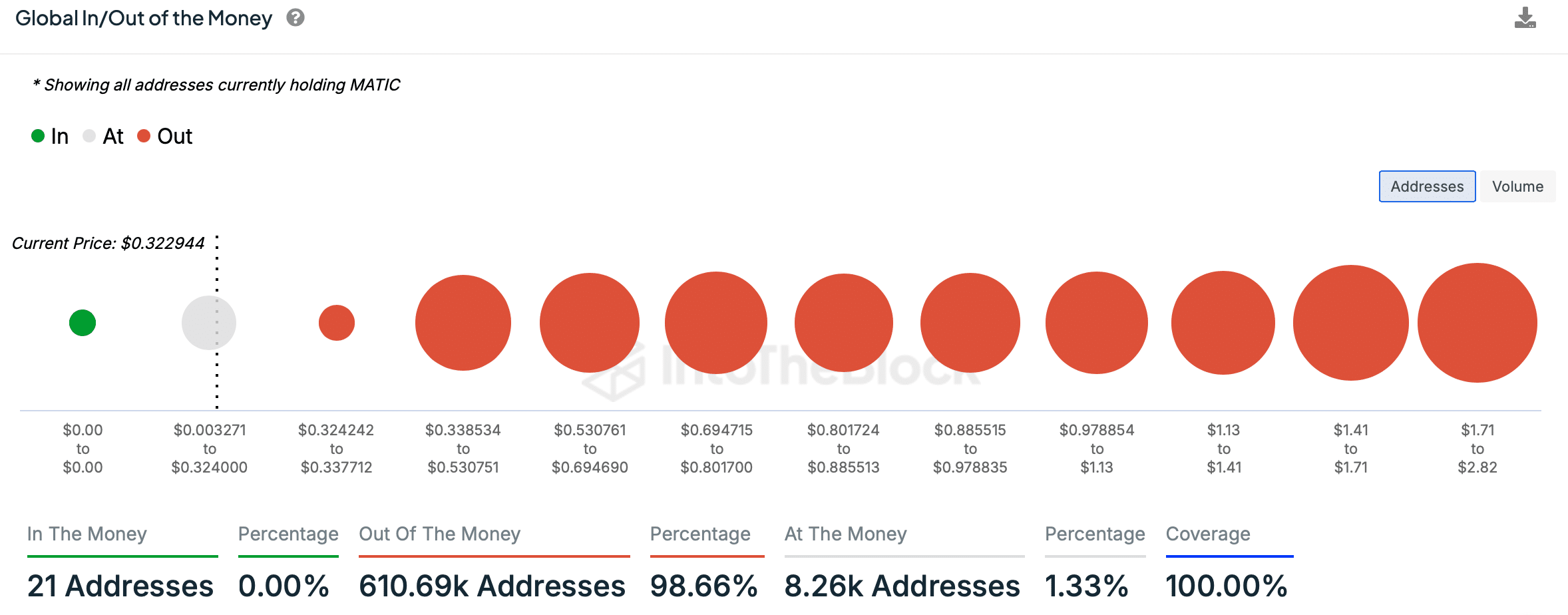

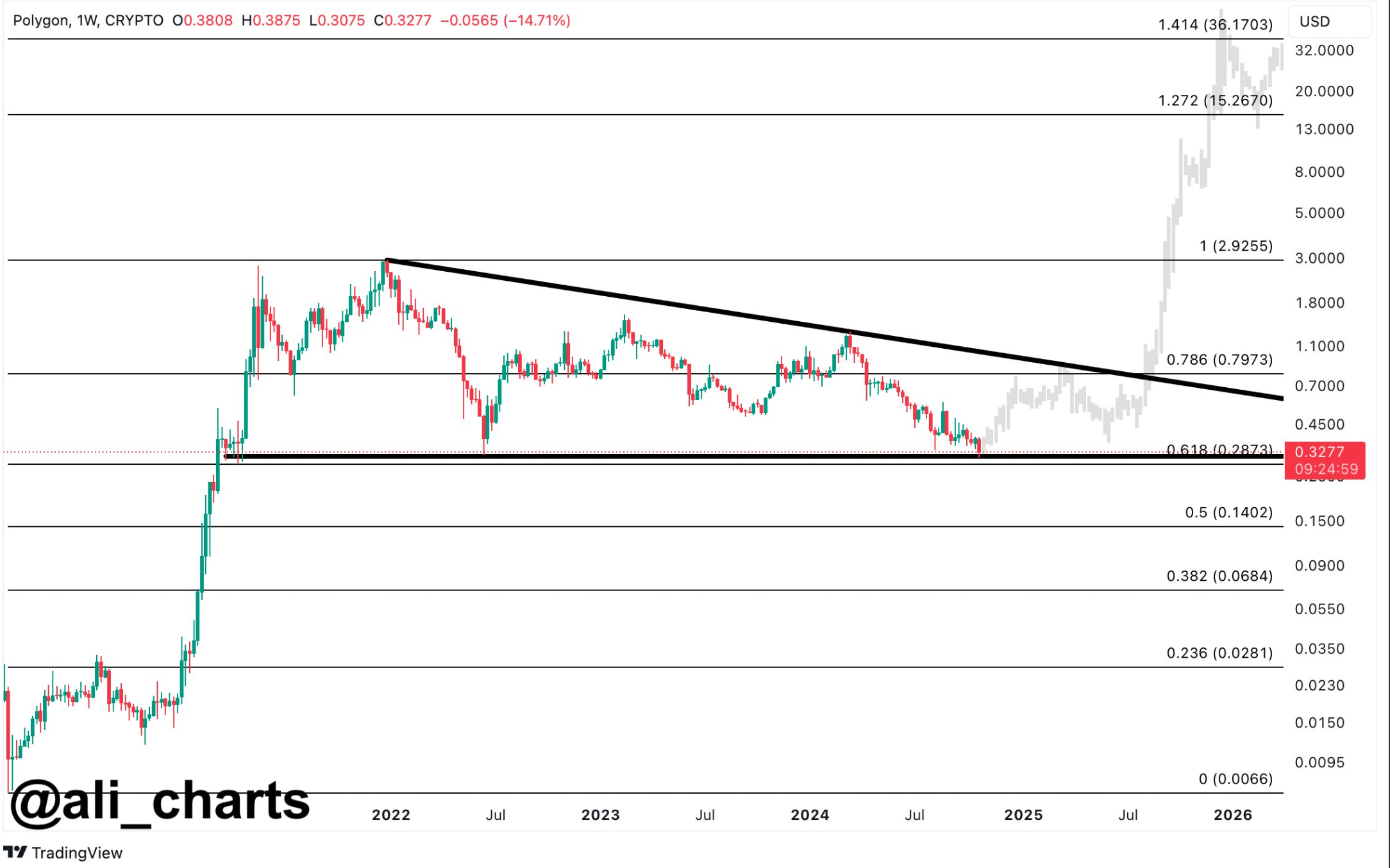

- A multi-year bullish pattern appeared on the token’s price chart.

