Although the Bitcoin price has not yet reached the crucial $60,000 level to get back into the four-month trading range, Ikigai Asset Management Chief Investment Officer (CIO) Travis Kling thinks the current bearish phase is nothing more than a ‘bogeyman’. Via X, Kling mention eight reasons to be optimistic about Bitcoin. He stated: “NFA. I’m often wrong. The current bearish environment seems easier to look through and buy than most of the bogeyman we’ve had in these markets over the past six years.”

#1 Fast Bitcoin Liquidations by Germany

Travis Kling notes that Germany has significantly reduced its Bitcoin holdings in recent weeks, from 50,000 BTC to 22,000 BTC. According to him, “Germany is accelerating their #Bitcoin dump.” He predicts the selling will stop soon and suggests, “By the time they get to ~5k, the market will see through it.” Kling implies that the market impact of the German Bitcoin liquidations is temporary and nearing an end.

#2 The overestimated market impact of Mount Gox

Addressing the potential market impact of Mount Gox’s redemptions, Kling characterized fears of massive sell-offs as more speculative than based on creditors’ likely actions. He said: “Gox seems more FUD than actual mass sales (just a guess, but feels that way).”

Related reading

He believes creditors, many of whom are sophisticated investors, are likely to sell their assets methodically, for example through TWAPs, reducing the impact on the market. With regard to private investors, Kling asked a rhetorical question: ‘You have held on for ten years, while you could have sold centuries ago. Are you going to dump aggressively now, three months after the halving?”

#3 US Government Bitcoin Strategy

Regarding the US government’s Bitcoin sales, Kling highlighted the measured approach taken thus far. He said: “But so far they’ve been quite measured in terms of sales, so I imagine they’ll continue to be quite measured.” While he admits that the US government sale is “the most difficult to understand in terms of pace and method, and their stack is huge,” he maintains that the sale is unlikely to disrupt market stability.

#4 Boost for retail investments through ETFs

Kling highlighted an increase in retail investment in Bitcoin, especially through ETFs, following recent price declines. He noted: “You’ve got boomers guzzling the dipperino in the BTC ETFs Friday and Monday.” This trend indicates strong interest from retail investors to take advantage of lower prices, indicating bullish sentiment among this investor segment.

#5 Ethereum ETF anticipation

Ahead of US Ethereum ETFs, Kling noted that the price of ETH remains only slightly below levels seen before the rise of ETF rumors, suggesting minimal speculative hype has been priced in. This observation suggests that the market could react positively to the launches.

#6 Interest rate cuts are imminent

Kling also discussed the potential for upcoming Federal Reserve rate cuts, noting that the market has priced in a significant probability of such an event in September. He stated: “If inflation/labor data is light this month, Powell will likely tell the market that September is a live meeting at the September 31 FOMC. Nickileaks has already teased this.

Related reading

The fund manager is referring to Nick Timiraos of the Wall Street Journal, also known as the “Fed mouthpiece”. A few days ago, Timiraos wrote via X that the June jobs report will make the July Fed meeting “more interesting” because. “For the first time this year – a real debate on whether to make cuts at the *next* meeting (in September),” he noted.

#7 The potential Trump pump

Kling speculated about the influence of the political landscape on Bitcoin, especially under a potential Trump presidency. Kling asked a rhetorical question: “What would you rather own than have crypto hold the Trump presidency?” regarding the leading presidential candidate’s latest pro-Bitcoin and crypto comments in the polls.

#8 Bitcoin and Nasdaq relink

Kling pointed out the difference between NASDAQ’s continued new all-time highs and Bitcoin’s relative underperformance. He noted, “NASDAQ continues to create new ATH after new ATH. Crypto is completely decoupled to the downside.” He suggests that Bitcoin is undervalued relative to the major market index and will soon start to catch up. “You could say that BTC is trailing QQQ by 40% YTD,” Kling concluded.

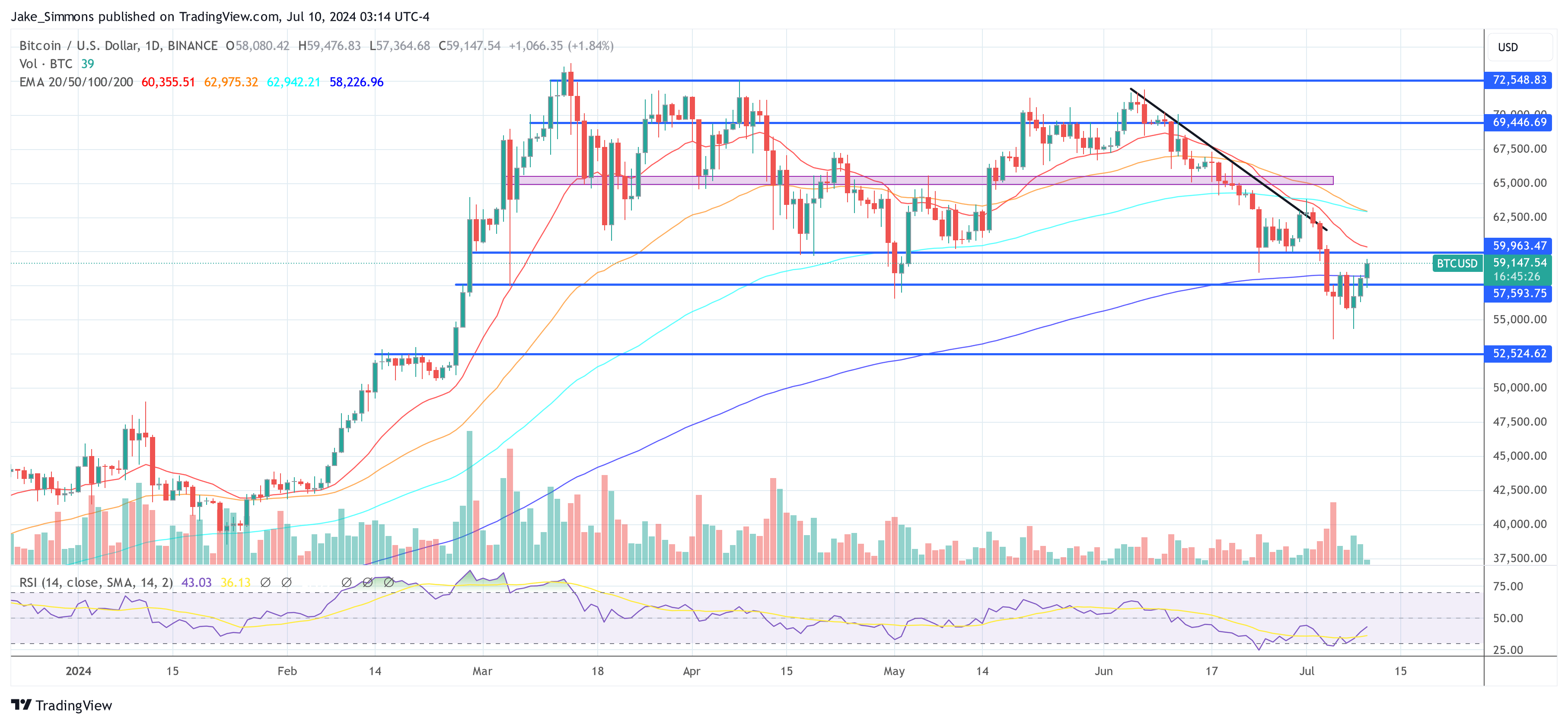

At the time of writing, BTC was trading at $59,147.

Featured image created with DALL·E, chart from TradingView.com