- Trader Joe’s rapid growth propels Avalanche with an increase in active addresses and token trading volume.

- However, Avalanche’s overall growth faces multiple challenges.

The past few days, Avalanche [AVAX] experienced a significant increase in activity and the emergence of Trader Joe has played a vital role in driving this growth. As dApps gain traction on the Avalanche protocol, the platform is poised to compete more effectively in the L1 space.

Trader Joe’s impact

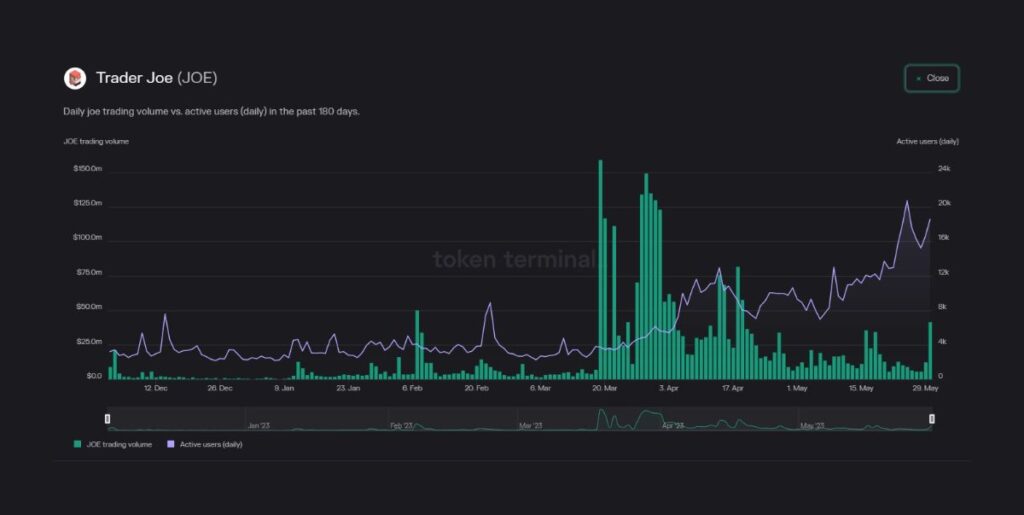

The last facts reveals that the number of active addresses on the Avalanche network has increased by 74% in the past 24 hours. JOE’s trading volume also saw a significant increase of 23.3% over the same period.

This shows that Trader Joe has the potential to deliver long-term positive effects for the Avalanche protocol.

Source: Token Terminal

Data from the Token terminal showed a 26% increase in the number of Avalanche users over the past week. It was accompanied by an 11.8% increase in sales over the same period.

These statistics further underline the growing interest and engagement within the Avalanche ecosystem.

Source: Token Terminal

While Trader Joe witnessed significant growth on Avalanche, the same cannot be said for other protocols on the network.

For example, GMX, a DeFi protocol on Avalanche, experienced a decline in both unique active wallets and volume over the past week.

Consequently, the number of transactions on the network fell by an alarming 41% over the past month.

This disparity highlights the need for continued innovation and diversification within the ecosystem to support and enhance its overall growth.

Source: Dapp Radar

Challenges in the NFT sector

Within the NFT sector on Avalanche, blue-chip collections such as Roostr and Doggerinos have seen a significant decline in interest in recent weeks. In addition, the number of NFTs minted on the network also experienced a substantial drop during this period.

Source: AVAXNFTSTATS

Read AVAX’s Price Forecast 2023-2024

Nevertheless, Avalanche’s support infrastructure for NFTs and potential partnerships could pave the way for renewed interest and industry revitalization.

Source: Sentiment

The rise of Trader Joe and the subsequent increase in network activity have the potential to shape the network’s trajectory.

However, the falling prices of AVAX tokens and the decrease in trading volume raise questions about the correlation between increased activity and market performance.