- Bernstein analysts predict Bitcoin will peak at $200,000 in 2025.

- Amid inflation concerns, BTC is emerging as a safe haven.

After the ‘Uptober’ rally took the market by storm, Bitcoins [BTC] price has experienced a slight increase dive. However, analysts at Bernstein Research remain optimistic and provide a bullish forecast for the cryptocurrency.

Matthew Sigel, Head of Digital Assets Research at VanEck, shared key insights from Bernstein’s report entitled “From Coin to Compute: The Bitcoin Investing Guide” on X.

The report predicts that Bitcoin will reach an ambitious target of $200,000 next year.

Analysts Gautam Chhugani, Mahika Sapra and Sanskar Chindalia identified the key factors that drove and explained their price targets for BTC:

“The new institutional era could, in our view, push Bitcoin to a high of $200,000 by the end of 2025.”

It is worth noting that the king coin has increased in value by approximately 110% in the past year CoinMarketCap.

At the time of writing, the market cap was $1.3 trillion, which is more than half of the total global crypto market cap of $2.32 trillion.

Institutional adoption drives Bitcoin’s growth

Bernstein’s extensive 160-page “Black Book” highlighted the important role institutional investors play in Bitcoin’s current and future growth.

According to the report, 10 global asset managers now hold more than $60 billion in BTC through regulated exchange-traded funds (ETFs). This marked a sharp increase from just $12 billion in September 2022.

Additionally, Bitcoin ETFs have seen one of the most successful launches in ETF history, attracting $21 billion inflow until now.

AMBCrypto recently reported that the top BTC ETF, IBIT, has surpassed Vanguard’s VTI and ranked third in YTD flows.

In light of this substantial institutional importance, Bernstein’s report emphasized:

“By the end of 2024, we expect Wall Street to replace Satoshi as the best Bitcoin wallet.”

Eric Balchunas, senior ETF analyst at Bloomberg, also shared this sentiment. For reference, Satoshi Nakamoto, the creator of Bitcoin, is said to own approximately 1.1 million BTC.

The Evolving Bitcoin Mining Industry

In addition to institutional adoption, the report shines a spotlight on… miningwhich is expected to recover after the April 2024 halving.

It noted that leading US miners are consolidating their market share and emerging as major players in the energy infrastructure for AI data centers.

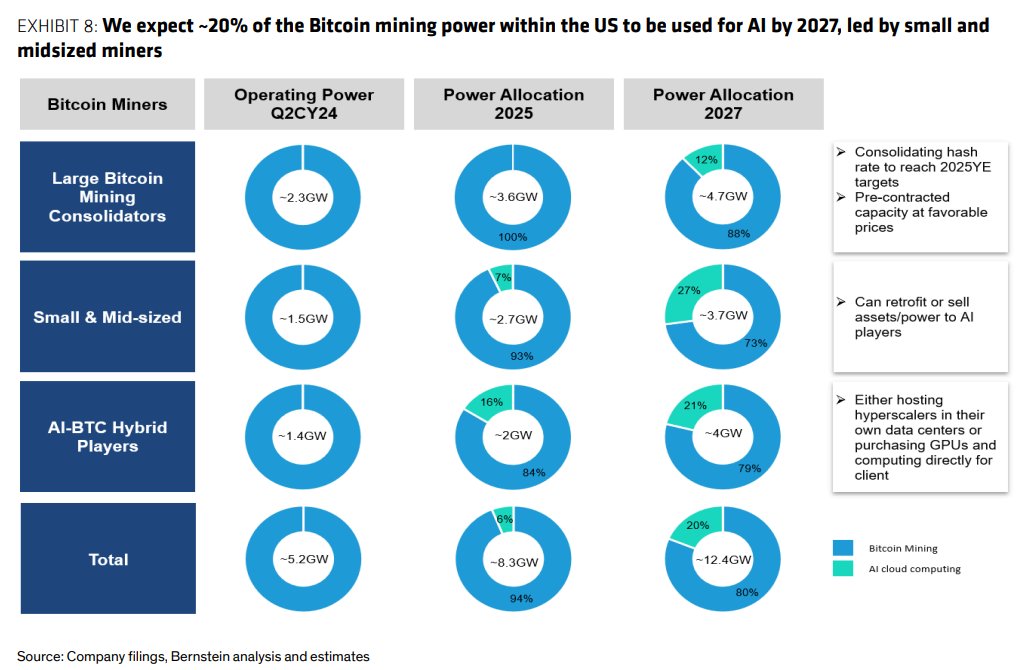

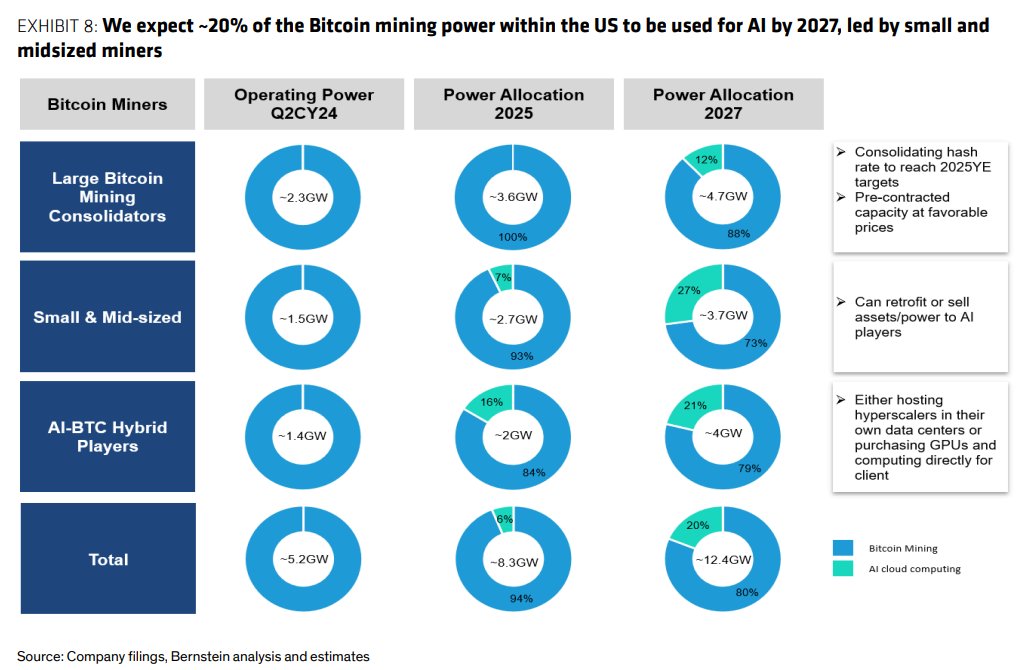

Bernstein’s report predicts that more than 20% of US Bitcoin mining energy could be devoted to AI by 2027, with smaller miners driving this shift.

Furthermore, revenues from the Bitcoin mining hardware industry are expected to exceed $20 billion in the next five years.

Source: Matthew Sigel/X

A ‘conservative’ price estimate?

Meanwhile, Chhugani, one of the report’s lead analysts, referred to the $200,000 Bitcoin price forecast as a “conservative estimate,” citing rising US debt levels.

With the national debt surpassing $35 trillion, Bitcoin’s limited supply makes it an increasingly attractive store of value.

High-profile investors used to like it Paul Tudor Jones also advocated Bitcoin as an inflation hedge.

Against the backdrop of these factors, it seems increasingly likely that Bitcoin will reach $200,000 by 2025.