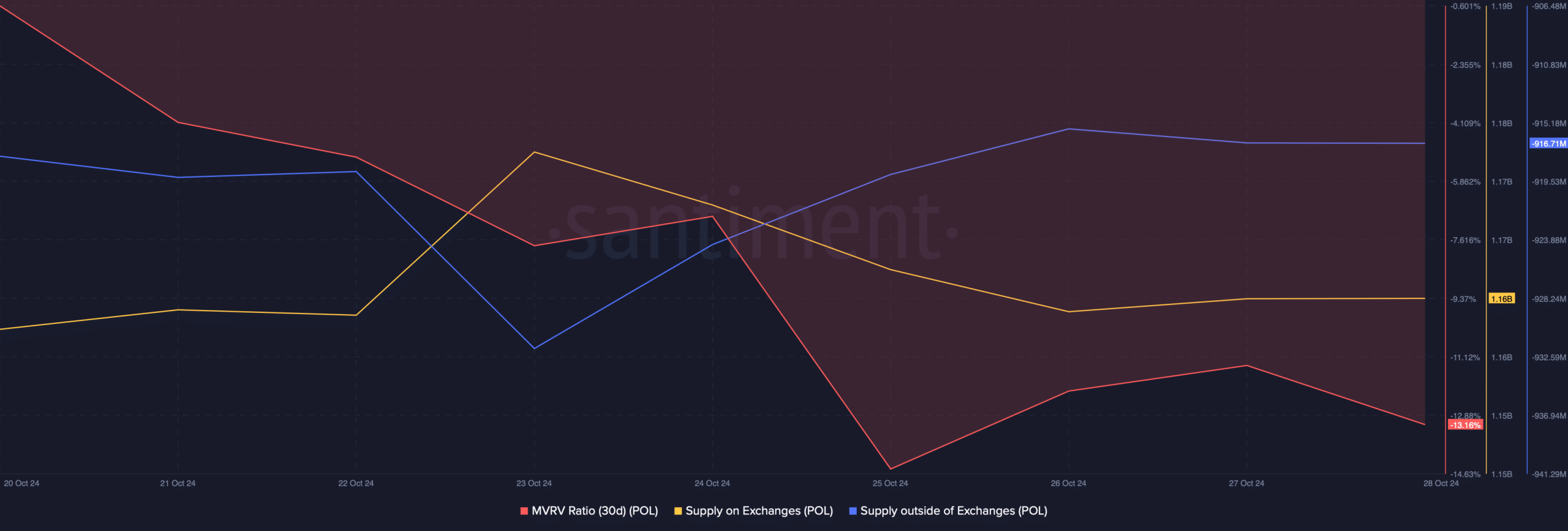

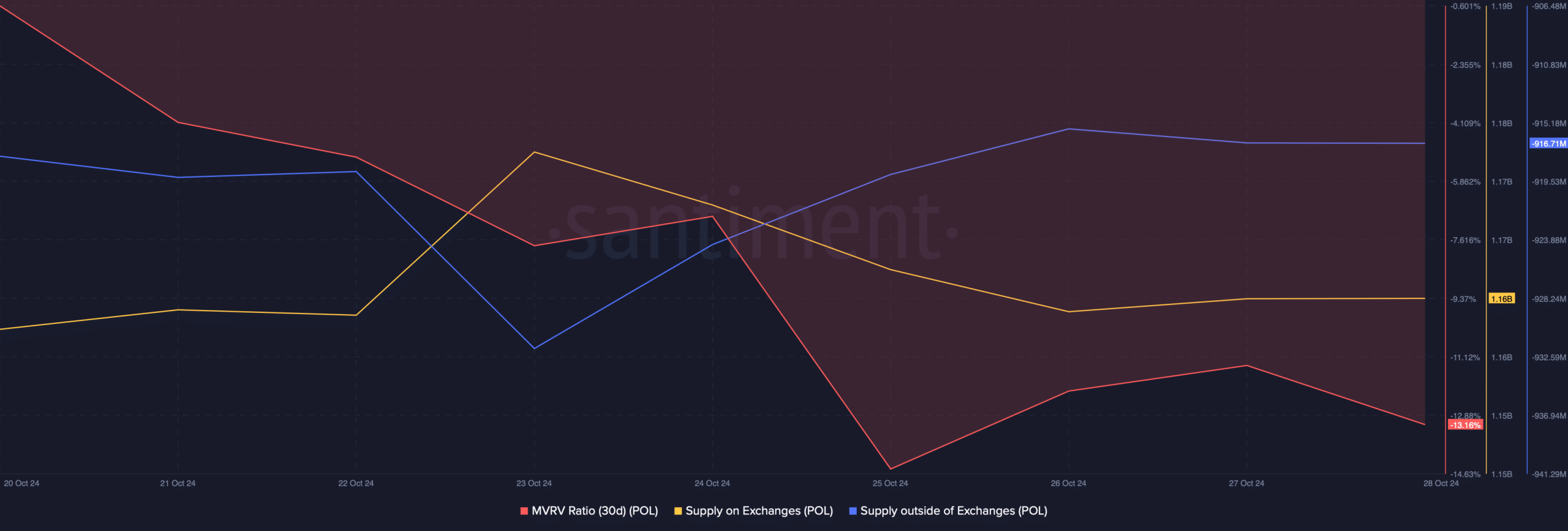

- Buying pressure increased slightly, indicating a price increase.

After Polygon [POL] MATIC to POL upgrade, many expected the price of the token to rise. However, that was not the case as the token suffered several setbacks in recent weeks. That’s why AMBCrypto investigated what’s going on.

The Dark Fate of Polygon

POL did not generate enough bullish sentiment after the upgrade. This was the case because the price fell by more than 25% in the past month. Furthermore, the token witnessed a 15% correction in the last seven days alone.

