The fallout from the U.S. Securities and Exchange Commission (SEC) lawsuits against major cryptocurrency exchanges Binance and Coinbase are beginning to manifest in the market.

The legal action sent shockwaves through the crypto market and hit many tokens in the lawsuits as evidence that the exchanges traded crypto securities. Analyzing the performance of these tokens against Bitcoin since the cases were announced yields the following chart.

On June 6, the tokens mentioned in the lawsuits began to fall, with the sell-off accelerating for most on June 10.

Gaming-related tokens such as CHZ, SAND, MANA, FLOW, and AXS all saw double-digit gains of up to 28%.

The only token that could prevent the June 10 collapse was Nexo’s own token.

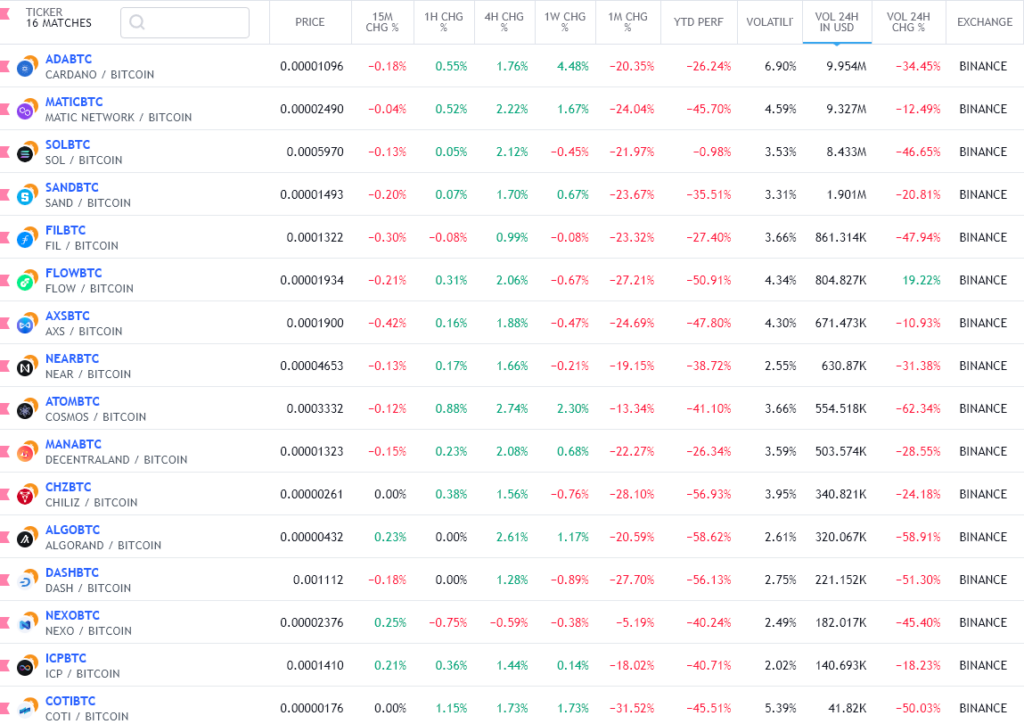

Tokens named in one or both colors included SOL, ADA, MATIC, FIL, SAND, AXS, CHZ, FLOW, ICP, NEAR, VGX, DASH, NEXO, ATOM, SAND, MANA, ALGO, and COTI. The chart below shows a screener of the tokens and their performance through 2023.

Potential performance of security tokens

Of all the tokens cited in the lawsuits, Nexo’s native token appears to have outperformed others by some margin when denominated in Bitcoin.

The token used on the Nexo exchange to unlock higher yields and other features is down just 5.19% over the past month. In addition, it is down 40% since the start of the year and ranks sixth in the year-to-date (YTD) ranking of tokens cited in the lawsuits.

Nexo pulled out of the US in 2022, citing “a lack of regulatory clarity” as the main reason behind the decision. The move doesn’t necessarily mean Nexo is immune from SEC prosecution, as the regulatory body can still take legal action against the company for past activities or ongoing violations involving US-based customers.

However, it seems that NEXO has avoided the same downturn that affected other tokens.

Cardano (ADA) also showed resilience in the face of adversity, with a weekly increase of 4.48%, indicating a slight recovery since the lawsuit. However, when compared to monthly and annual performance, Cardano suffered a -26.24% decline.

In addition, Polygon (MATIC), Sandbox (SAND), Cosmos (ATOM), Decentraland (MANA), Algorand (ALGO), and Coti have all managed to regain some market share over the past seven days.

In particular, tokens with higher trading volume on Binance, such as ADA and MATIC, seem to have weathered the storm better than tokens with lower trading volume, such as FLOW.

Solana (SOL) experienced a -0.65% weekly change as the price struggled to recover from the market-wide sell-off. However, the overall performance remains relatively stable this year, with only a -1.18% drop in value.

Solana was also hit by the collapse of FTX due to its association with the exchange’s founder, Sam Bankman-Fried, which caused SOL to drop more than 70% before recovering somewhat. When the SEC lawsuits were released, the price of SOL fell 91% from its all-time high and then fell another 21.9%.

In addition, tokens such as FLOW, AXS and NEAR have had a bigger impact, which have struggled to recover, with weekly changes of -1.08%, -0.89% and -0.34% respectively. These tokens have experienced significant declines in both their monthly and annual performance.

Looking at the data, it is clear that the lawsuits have undoubtedly impacted the performance of the said tokens. While some tokens showed signs of recovery, others were more severely affected and struggled to regain previous price levels.

Broader implications

In the broader crypto market, the SEC’s lawsuits have had a significant impact on the cryptocurrency market, impacting tokens labeled as securities and leading to mass liquidations, wiping out more than $200 million in an hour from traders who take positions in the market.

The total market capitalization of digital assets fell 2.87% to $1.12 trillion. In addition, the cryptocurrency market saw a net outflow of more than $40 billion in the first 24 hours after the lawsuits were released, with all top 10 cryptocurrencies posting losses.

As the cryptocurrency industry continues to debate the next steps, the outcome of the SEC lawsuits against Binance and Coinbase will play a critical role in shaping future market dynamics. Regulatory actions and their effects on various tokens and exchanges remain uncertain and attract the attention of investors and industry professionals.

Despite the initial turbulence, some tokens have shown resilience, highlighting the adaptability within the market. The long-term impact of the lawsuits on the cryptocurrency landscape has yet to be determined.

*All figures are based on data from TradingView as of June 12.

Disclaimer: Nexo is an advertising partner of CrytoSlate.