The recent dip in the price of Bitcoin below the $59,000 support level has created jitters in the cryptocurrency market. While the price drop led to liquidations in the futures markets, analysts warn that an even more significant decline could be in store if there is no complete market capitulation.

Measured retreat, not a mass exodus

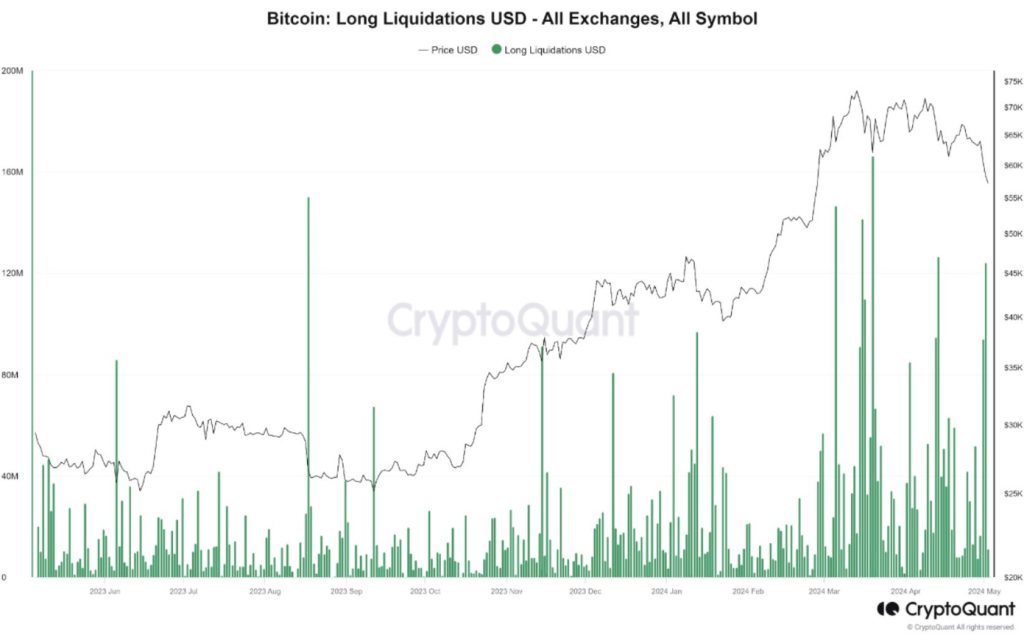

Following the price drop, CryptoQuant, a cryptocurrency analytics platform, reported approximately $120 million in liquidated long positions (bets that the price would rise). This liquidation is notable, but unlike previous selloffs at the same support level, it does not indicate a panicked exodus of investors. Investors appear to be taking a more measured approach, pointing to a possible short-term correction rather than a long-term bear market.

$BTC Futures market does not yet signal a capitulation

“Given the relatively small amount of liquidation of long positions and the lack of dramatic negative funding ratios, we believe that no ‘capitulation’ has yet occurred in the futures market.” – By means of @MAC_D46035

Link 👇… pic.twitter.com/xqArLQiITf

— CryptoQuant.com (@cryptoquant_com) May 2, 2024

A ray of hope for long-term investors

While the short-term outlook appears cautious, there are reasons for long-term investors to remain optimistic. On-chain metrics, which analyze data directly on the Bitcoin blockchain, offer clues to a potential future rebound.

Statistics such as MVRV (Market Value to Realized Value) suggest that there is a chance of an upward move in the larger market cycle. This information allows strategic investors to view the current situation as a potential buying opportunity, especially if a significant capitulation occurs in the futures market.

Bitcoin price action in the last week. Source: Coingecko

Navigating the Bitcoin Maze: Data-driven decisions are crucial

Current market volatility poses a complex challenge for investors. Understanding market sentiment is crucial to making informed decisions. The financing rate, an indicator of sentiment in futures contracts, has occasionally turned negative.

BTCUSD trading at $59,167 on the daily chart: TradingView.com

Traditionally, this indicates a stronger presence of bears (investors betting on a price drop) than of bulls. However, the negativity has not yet reached the extremes seen during previous significant downturns, leaving the overall sentiment somewhat unclear.

Bitcoin’s long-term story remains unwritten

Closely monitoring the futures markets for signs of capitulation, along with analyzing other market indicators such as funding levels, is essential for success in this dynamic environment. Astute investors, armed with a strategic understanding of market dynamics, are likely to profit from future moves.

Bitcoin’s recent price drop has created volatility in the short term, but the long-term story remains unwritten. While the coming weeks may test investors’ resolve, those who can analyze market data and make strategic decisions could be well positioned to take advantage of future opportunities.

Featured image from Pixabay, chart from TradingView

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.