On a YTD basis, total value locked (TVL) in liquid staking protocols skyrocketed 144% to $21.6 billion at the time of writing.

Unsurprisingly, the heavy lifting was done by lido Finance with liquid staking [LDO] what was the largest DeFi protocol at the time of writing, with a TVL of $14.76 billion. The fact that Lido’s TVL was more than twice as high as the next Aave [AAVE] on the list provided proof of his superiority.

Source: DeFiLlama

Is your wallet green? Check out the Lido Profit Calculator

LDO sees adoption

The increasing prominence of liquid staking also began to reflect on their own tokens. LDO was trading at $2.03 at time of publication, with gains of 7.45% over the past 30 days.

With its increasing value, the token caught the attention of traders. The total number of LDO holders has grown 6% over the past month, according to data from Santiment.

Source: Sentiment