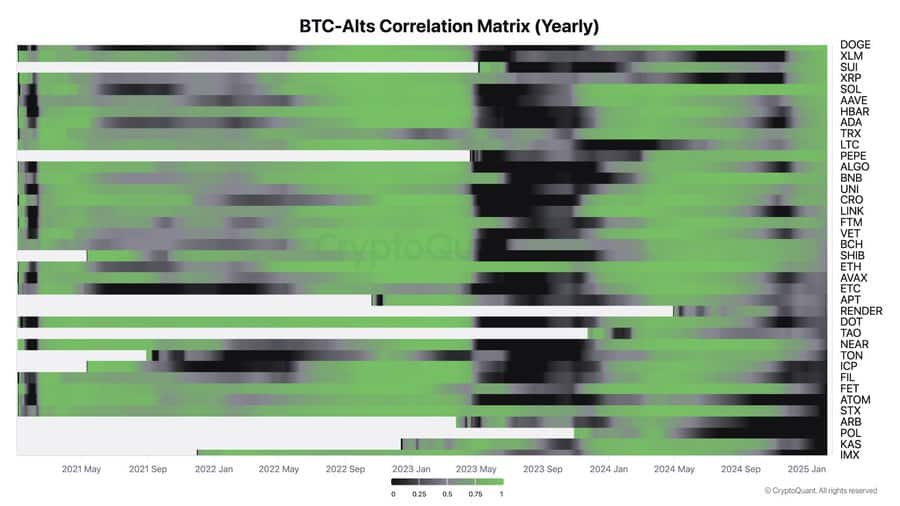

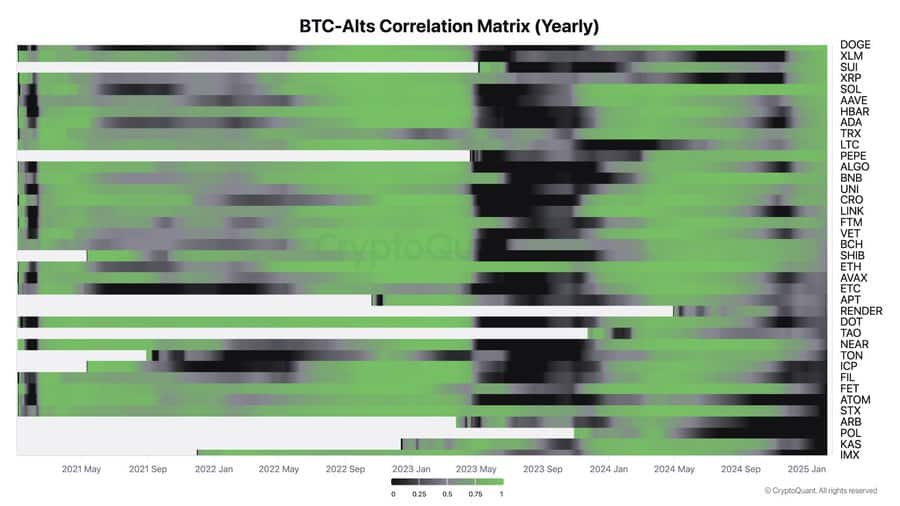

The BTC-Alts correlation matrix provides insight into the relationship between Bitcoin and various altcoins over time.

As can be seen on the graph, certain altcoins such as Ethereum, Binance Coin [BNB]and avalanche [AVAX] Have continued to maintain with a high correlation with Bitcoin, which reflects their tendency to mirror the price movements of BTC.

Source: X

However, a clear trend of decoupling has emerged, especially among altcoins such as Dogecoin [DOGE]Shiba Inu [SHIB]and Pepe [PEPE]As well as the SUI network.

These coins have shown considerably lower correlations. Their performance is powered by independent factors such as unique use cases, social sentiment or ecosystem -specific developments.

Resilient Altcoins and Memecoin Manie

In 2025, Altcoins showed a remarkable resilience associated with institutional adoption. Projects such as XRP disconnected from wider Altcoin trends, driven by increasing partnerships with financial institutions. This institutional support has reinforced investor confidence, which leads to considerable profit on the charts.

At the same time, the market witnessed a revival of Memecoins. Despite the lack of inherent usefulness, these tokens performed better than traditional infrastructure coins, propelled by community -driven enthusiasm and speculative zeal. The launch of President Donald Trump’s memecoin, for example, aimed the establishment of more than 700 Imitators, which emphasized the powerful influence of social sentiment in this segment.

From a psychological point of view, Memecoin investments are often powered by herd mentality, a common characteristic in speculative markets. Investors often come to these coins based on prevailing trends instead of fundamental analysis, leading to rapid price increases.

What does this mean for investors?

The disconnection of Bitcoin correlation means that investors must adjust their strategies. Because Bitcoin no longer dictates Altcoin movements, alternative market drivers are becoming more important. Altcoins supported by the institution is linked to financial and business sectors, show strong potential and offer stability in the midst of market shifts. Meanwhile, memecoins thrive on sentiment, but continue to bet with a high risk.

With traditional indicators that lose relevance, a targeted approach is crucial. Investors must give priority to projects with Real-World use cases and growing acceptance. Infrastructure cooks can continue to lag behind, making them less attractive. Diversity and a focus on data -driven decisions are essential as the market evolves, so that investors have to navigate with precision in this new, disconnected landscape.