- Bitcoin has seen more long positions in recent weeks.

- BTC has maintained the $60,000 price level for the past two days.

Bitcoin [BTC] has experienced significant volatility in recent weeks, fluctuating but eventually settling back down to the $60,000 level.

Despite this turbulence, the majority of traders maintain a bullish outlook, favoring long positions. However, recent data shows that these long positions have suffered some setbacks during this period.

Bitcoin traders stay long

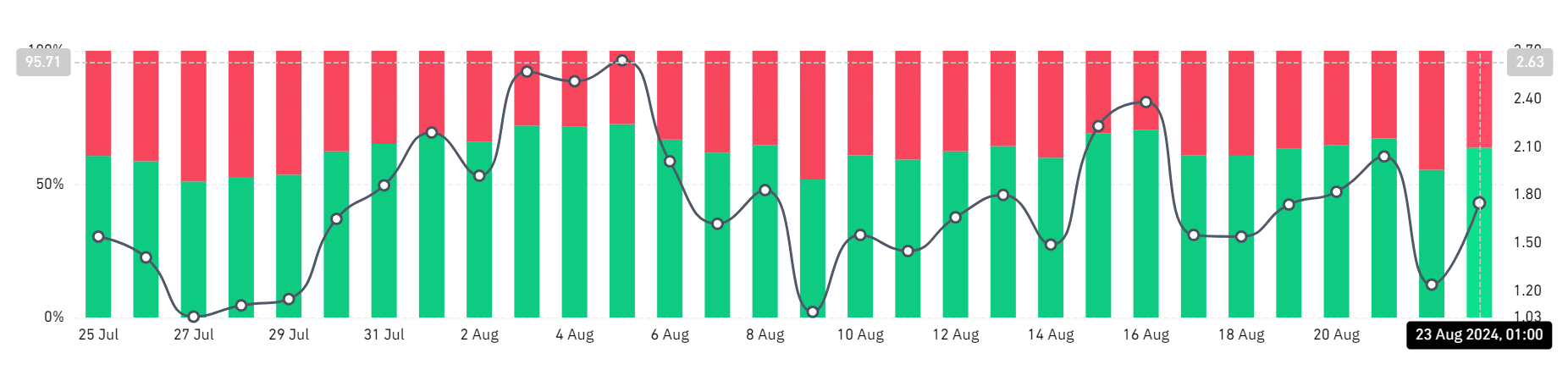

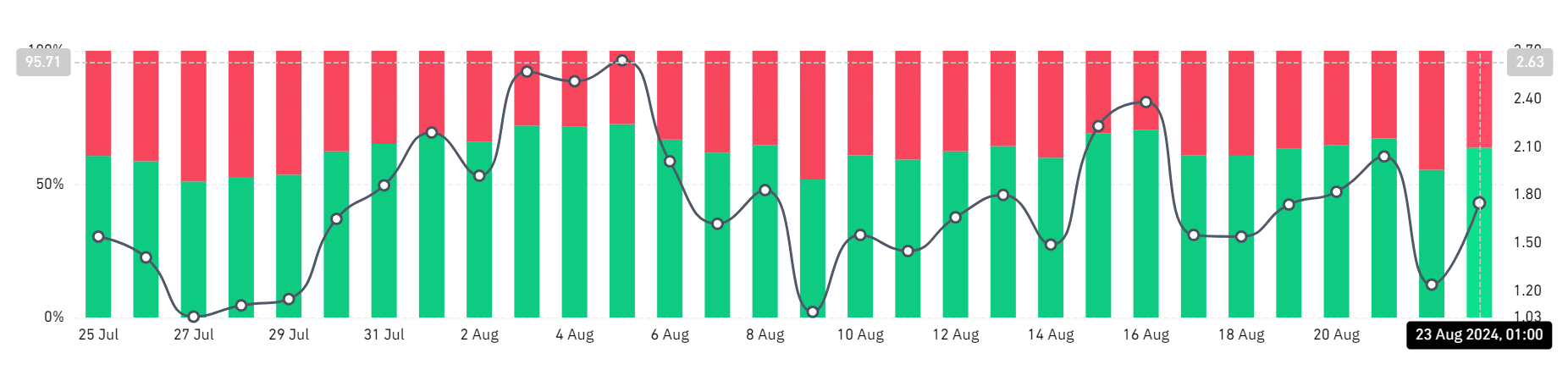

Recent data analysis of Mint glass has shed light on the relationship between long and short positions in Bitcoin on Binance, the world’s largest cryptocurrency exchange.