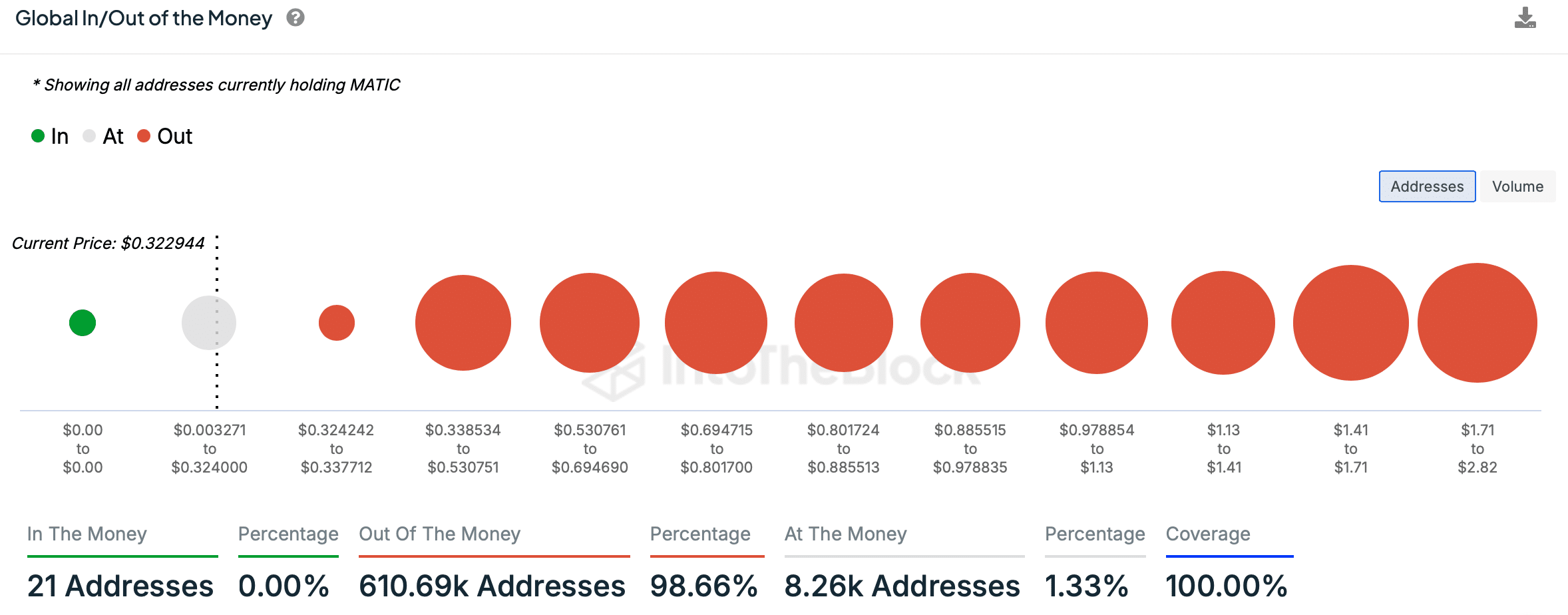

AMBCrypto’s analysis of IntoTheBlock’s data showed that only 21 Polygon addresses made a profit. This number was negligible compared to the total number of POL addresses.

Source: IntoTheBlock

Apart from that, AMBCrypto has recently reported that despite the major update, Polygon suffered a massive drop in network activity in the third quarter of 2024. However, there may be chances of recovery in the coming days or weeks.

Ali, a popular crypto analyst, recently posted one tweet which highlights a bullish pattern on the POL chart. According to the tweet, a multi-year bullish pattern appeared on the token’s chart. To be precise, the pattern emerged in 2021, and Polygon’s price has been consolidating within it since then.

If POL tests this pattern and pulls off a successful breakout, investors could witness a massive rally. It could allow several investors to finally enjoy the profits. There were even chances that POL could reach $32 by 2025, which was an ambitious goal.

Source:

What can you expect in the short term?

AMBCrypto then assessed Polygon’s on-chain data to find out where POL may reach or fall in the short term. We found that POL’s MVRV ratio has fallen sharply over the past week. This can be inferred as a bearish measure.

