- Curve Finance’s new stablecoin, crvUSD, showed promise.

- Curve’s TVL fell, but a slight increase in token growth fueled optimism.

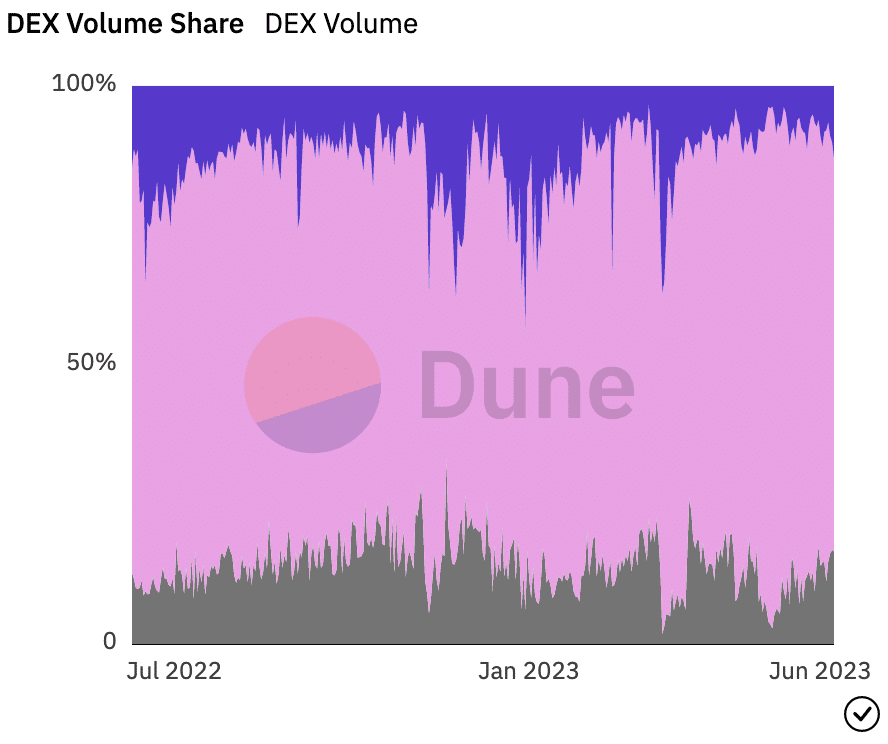

As new decentralized exchanges (DEXs) keep popping up, Curve Finance [CRV] has experienced a significant decline in its market dominance. However, with the introduction of its stablecoin, crvUSD, Curve Finance may regain a foothold in the competitive DEX space.

Realistic or not, here is CRV’s market cap in terms of BTC

Any stability for Curve?

Parsec Finance data shows that the crvUSD market attracted 3,000 wstETH (equivalent to $6.5 million) as collateral in just 24 hours.

$4.3 million in crvUSD has already been generated against this collateral, showing tremendous interest in this stablecoin.

In less than 24 hours, crvUSD’s new market has already minted 3,000 wstETH ($6.5 million) in collateral and $4.3 million in crvUSD pic.twitter.com/ykonxiIjgb

— parsec (@parsec_finance) June 8, 2023

The increased focus on crvUSD can be attributed to the adoption of a new proposal for the Curve protocol. This allows users to use their STETH holdings as collateral, with Curve automatically slapping crvUSD in return.

The value of the minted crvUSD is determined by a portion of the value of the stETH. To maintain the target $1 crvUSD peg, users must pay a 6% borrowing rate and will be automatically liquidated if the value of the collateral provided falls.

These developments have the potential to reinforce Curve’s dominance within the DEX industry. At the time of going to press, Curve had captured 10.1% of all volume on DEXs, while Uniswap maintains a market share of 74.1%.

Despite Curve’s popularity and the success of its stablecoin, its Total Value Locked (TVL) has been on the decline, dropping 2.3% in the past 24 hours. At the time of writing, the cumulative TVL on the protocol was $4.1 billion.

Nevertheless, Curve outperformed both Uniswap [UNI] and Sushi Swap [SUSHI] in terms of TVL, as indicated by Token Terminal. Uniswap’s TVL was $3.9 billion at the time of writing, while SushiSwap’s TVL was $368.8 million.

Source: Dune analysis

Legal problems

Curve’s dominance in TVL may face challenges due to ongoing lawsuits involving the founder. At the time of going to press, a legal dispute was underway in San Francisco, with three leading crypto venture capital firms accusing Curve founder Michael Egorov of deceptive practices and misappropriation of trade secrets, resulting in financial loss.

These costs can affect the sentiment around Curve, leading to a decline in activity and subsequent TVL.

Is your wallet green? View the UNI Profit Calculator

In terms of tokens, the market capitalization of SUSHI, UNI, and CRV has dropped significantly over the past month. However, a slight increase in network growth has been observed in recent days.

This indicates a growing interest in these tokens among new addresses, suggesting a possible turnaround for these tokens in the future.

Source: Sentiment