The findings show that most accounts have held long positions in recent weeks, consistently trading above 60%. According to the latest data, the percentage of long positions has increased to over 63%.

Source: Coinglass

Since July, this trend has continued, with the number of long positions consistently exceeding short positions even as Bitcoin’s price fell below the critical $60,000 mark.

This suggested that traders remained confident in Bitcoin’s upward trajectory regardless of price fluctuations.

The liquidation volume shows the degree of volatility

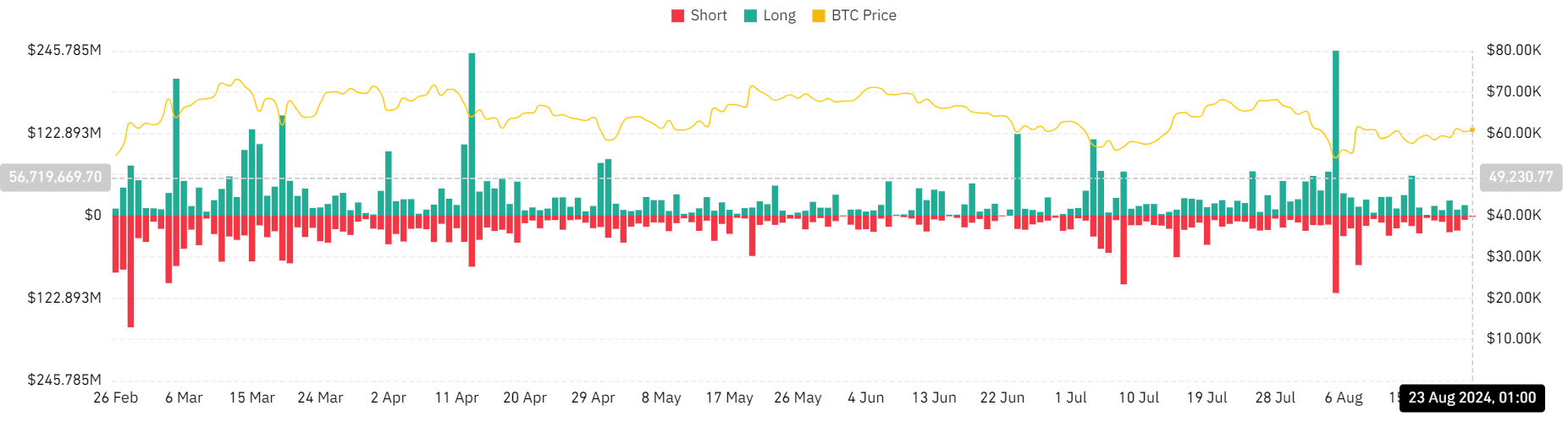

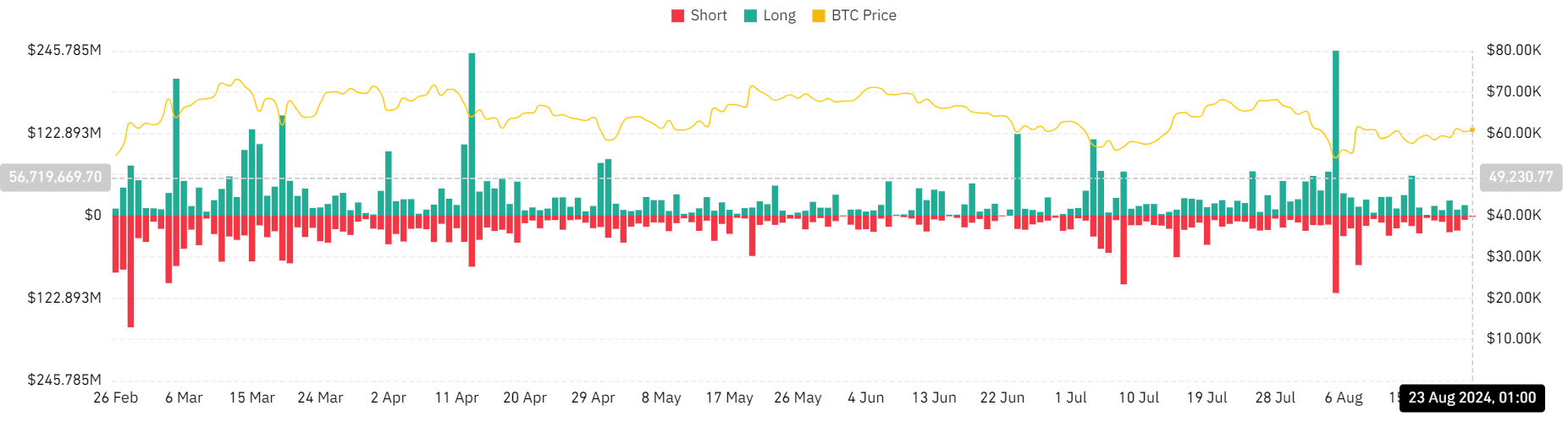

AMBCrypto’s analysis of Bitcoin’s liquidation trend added an intriguing dimension to the dominance of long positions.

Despite most accounts holding long positions, there has been a notable increase in long liquidations in recent weeks.

Source: Coinglass

In August, the volume of long liquidations reached the highest level in more than a year, at more than $245 million.

When combined with short liquidations, this trend becomes even more important, highlighting the volatility and risk in the current market despite the general bullish sentiment among traders.

