- 49% of Bitcoin holders are making a profit as the price has recently dipped below $25,000.

- If the price falls to $23,000, long-term market participants can create demand in the zone.

Less than half for the first time this year Bitcoin [BTC] holders are in profit. As confirmed by IntoTheBlock, 49% of King Coin holders have profits. On the other hand, 39% of investors with BTC in their portfolio are at a loss. And finally, 12% are at the break-even point.

Less than 50% of #Bitcoin holders are making a profit for the first time since January of this year. pic.twitter.com/HSpmaq091h

— IntoTheBlock (@intotheblock) June 15, 2023

Is your wallet green? Check the Bitcoin Profit Calculator

Globes stare as the price falls

The main reason why this happened may be related to the price of Bitcoin falling below the $25,000 threshold.

Last year this would have been an impressive feat. But Bitcoin’s 53% Year-To-Date (YTD) rise returned hopes of continued respite. But recently it has been fed back by selling pressure and regulating heat.

Still, one cannot deny that the fall in prices caused fear in the market. However, data from the blockchain-powered crypto insight platform showed that demand rose between $18,900 and $23,000.

This was before BTC value rose to $30,000. Usually, an action of this magnitude suggests that a significant number of market participants were optimistic about the long-term price action.

So if the price drops from current levels, many holders may be willing to scoop up tons of BTC. IntotheBlock pointed out,

“More than 1.1 million addresses bought Bitcoin around the 23k level and this could certainly serve as support”

Interestingly, at the time of writing, BTC has been able to revive more than USD 25,000. Nevertheless, it seemed that quite a few investors took the opportunity of the price drop to demonstrate a commitment to holding BTC for the long haul.

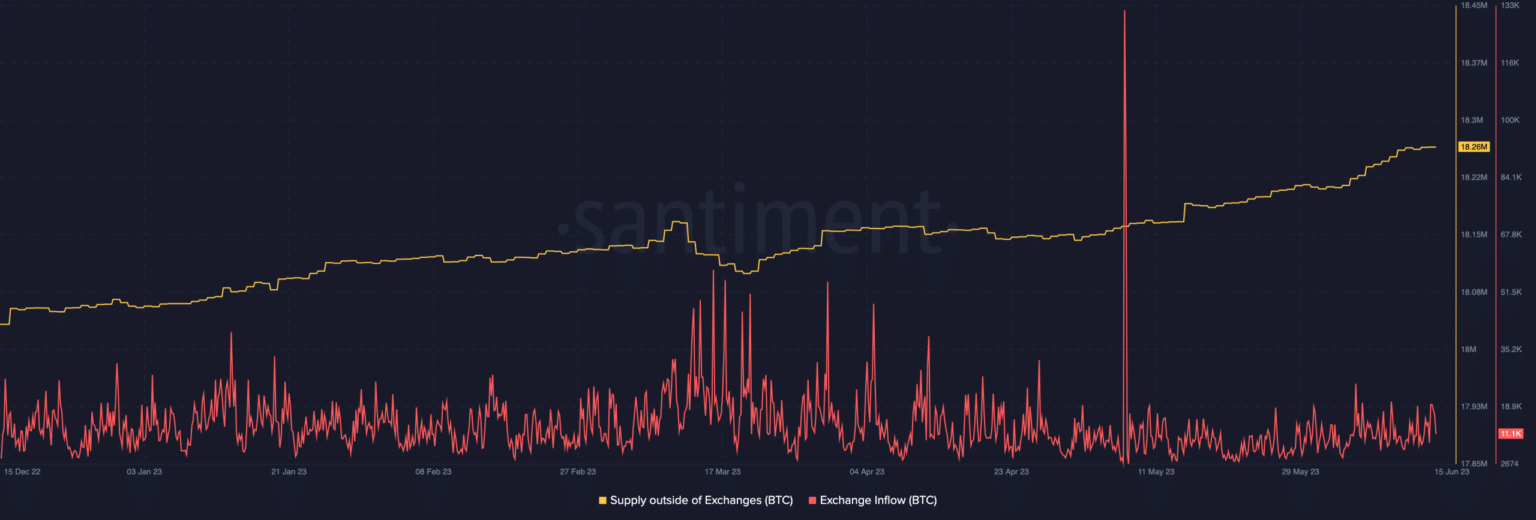

This was due to Santiment’s data revealed that the off-exchange BTC supply increased by more than 500,000 between June 5 and June 15.

However, the number of inflows on the stock market fell to 11.1000. Usually used to measure the rate of deposits on exchanges, an increase in the metric would have suggested an increase in selling pressure.

Source: Sentiment

When compared with the supply off exchanges, the statistic indicates that only a select few were willing to sell BTC at the price at the time of writing.

Read Bitcoins [BTC] Price prediction 2023-2024

Risks of the downside

However, before BTC’s resurgence, crypto analyst Michaël van de Poppe believed that the lows were swept. This implies price compression and a possible downward move in liquidity.

There we go #Bitcoin.

The lows are swept.

Very interested to see response in the $25K region. pic.twitter.com/0ekuDdRptL

— Michael van de Poppe (@CryptoMichNL) June 14, 2023

According to van de Poppe’s chart, if BTC fails to hold on to $25,000, it could eventually fall into the $23,000 demand area.

While this has not been the case, holders may need to keep an eye out for other market events.

For example, the stablecoin market was recently hit as Tether [USDT] lost his dollar peg again. As the go-to safe haven asset for turbulent periods in the market, this event could also have a significant impact on the action taken by BTC holders.