- The latest analysis has shown that accumulation addresses have stored BTC

- In the event of a trend reversal, the cryptocurrency could reclaim $67,000

Bitcoins [BTC] price action shifted down a gear as it was near $61,000 at the time of writing. However, there could be more to the story as several investors have taken this opportunity to accumulate more BTC.

Will this have a positive impact on the price and trigger another bull rally soon?

Are Investors Buying Bitcoin?

CoinMarketCaps facts revealed that BTC witnessed a major price correction last week as its value fell by more than 9%. In the last 24 hours alone, the value of BTC fell by more than 4%. At the time of writing, the crypto was trading at $61,727.17 with a market cap of over $1.22 trillion.

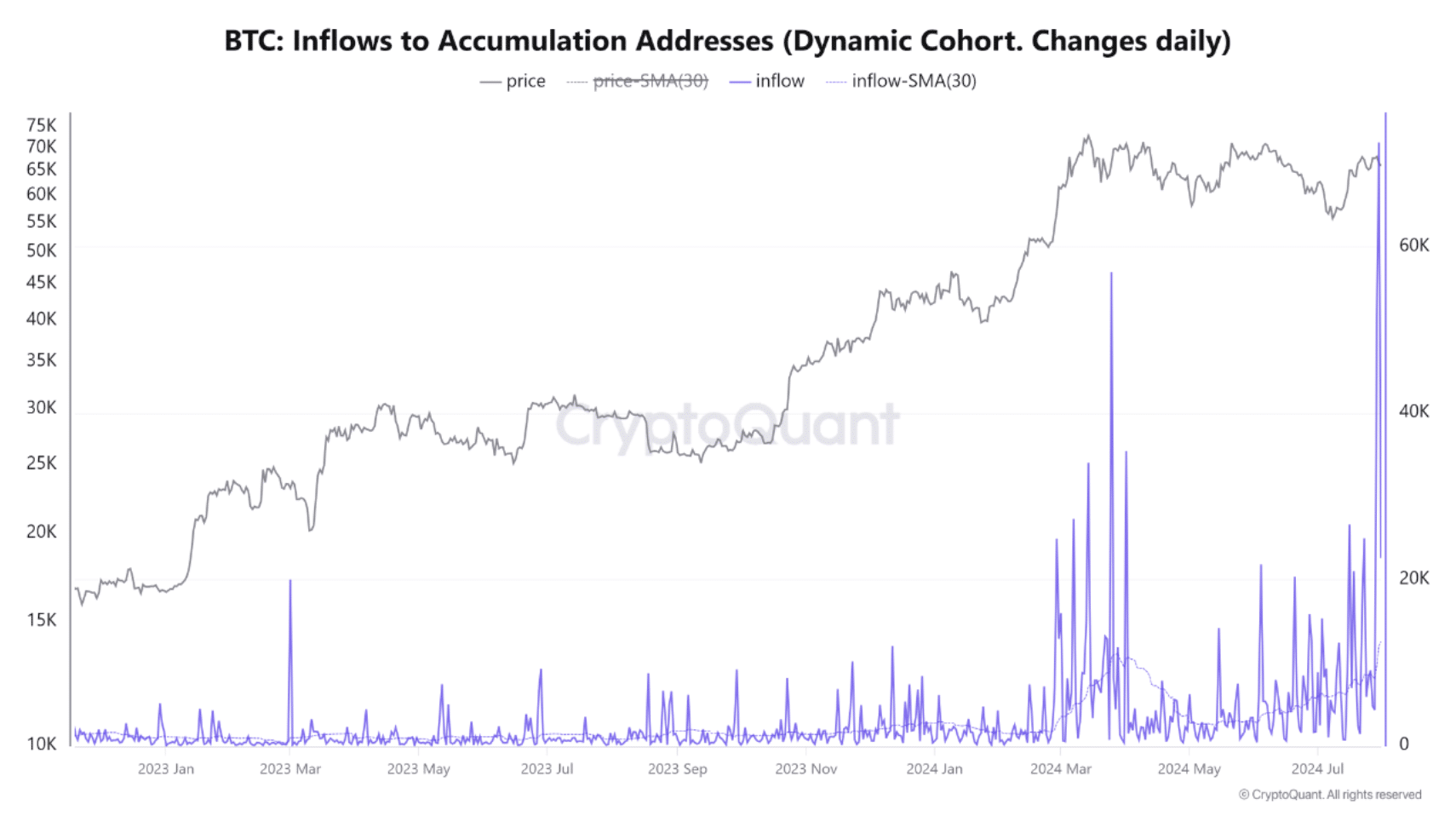

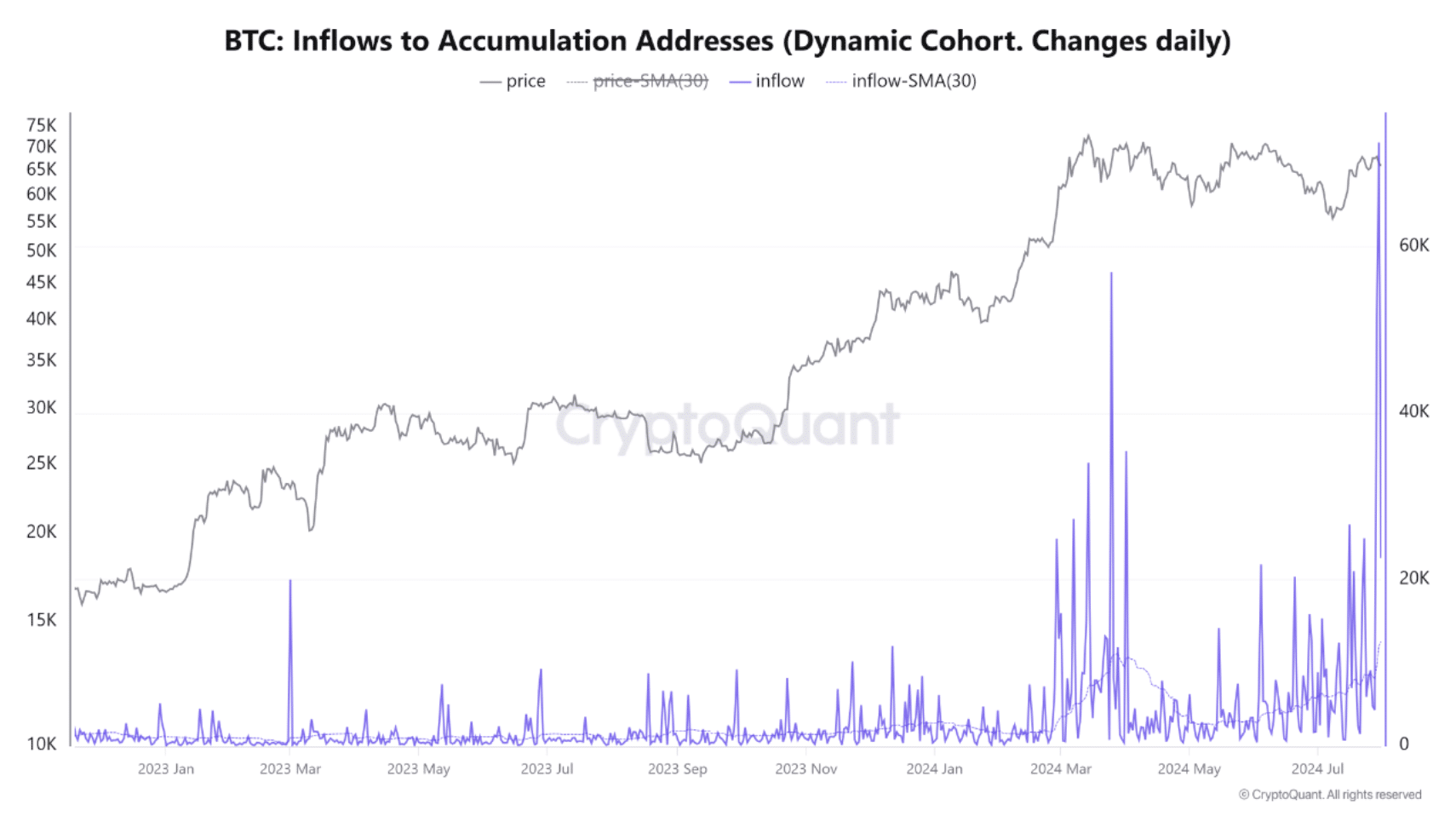

Meanwhile, caueconomy, an author and analyst at CryptoQuant, recently shared a analysis shows an interesting development. The analysis used the accumulation addresses metric, which tracks addresses that have no outgoing transactions, excluding miners and exchanges. This statistic is updated daily, but also provides insight into interest in long-term accumulation.

According to the analysis, accumulation addresses reduced coin absorption between April and May. On the contrary, this dynamic returned to the market from June onwards.