However, buying pressure on the token has increased in recent days. Polygon’s supply on the exchanges fell, while off-exchange supply increased, meaning investors bought POL.

In general, an increase in purchasing pressure is often followed by a price increase.

Source: Santiment

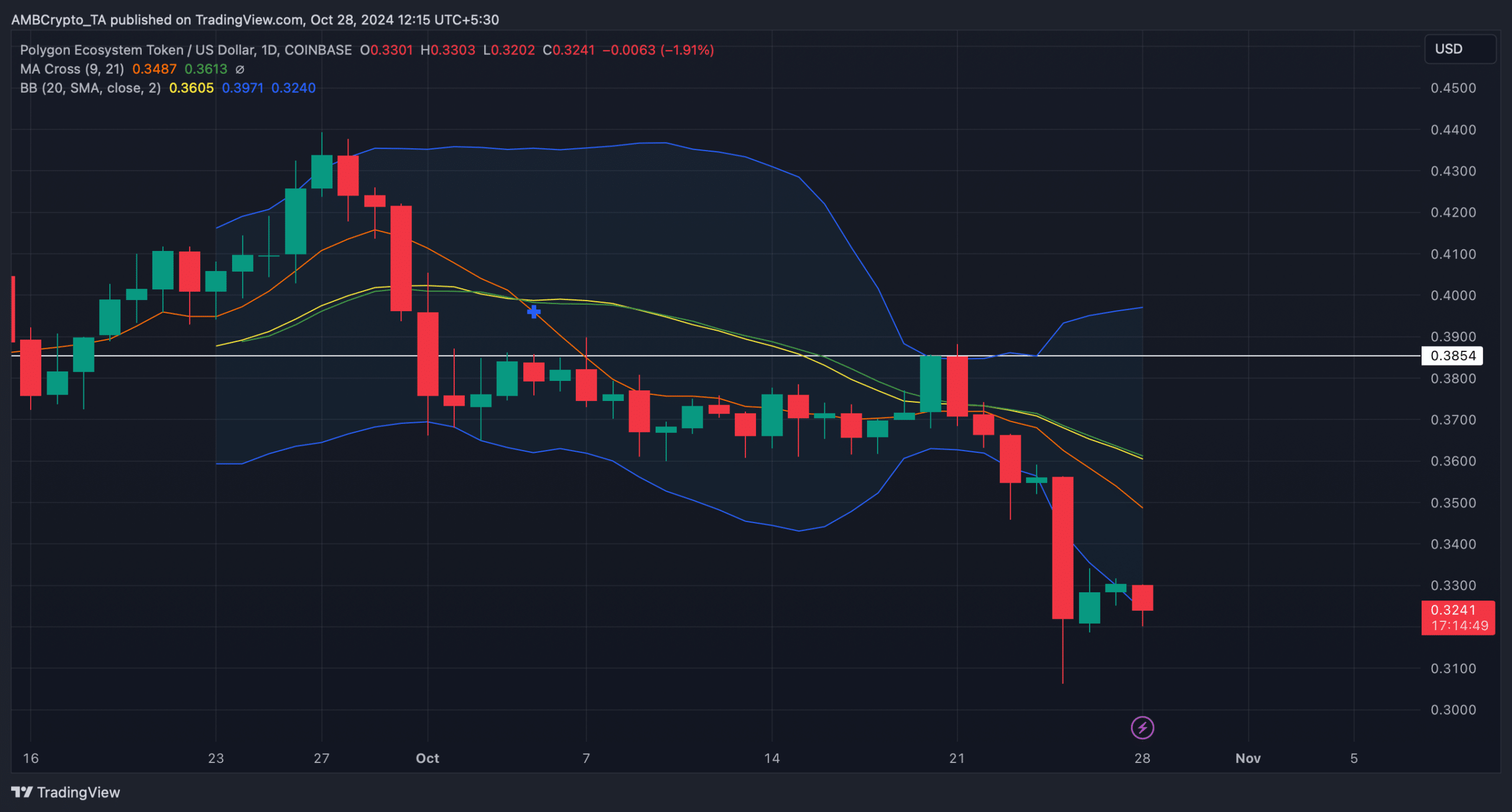

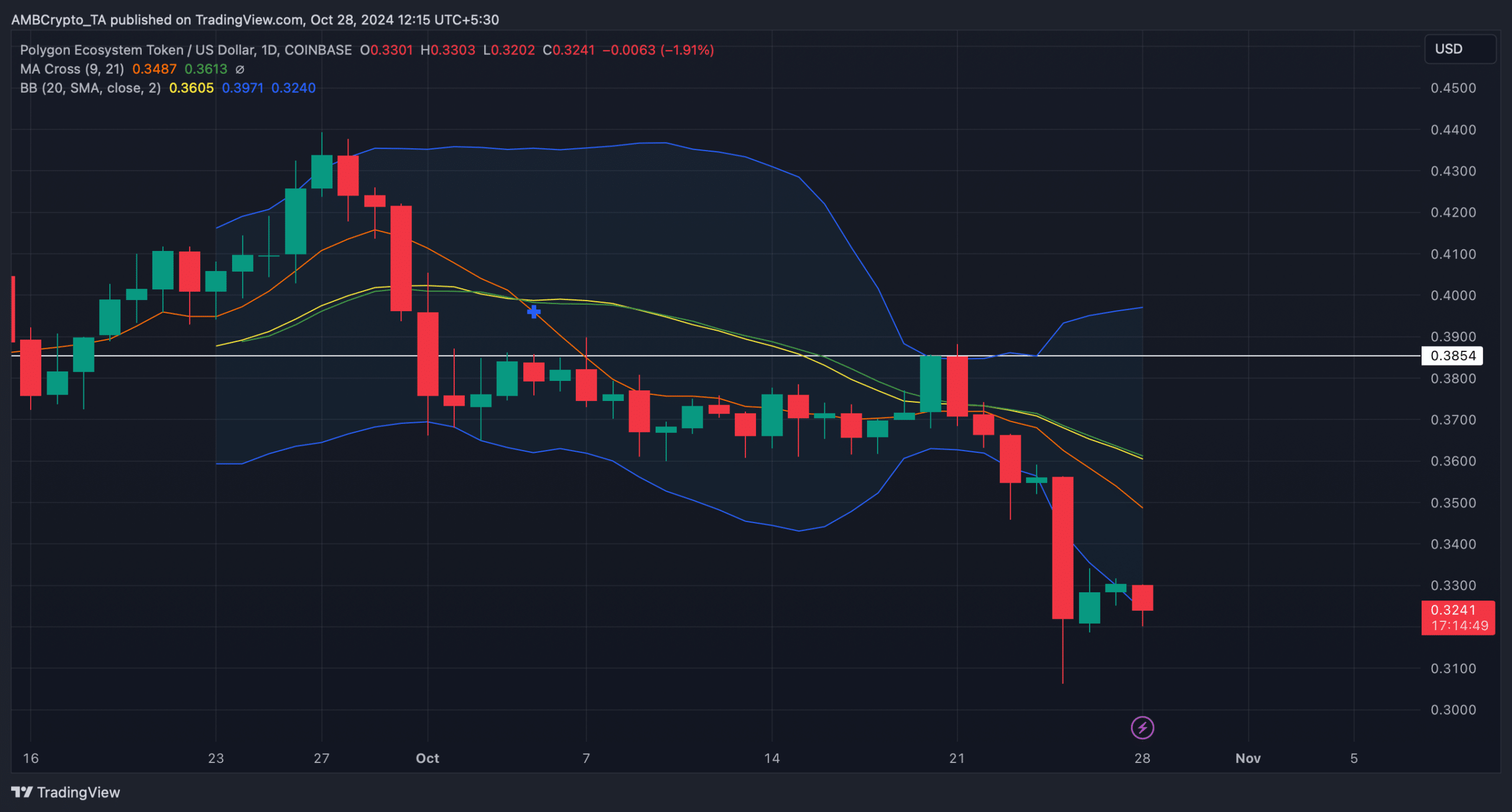

We then reviewed the token’s daily chart to better understand what to expect. According to our analysis, the MA cross-technical indicator showed a bearish advantage in the market as the 21-day MA was well above the 9-day MA.

Is your portfolio green? View the POL profit calculator

Nevertheless, the price of POL had reached the lower limit of the Bollinger Bands. When that happens, it usually indicates that there are chances of a price increase in the coming days.

If that happens, POL could target $0.38 first before embarking on a full recovery.

Source: TradingView