- BTC inflows since the start of the year exceeded $500 million.

- Leading alt ETH saw outflows despite the rise in the coin’s value.

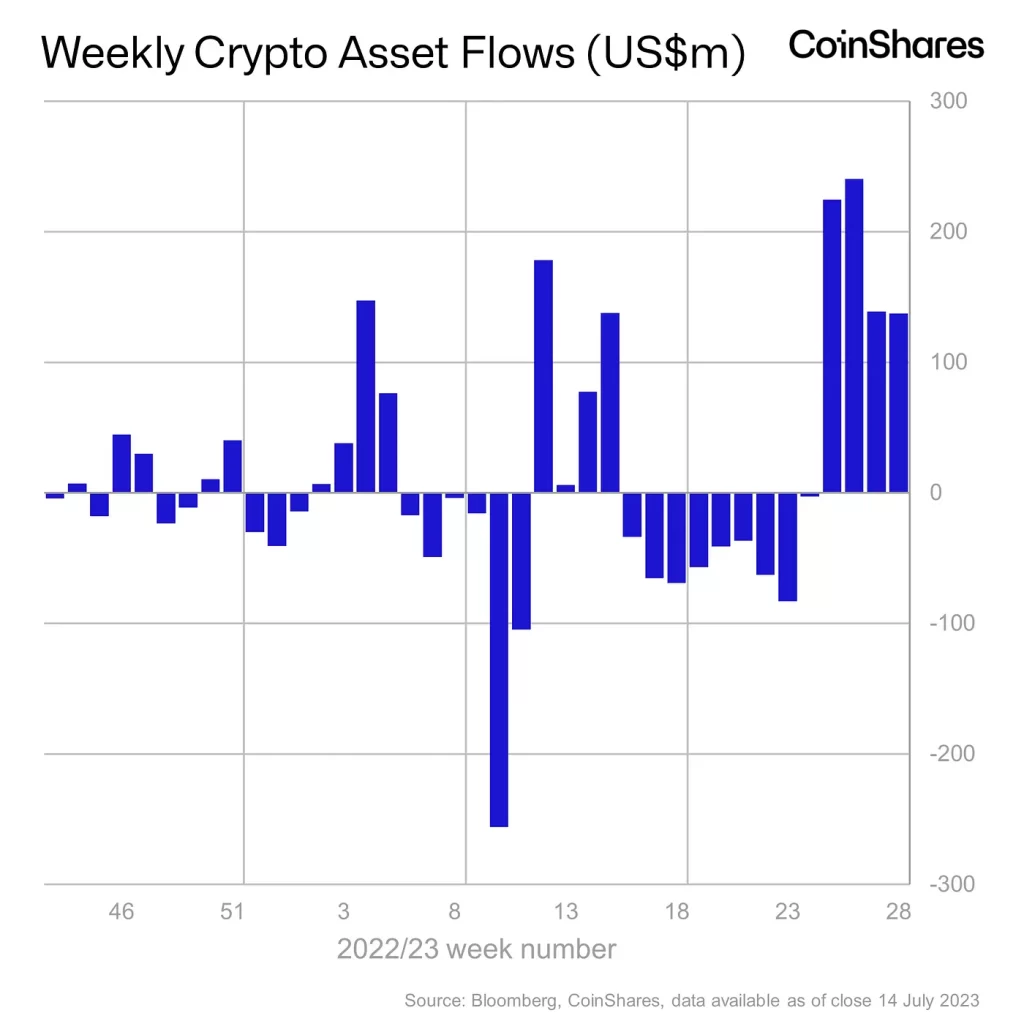

Digital asset investment product inflows topped $137 million last week, marking its fourth consecutive week of inflows at $742 million, CoinShares found in a new report.

According to the digital asset investment firm, last month’s total inflows represented the largest inflow since the last quarter of 2021.

Source: CoinShares

Despite the annual average trading volume for investment products hovering around $1.4 billion, CoinShares noted that last week’s trading volumes for these products increased to a total of $2.3 billion, beating the average by a significant margin.

CoinShares added,

“Volumes currently make up a much larger portion of total crypto volumes, up 11% last week compared to the 2% average.”

Investor sentiment is favorable for Bitcoin

For the fourth straight week, investors are “maintaining (rescuing) their focus on Bitcoin” as the king coin recorded inflows totaling $140 million last week. This accounted for 99% of the total intake in that period. While the price of BTC trended downward after a short trade at a two-month high of $31,693 on July 13, the king coin saw its inflows grow by 5% over that period.

The additional $140 million inflow brought the leading coin’s YTD net inflows to $571 million, with $25 billion in assets under management (AuM). This represented the third week in which BTC recorded net inflows YTD after being in a net outflow position of $171 million a month ago.

On the other hand, short bitcoin investment products saw outflows of $3.2 million last week, representing 12 weeks of consecutive outflows. According to CoinShares:

“A combination of recent price increases and outflows has caused short bitcoin total assets under management to drop from their peak of US$198 million in April to just US$55 million.”

However, despite continued bearishness for short bitcoin, it remained the second best performing asset in terms of inflows YTD at $55 million, albeit in a steady decline, data from the report showed.

Source: CoinShares

ETH leads from the back

With an outflow of $2 million recorded during the reporting period, altcoin leads Ethereum [ETH] emerged as the “assets with the most outflows since the start of the year”.

Source: CoinShares

While the alt’s price saw some growth over the past week, the price growth failed to translate into any inflows for ETH, CoinShares found.

As for other altcoins, Solana [SOL]polygon [MATIC]and Litecoin [LTC] saw a small inflow of “between US$0.5 million, US$0.5 million and US$0.3 million, respectively.”