Source: CryptoQuant

The said analysis,

“Recently, these addresses collected around 72.5 thousand BTC and in the last 30 days they saw a daily inflow of 12.5 thousand BTC. If this trend continues, it could have a positive impact on market prices.”

AMBCrypto then checked CryptoQuant’s facts to find out whether buying pressure was generally dominant in the market. According to our analysis, BTC’s foreign exchange reserve has fallen – a sign of high buying pressure.

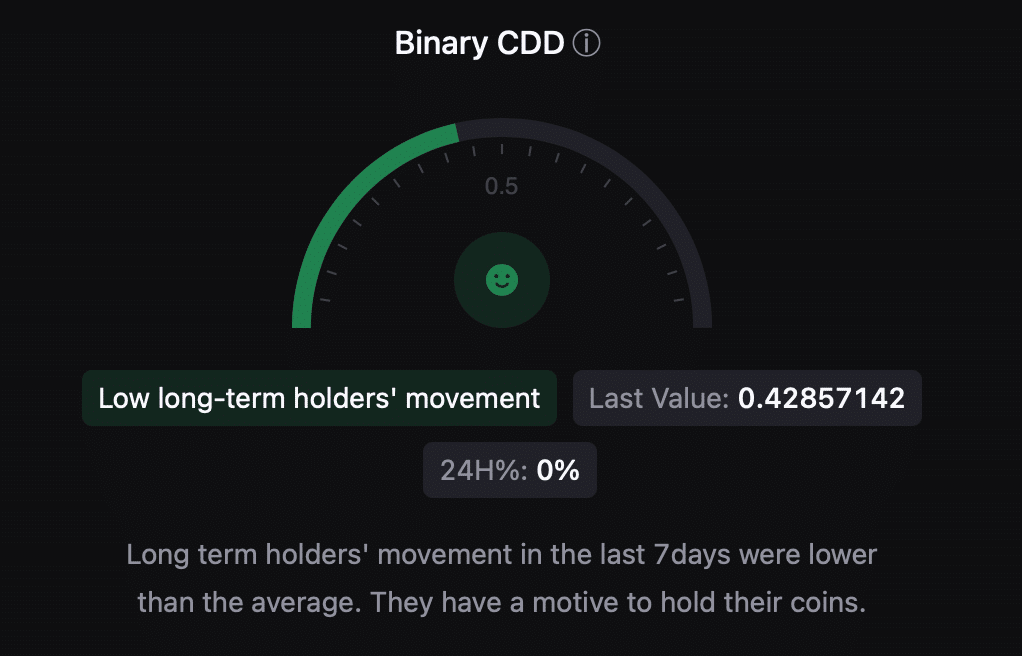

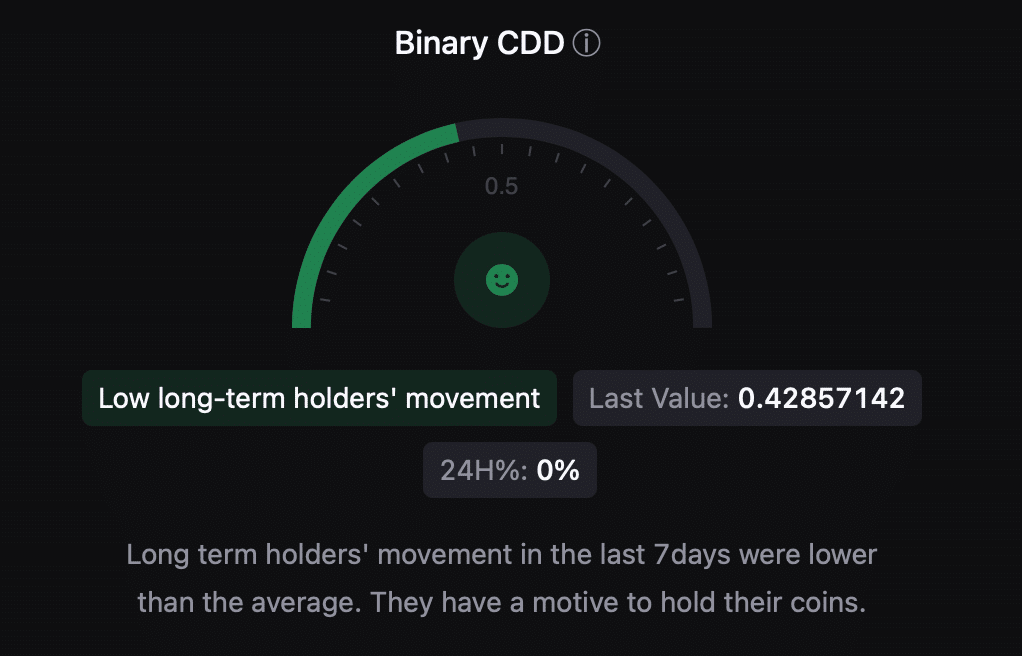

Its binary CDD was greed, which suggested that the movement of long-term holders over the past seven days was lower than the average. They have a motive to hold on to their coins. Apart from this, BTC’s Korea Premium revealed that buying sentiment among Korean investors was strong.

