On-chain data shows that Bitcoin’s realized loss metric has remained at a low value lately, despite the volatility the coin has experienced.

The loss realized by Bitcoin remains relatively low

This is evident from data from the on-chain analytics company Glasnodeinvestors realized only $112 million in losses during the cryptocurrency’s recent fall in value.

The “entity-adjusted realized loss” is a metric that measures the total loss (in USD) that Bitcoin investors have recently realized on the blockchain.

Whenever a coin is stationary on the network for a period of time (meaning it has not been transferred to another address) and the price goes above or below the value it was acquired for, the coin is said to produce an “unrealized gain”. loss.”

When such a coin with an unrealized profit or loss is finally moved or sold on the blockchain, the profit/loss it previously carried is “realized”.

The realized loss metric specifically tracks such losses being reaped throughout the network (and of course its counterpart, realized gain, measures profit).

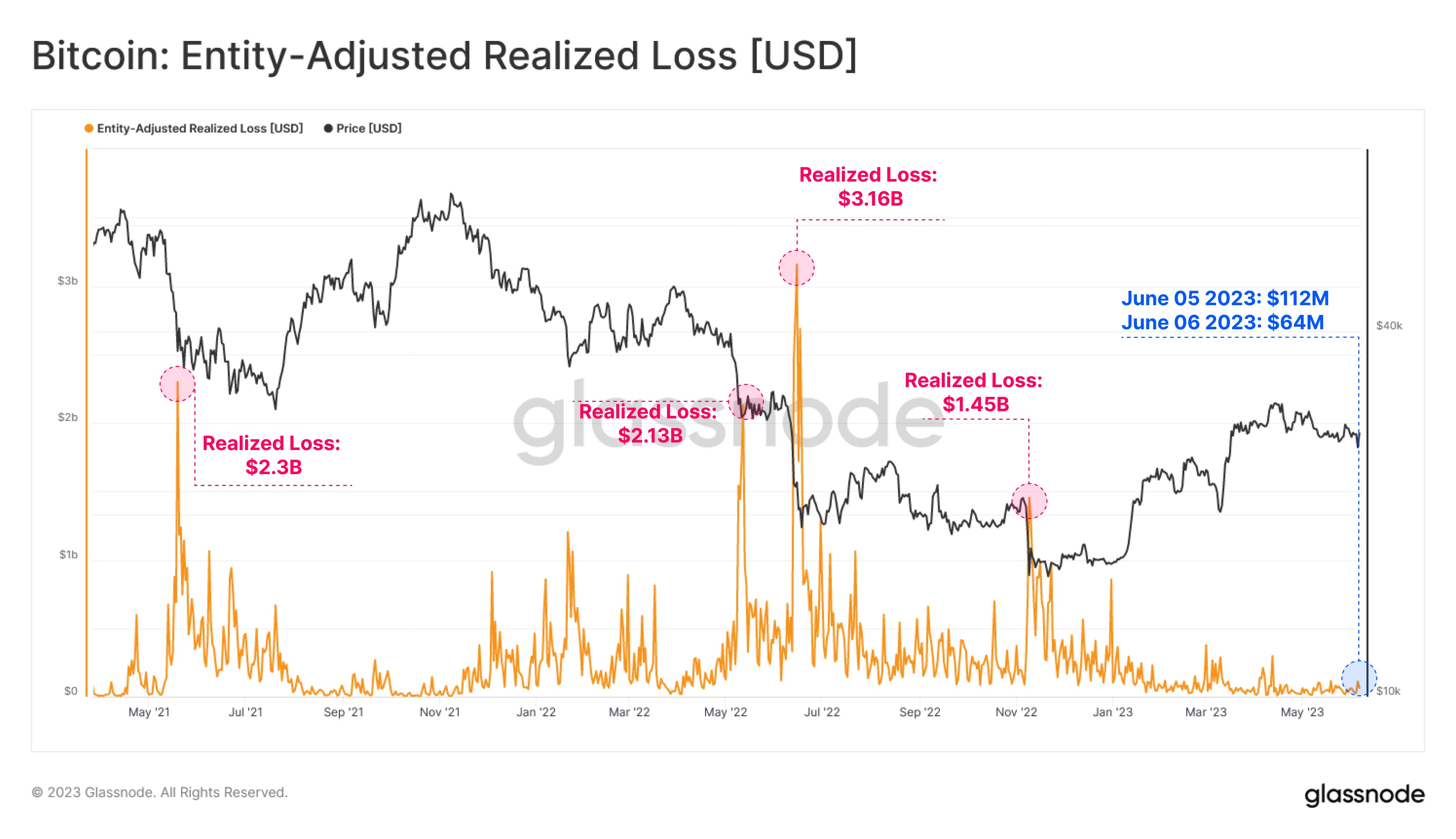

Now, here’s a chart showing the trend in Bitcoin’s entity-adjusted realized loss over the past few years:

Looks like the value of the metric has been relatively unchanged in recent weeks | Source: Glassnode on Twitter

As can be seen in the chart above, when Bitcoin crashed a few days ago following the news of new regulatory pressure on cryptocurrency exchange Binance, the realized loss was about $112 million. Then, the next day, the losses nearly halved as the benchmark was about $64 million.

Usually during volatile events like crashes there are a large number of investors who panic and sell their coins even if they hold them at a loss. Such investors are generally inexperienced short-term investors, who quickly lose conviction in the asset.

For this reason, sharp declines in the price of the cryptocurrency have historically been marked by massive capitulation events where the realized loss indicator registers a major spike.

The chart shows that the May 2021 crash, the May 2022 collapse of LUNA, the June 2022 bankruptcy of 3AC, and the November 2022 collapse of FTX all saw widespread capitulation of holders.

Of these, the crash following 3AC’s bankruptcy saw the largest amount of realized losses, as the value of the indicator reached about $3.1 billion during the crash, while the FTX collapse produced the fewest losses at $1.45 billion.

However, both values are extremely large compared to the losses that Bitcoin investors have reaped in this latest period of price volatility. According to Glassnode, this trend would indicate “a greater degree of resilience among market participants”.

BTC price

At the time of writing, Bitcoin is trading around $26,800, down 1% over the past week.

The asset seems to have made recovery during the past day | Source: BTCUSD on TradingView

Featured image from iStock.com, charts from TradingView.com, Glassnode.com