In a forecast issued Friday via “There is a 90% chance that Bitcoin will reach a new ATH before March 2025,” says Peterson proclaimed.

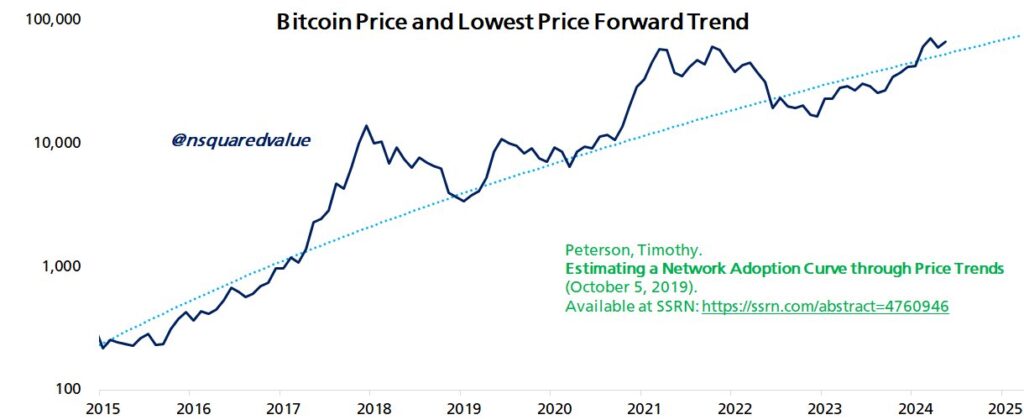

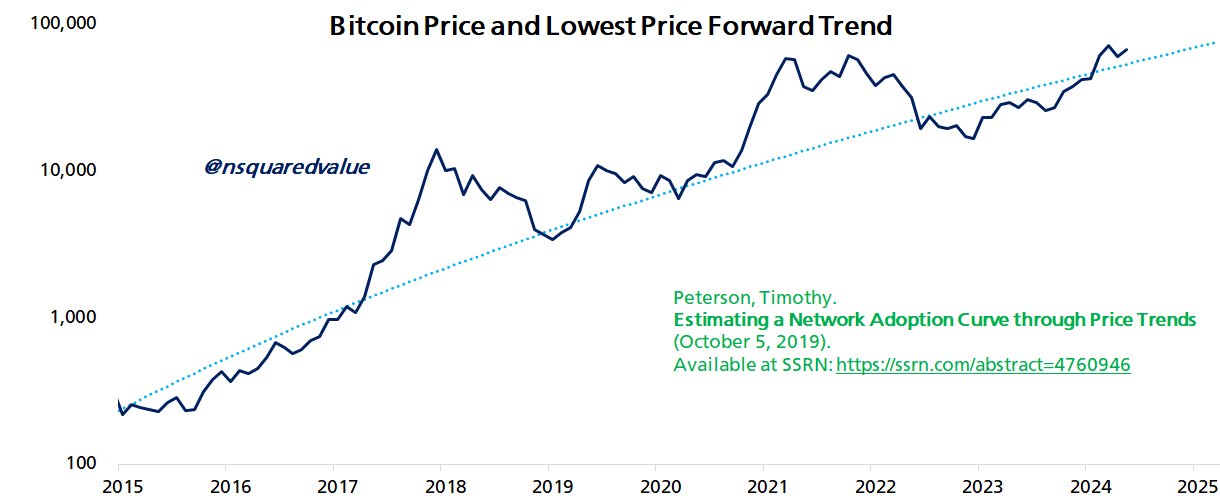

Peterson, known for his works including ‘Metcalfe’s Law as a Model for Bitcoin’s Value’, bases his prediction on the analytical framework outlined in his research paper entitled ‘Lowest Price Forward: Why Bitcoin’s Price is Never Looking Back’. This article, first published in 2019 and subsequently revised, introduces an innovative approach to understanding the Bitcoin price trajectory by focusing on the historical lowest prices, known as the ‘Never Look Back Price’ (NLB). This NLB marks the last time Bitcoin traded at a certain price level and never dropped to that level again.

Related reading

The methodology Peterson uses involves plotting these NLB data points on a lognormal scale, adjusted using what he calls a “square root time scale.” This unconventional measure facilitates a deeper understanding of Bitcoin’s long-term growth patterns, effectively comparing it to the diffusion processes observed in technology adoption in other domains.

Bitcoin adoption is key

Central to Peterson’s analysis is Metcalfe’s law, which he elaborates as “the value of the network is proportional to the square of the number of users.” Applying this principle to Bitcoin, Peterson argues that as the digital currency’s user base grows, its intrinsic value is expected to increase exponentially. The article describes the use of a “square root time” model to align traditional time-value-money concepts with the non-linear growth rates typical of the network economy, making a compelling case for Bitcoin’s future valuation trajectories.

Notably, Peterson’s approach incorporates elements of conservative financial analysis by focusing on Bitcoin’s lowest historical prices. “By focusing on the lowest price, the analysis inherently takes a conservative stance, underestimating rather than overestimating value,” notes Peterson, which helps “minimize the risk of overvaluation and ensures that forecasts are not overreliance on optimistic scenarios that may not come true. .”

Related reading

In his article, Peterson also discusses possible anomalies and market manipulations that can distort price perceptions. By focusing on the NLB, the analysis filters out such distortions, providing a cleaner view of Bitcoin’s value appreciation, unaffected by short-term speculative pressures or external shocks such as the COVID-induced market anomalies of 2021.

Peterson’s prediction of a new all-time high before March 2025 reflects a broader sentiment of confidence in the continued growth of the Bitcoin network. As adoption curves continue to rise and network effects further entrench Bitcoin’s value, the predictions are not purely speculative, but based on quantifiable and observed historical trends.

Peterson concludes: “As long as adoption continues, the value of Bitcoin – represented by the NLB price – will rise. If adoption is hindered, the price will stagnate or fall.”

At the time of writing, BTC was trading at $58,192.

Featured image created with DALL·E, chart from TradingView.com