Source: CryptoQuant

Will the price of BTC be affected?

Since accumulation was high, AMBCrypto checked BTC’s daily chart to see if it might be preparing for a trend reversal. According to the same, the price of BTC reached the lower limit of the Bollinger Bands, which often results in price increases.

However, both the Money Flow Index (MFI) and Chaikin Money Flow (CMF) registered a decline, indicating that BTC may remain bearish.

Read Bitcoins [BTC] Price prediction 2024-25

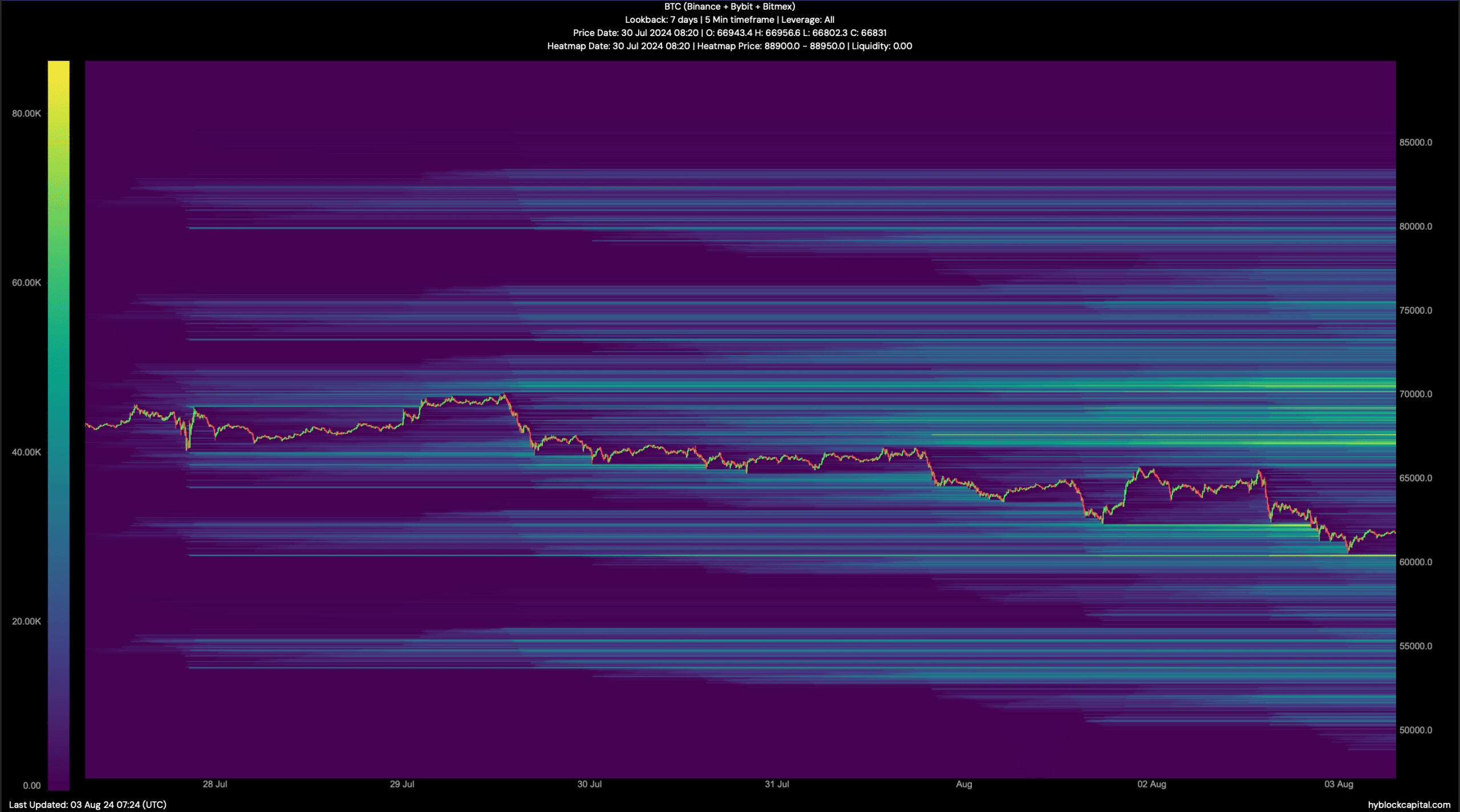

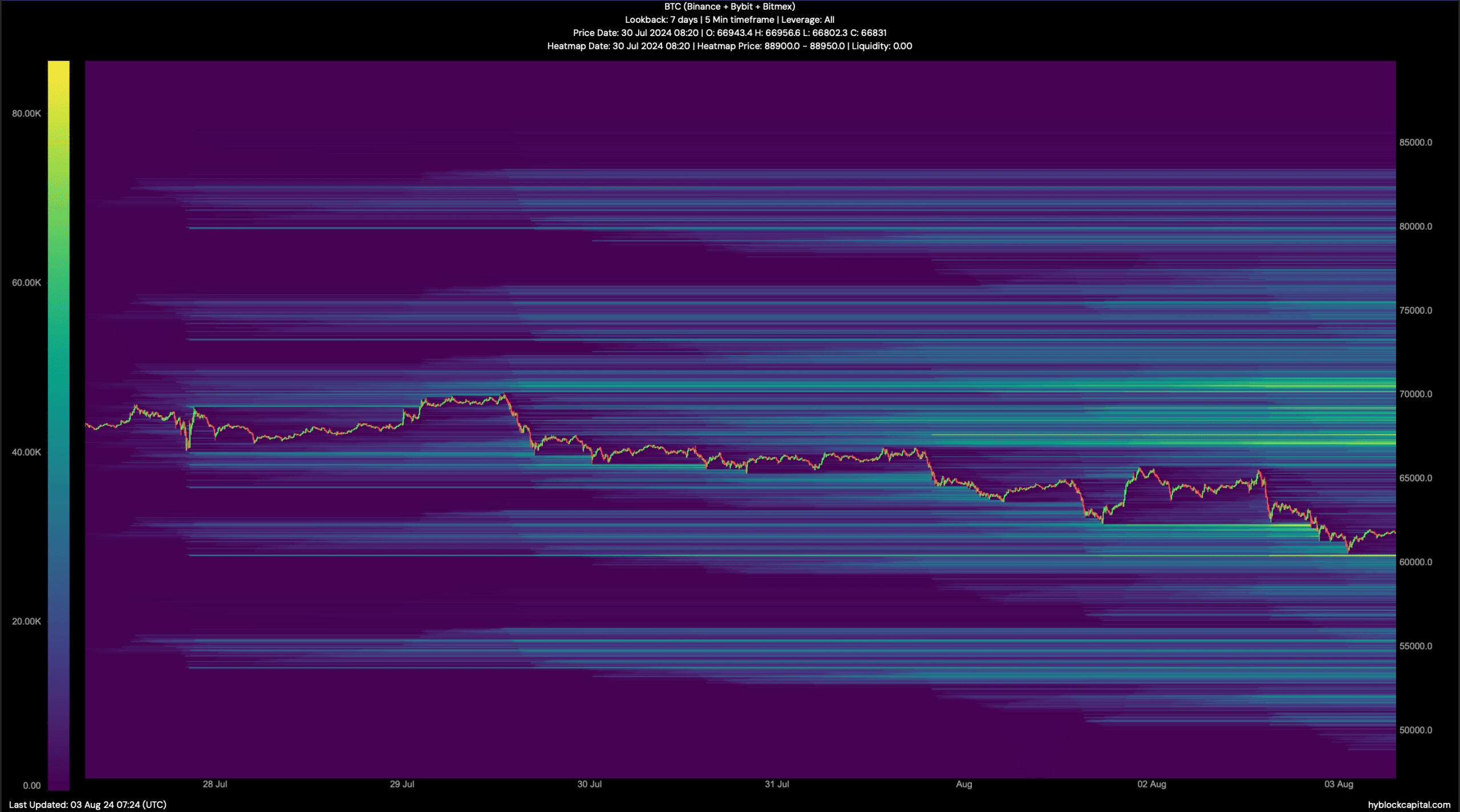

Finally, we then checked the liquidation heatmap to find out possible support and target levels.

If the downturn continues, it won’t be surprising to see Bitcoin fall to $60,000 in the coming days. Nevertheless, in the event of a trend reversal, BTC could first reclaim $67,000.

Source: Hyblock Capital