Bitcoin maintains its price level at $60,000

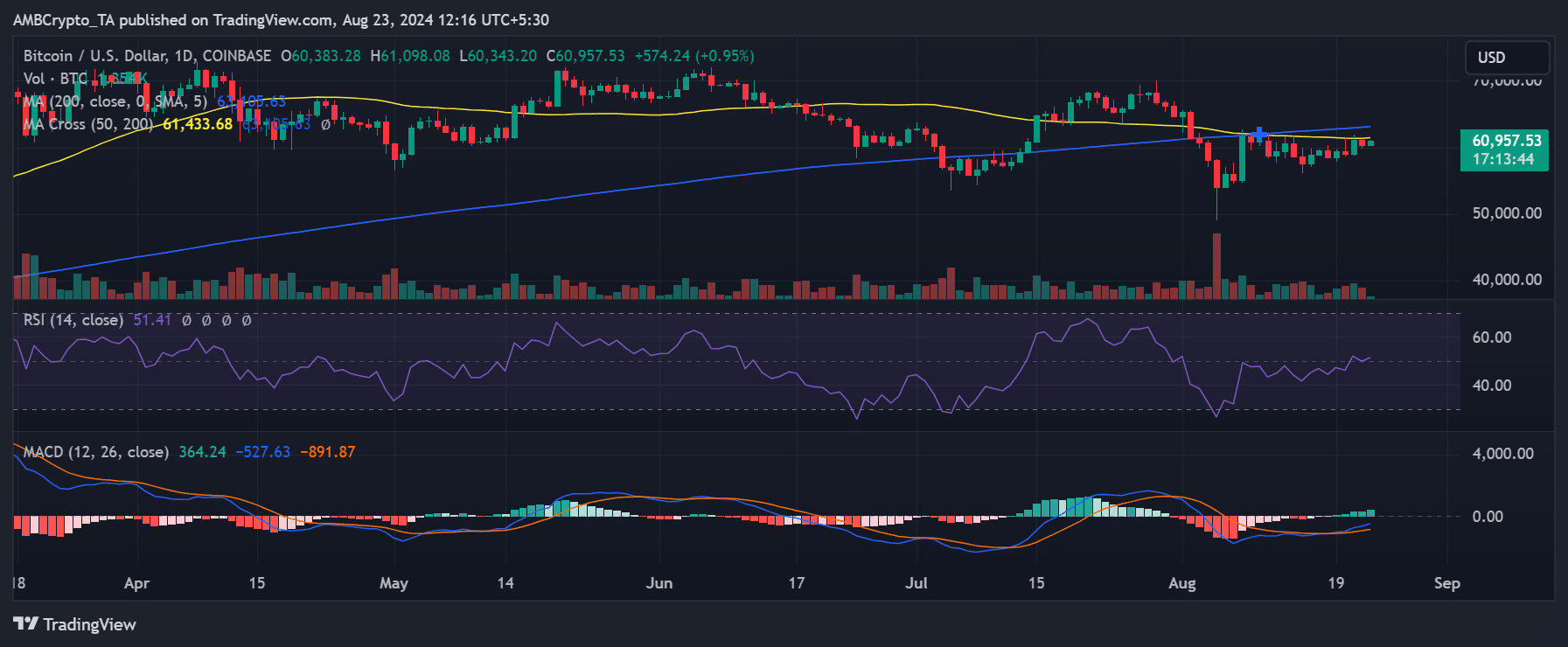

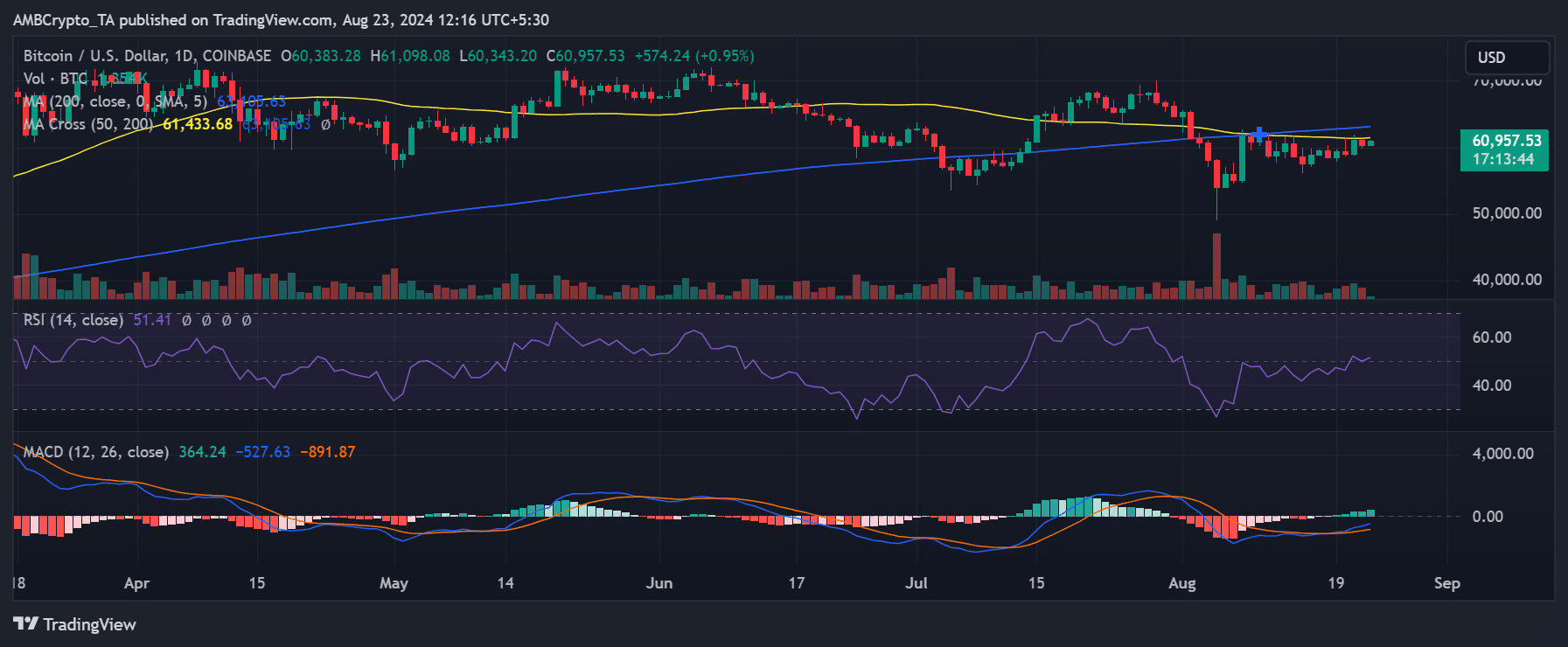

AMBCrypto’s look at Bitcoin’s price trend revealed that it is struggling to consistently regain the $60,000 level despite briefly doing so in recent days.

During the previous trading session, the price closed with a slight decline of over 1%, but still managed to stay within the $60,000 range.

Source: TradingView

At the time of writing, BTC was trading at around $60,900, reflecting an increase of almost 1%. The king coin Bitcoin remained just below its short-term moving average (yellow line), although it is close to this.

A break above this moving average, which aligned with the resistance level at around $61,000, would signal a potential uptrend.

Long positions to remain dominant

Bitcoin’s price trend, along with the Top Trader Long Short Ratio, indicated that long positions were likely to remain dominant regardless of price movements.

Read Bitcoin’s [BTC] Price forecast 2024-25

The charts showed that even as Bitcoin’s price fell to around $54,000 earlier in August, the percentage of long positions remained stable at around 60%.

This suggested that traders continued to favor long positions and maintained a bullish outlook despite price declines.